Nvidia's Rise: Have we hit peak AI Summer? ☀️

Is an AI Winter coming? ❄️ Can the economy keep up in an AI-driven bull market alone? The economy shows the high stakes of the AI bubble.

If you know someone who might enjoy this topic, why not share it with them.

“It is possible to believe that all the past is but the beginning of a beginning, and that all that is and has been is but the twilight of the dawn.”

H. G. Wells, “The Discovery of the Future” (1902) - Quote via Jason Crawford, Roots of Progress Newsletter.

There’s a history here. Artificial intelligence is a field that officially began with the coining of the term and the Dartmouth conference in 1956, making AI research soon to be 70 years old in 2026. For Generative AI it stems back to a 2017 transformer paper, making it 8 years old. This suggests we are at the very beginning of the Generative AI era. Nvidia’s earnings this week (on the 27th after the close) will give us yet another valuable measuring rod for how close are to the next AI winter vs. the insatiable demand for AI compute. The push-pull of the AI cycle is in full swing now.

According to data from CB Insights, 50% of venture dollars were spent on AI startups during the first half of 2025. In those six months, AI funding exceeded spending for all of last year.

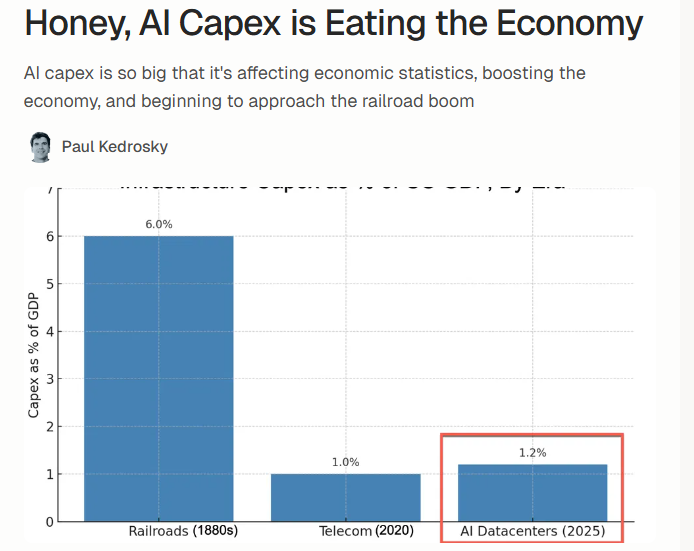

When in the real economy a tightening labor market is observed at the precipice of a monopoly capitalism induced technological bull-market brought upon by the capital expenditures (“Capex”) of the magnificent seven (“BigTech”), AI bubble talk becomes a lot more interesting - and real. When real identifiable and relatable jobs begin to become more impacted by AI, we take notice. In a dubious scenario of invisible or long-term ROI of the great investment in Generative AI models, at least we can vaguely point to the developments in AI coding capabilities. 🗺️ But is it a map we can point to, or is the aligning cartophacry of our AI hopes just a symptom of the euphoria?

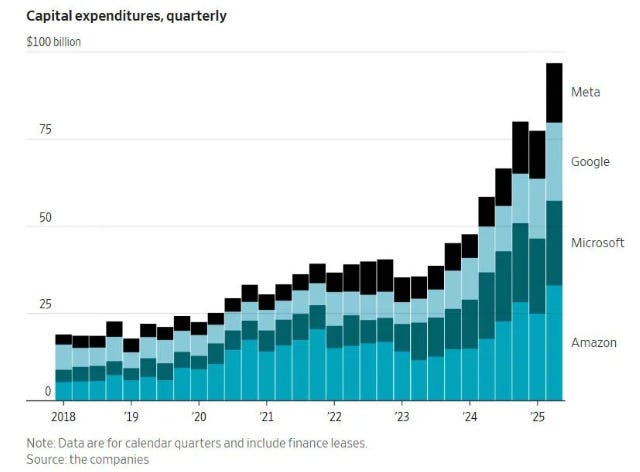

Anticipating Nvidia’s earnings tomorrow at or near stock market all-time highs, demand for compute is at insatiable levels propped up by a Mag-7 (BigTech’s “magnificent seven”) that continues to pump AI Infrastructure spending in the form of Datacenters and GPUs that function as AI chips for speculative returns. The magical formula for Nvidia’s revenue is self-perpetuating, like a carefully derived Trump Administration scheme. It’s less a tribute (“sacrifice”) of the economy to the Machine Gods, more a self-perpetuating cycle of American corporate incumbents, and their fear of missing out (“FOMO”), a function of their greed. American capitalism with characteristics of monopoly incentives and the U.S. Government approaching invasive industrial policy (“intervention”) leadership, that shouldn’t be possible in a real democracy raises eyebrows to what America is becoming. Is this coordinated?

A technological bubble, also known as a tech bubble, is a market phenomenon where the prices of technology stocks or assets rise far beyond their intrinsic value, driven by speculation, hype, and irrational investor behavior rather than fundamental business metrics. To consider how much weaker America’s economic data and tightening labor markets are impacted by the the exuberance of BigTech’s belief in LLMs and Nvidia’s 92% monopoly of the GPU market isn’t abundantly clear as we approach September, 2025 where labor market are seeing sizeable shifts.

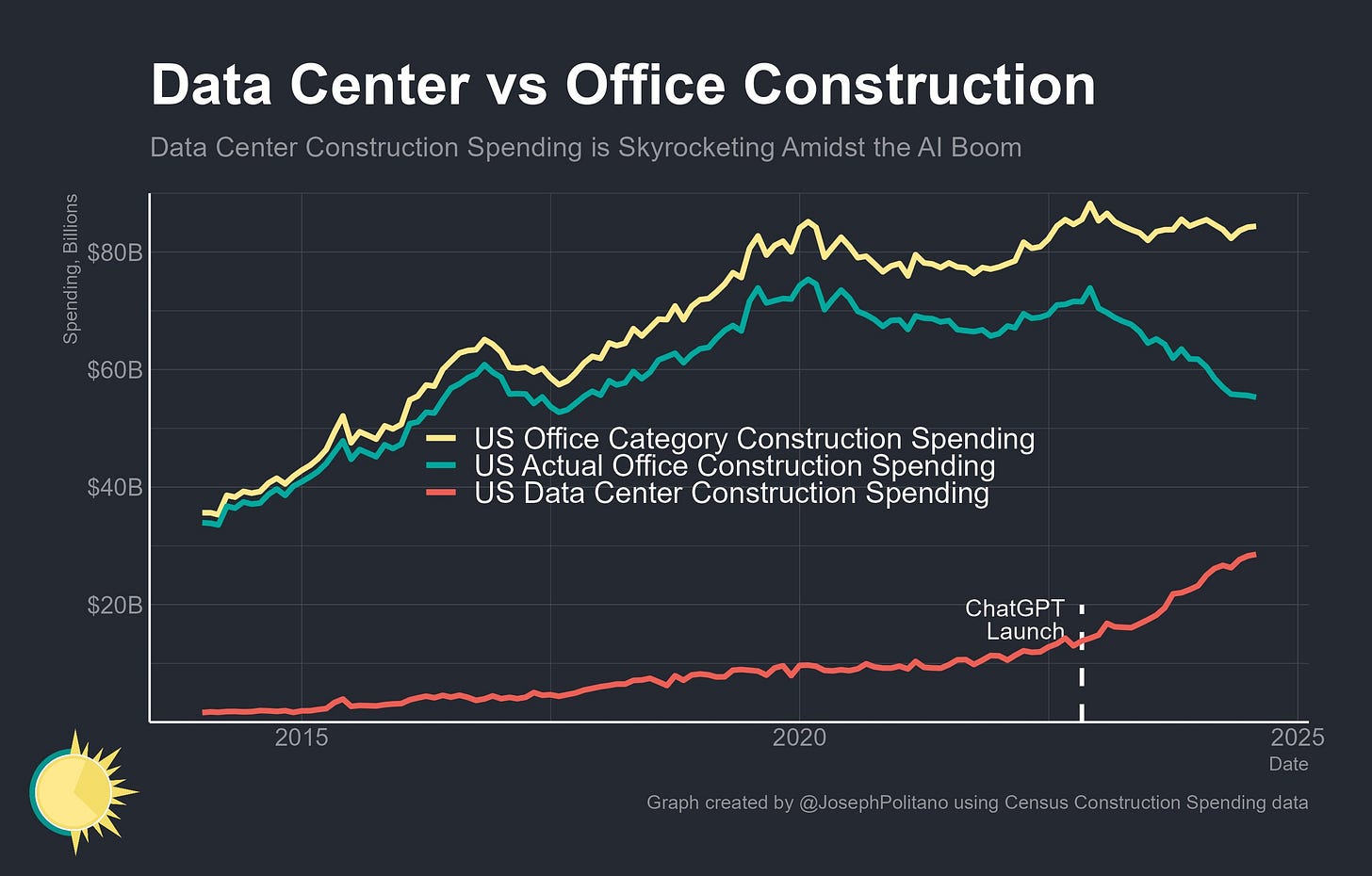

In a world where Europe’s biggest economy is in economic decline, and China is in a prolonged recession, the United States thinks it should be spending more on datacenters construction than office spaces, and it’s a flashing warning signal. In the speculation that we need more and more datacenters with this many GPUs for debatable ROI while many workers are staying put, while businesses are putting the brakes on hiring or firing - the spiraling economy, amid the slow burn of the impact of tariffs and geopolitical uncertainty - is going to become a focal point in the final quarter of 2025.

The mid 2020s might be that odd moment in AI history when capex for AI Infrastructure rises faster than spending on urban things like Office Construction. What is your take on Nvidia’s earnings?

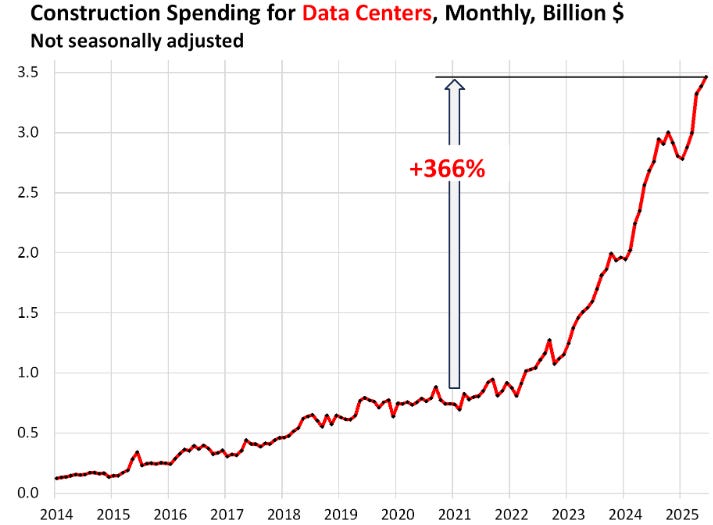

Construction spending on data centers soared by 29% year-over-year to $3.5 billion in June, 2025 not seasonally adjusted, up by 366% since the beginning of 2021, and up by 430% in the seven years since mid-2018.

Capital Expenditures on AI Infrastructure is soaring in the mid 2020s.

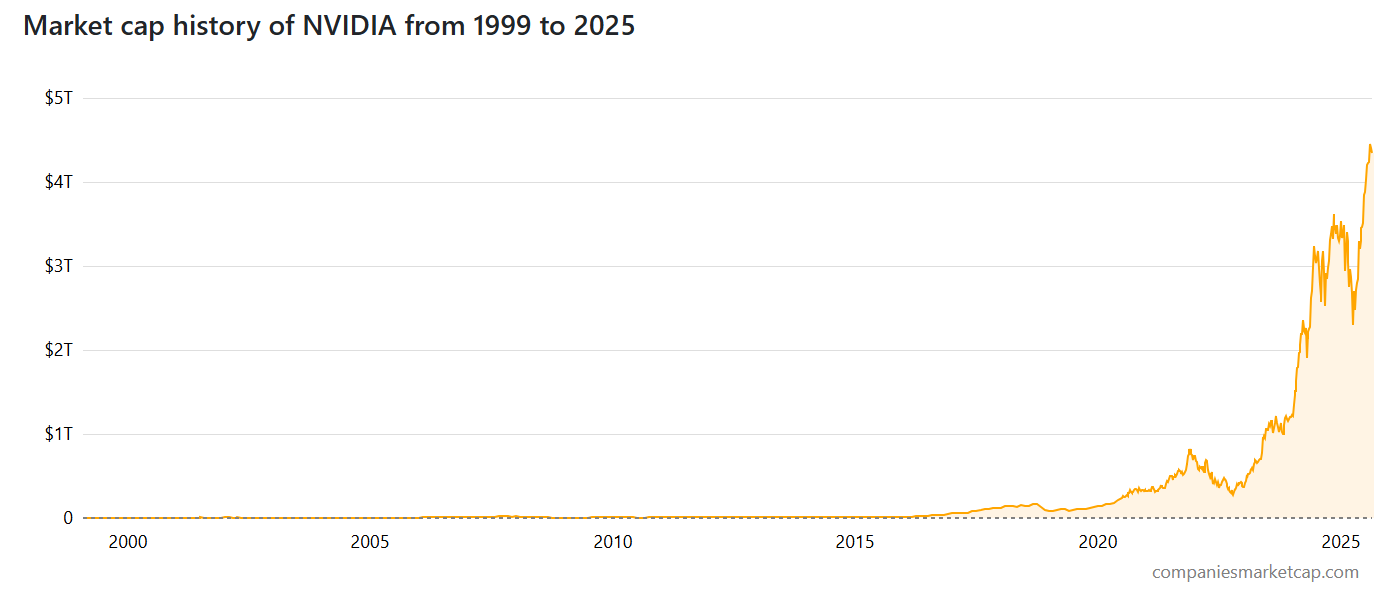

With Nvidia’s stock pricing in an insatiable demand for compute reciprocal to BigTech’s own insatiable greed, its valuation has soared to an unfathomable $4.34 trillion in market cap. Imagine a single corporation whose valuation exceeds the economic output of entire nations. Nvidia's market capitalization exceeds $4 trillion, representing 3.6% of the world's total GDP. That's more than the GDP of the United Kingdom, more than France, and nearly as much as Germany.

In the territory of technological bubbles, it could be 2000 all over again, and just like the bursting of the dotcom bubble, this time the stake are in the Trillions, and a stock market propped up by BigTech’s brutal gamble on large language models and their downstream products. Our expectations for Nvidia’s quarterly revenue priced in to today’s valuation of its stock are assuming it can continue to grow 70% year over year - obviously an unsustainable number. What’s the correct premium for that kind of growth? Why such a brutal gamble America?

Nvidia’s stock price illustrates peak AI summer speculation.

Nvidia's market capitalization, having exceeded $4 trillion as of July 2025, is greater than the GDP of most major European countries, including the UK and France, and approaches the GDP of Germany. The GDP of Germany is $4.66 Trillion and Nvidia could surpass that by September, 2025. The MAG-7 was already overly concentrated before the rise of Nvidia, Broadcom and TSMC. It’s not so much a question of the 493, but the 490, and especially that of NVDA 0.00%↑. Nvidia’s stock with real demands for compute, could go higher still.

Artificial Intelligence turns 70 years old next year and yet the tension between adoption and ROI, AI summer and AI winter is going to hit a new economic slowdown induced tension and debate most likely in the Autumn of 2025 in the United States. Nvidia’s stock really is the key public markets benchmark and sentiment zone to watch.

NVIDIA’s market capitalization is approximately $4.39 trillion, making it the largest single contributor to the S&P 500, accounting for about 8% of the index’s total market cap as of August 2025.

Nvidia’s contribution to the NASADQ, the best proxy for tech stocks, is even higher. Nvidia’s stock certainly coincides with AI GPU exuberance and U.S. hyperscalers investing enormous sums into datacenters that is not leading to overwhelming ROI for the economy or shareholders - is starting to become a problem around the AI bubble territory debates. This is not normal:

If one stock is 8% of the index which most ETFs are pegged to, it’s fairly dangerous for the investments of the general public. Public markets are now at the mercy to the AI trade, to things like how BigTech conduct layoffs and improve efficiency. Nvidia’s market cap is approaching 17% of the NASDAQ 100, and we’ve never seen anything like it. With Trillions of market cap on the line, the stock market is too big to fail, until it isn’t.

NVIDIA’s market capitalization represents approximately 15.9% to 17.1% of the NASDAQ 100’s total market cap as of August 25, 2025,

Nvidia represents 8% of the S&P

Nvidia represents 17.1% of the NASDAQ 100 (“Tech” stocks).

“The high cost required to train large foundation models makes them the fastest depreciating asset in human history.” - David Ha, Sakana AI.

Nvidia, U.S. AI Supremacy, Taiwan - the Unspoken Trinity

That is datacenter and GPU concentration baked into one singular monopolistic name, that curiously depends on a democratic island with the most geopolitical risks of World war III, the island of Taiwan. Many believe Taiwan is at grave risk to being invaded by 2027 or soon thereafter. This is not then just a bubble caused by speculative investors but by something else, a Bubble caused by national security like BigTech interventions in the AI arms race of National importance to America’s strategic competition with China.

This is a AI bull market fueled by global competition brewing below the surface:

An AI Bubble for World War III

U.S. technological hegemony over the rest of the world.

Not possible if Nvidia and TSMC were not themselves monopolies.

An AI bull-market with characteristics of compute demand that is slow to impossible to slow down.

Taiwan is curiously implicated and the war over its semiconductor supremacy is of strategic importance to the future of technology itself. This isn’t just about geopolitics, it’s about the real-estate that underpins the future of AI itself.

ChatGPT wouldn’t be possible without Nvidia, whose AI chips woudln’t be possible without TSMC and the dozens of Taiwanese companies in complicated semiconductor supply chains interconnected with South Korea, Japan, the U.S. and China.

Increasingly, The United States via the Trump Administration appears to be weaponizing Nvidia’s dominance to achieve strategic AI Supremacy over China, its only real peer rival in technological and economic leverage.

The AI bubble therefore has characteristics of AI Supremacy. It’s a mouthful, but the idea that the invention of LLMs rivals the invention of the internet (or even mobile or the cloud) is pretty far-fetched by any normal metrics or in normal times. Reality isn’t some Noah Smith essay defending the Silicon Valley status-quo of technological optimism or the triumph of American capitalism (flawed though it may be). Capex exuberance and Stock market Big-10 concentration is very real and could have toxic consequences:

If you live in Silicon Valley and write for a California audience, unfortunately you might be missing the sense of foreboding most of us who live outside of the United States feel with regards to this “AI Bubble” with World War III risk characteristics. These are not ordinary times we live in - the technological zeitgeist is super-charged with geopolitical uncertainty and global rivalries.

While the U.S. have a capital advantage over other areas of the world, and certainly over China, it doesn’t have a huge lead in AI talent. Meanwhile the significant capital investments necessary to maintain progress in LLMs and GPU capacity to meet demands for compute is forcing the U.S. down a path that assumes Generative AI is an architecture that won’t be improved upon soon. Beyond the headlines of prophelized by AI skeptics reality is more complicated. The biggest corporations in the United States might actually be collaborating with the U.S. Government at a scale not seen outside of China before.

AI Capex Eating the Economy and Machine God Sacrifices

The only real scenario where this Capex behavior makes sense by U.S. corporations is if its mandated by the Trump Administration. The AI arms race is real when you consider the existential threat that China symbolizes to the unipolar economic and technological dominance of the United States. BigTech and even Nvidia’s behavior begins to make sense when looking at this from a national security and geopolitical lens.

This isn’t just an economic historical analysis of macro technological trends, the real backdrop is this is immediately before a potential global war.

Macro economics too often doesn’t speak about the geopolitical context of the times we live in. Just as AI philosophers themselves don’t often understand the stock market or semiconductor realities impacting the larger narrative. The AI bubble isn’t subjective but correlates with the “consensus machine” of a stock market itself manipulated by the financial elite. How the AI bubble will persist and what it actually means for the world isn’t so easy to unpack as you might assume. The “Machine God” isn’t a benevolent construct of transhumanists for human civilization’s future utopia, it’s more likely to be a global agenda of the financial elite to achieve AI authoritarianism, a new system and projection of American power into the world. In this context so much of Trump’s industrial policy interventions begin to make sense. Generative AI is simply a means to this end and not some great discovery as relentless ‘media citations’ attempt to persuade.

Nvidia is the hammer, geopolitics is the nail. But at what point does the world rebel against a more assertive and imperialistic United States? The American project of projecting AI power with datacenters is a Manhattan project that uncannily resembles Trump’s approach to foreign policy. This isn’t just investor speculation or a technology of diminishing returns and AI scaling bottlenecks, this is the United States trying to assert itself while falling behind China in many areas of innovation.

This has always been about the United States trying to achieve and maintain AI supremacy. The stock market is simply the prefered benchmark and consensus driven machine of Capitalists, even in an era where monopoly capitalism rules ate the free market long ago. I’m not sure we should see the Mag-7 as independent entities here in the macro economic and global context any longer. The Trump Administration (and the “shadow actors” behind its motives) is steering them on to a new course. This is of course is what makes the rise of Nvidia feel so dislocated from the previous cycle. Almost as if this is the realization of a premeditated plan, and not some accident of history.

Nvidia is an anomaly of history, its revenue has more than tripled and profits have quadrupled.

So much of the guidance on Nvidia’s earnings will be centered around guidance involving China, and that odd H20 chip to China - where China is racing to push Huawei to catch up to Nvidia in AI chips and local LLM builders to use Chinese rather than American chips. This isn’t just about a technological bubble, but about trade, trying to suffocate China, and maintain national dominance at a time when the U.S. economy is showing signs of consumer tightening, labor freezes and where new graduates are having a harder time landing their first job. The tension between the AI bubble and economic hardships might become very real in late 2025 and 2026.

When OpenAI CEO Sam Altman called the AI sector a bubble at a planned media dinner, he was trying to leverage ChatGPT’s significant consumer adoption lead compared to rivals, and to prolong his first-mover advantage of late 2022 launched ChatGPT (just under three years ago), even as OpenAI’s relative position to frontier AI labs has weakened significantly in both execution, talent and API market share in the last few months. The AI bubble isn’t a story of American “abundance” but rather one of great manipulation of the future.

Nvidia’s has a 94% monopoly on the GPU AI chip market and that isn’t accidental, its intrinsic to the growing partnership (“exploitation”) of the United States with TSMC, Taiwan’s most important company - the most important semiconductor company in the world. TSMC recently cut Chinese tools from cutting-edge chip production to appease an unreasonable bullying Trump Administration. TSMC, a monopoly in its own right, but a vassal corporation to the new United States.