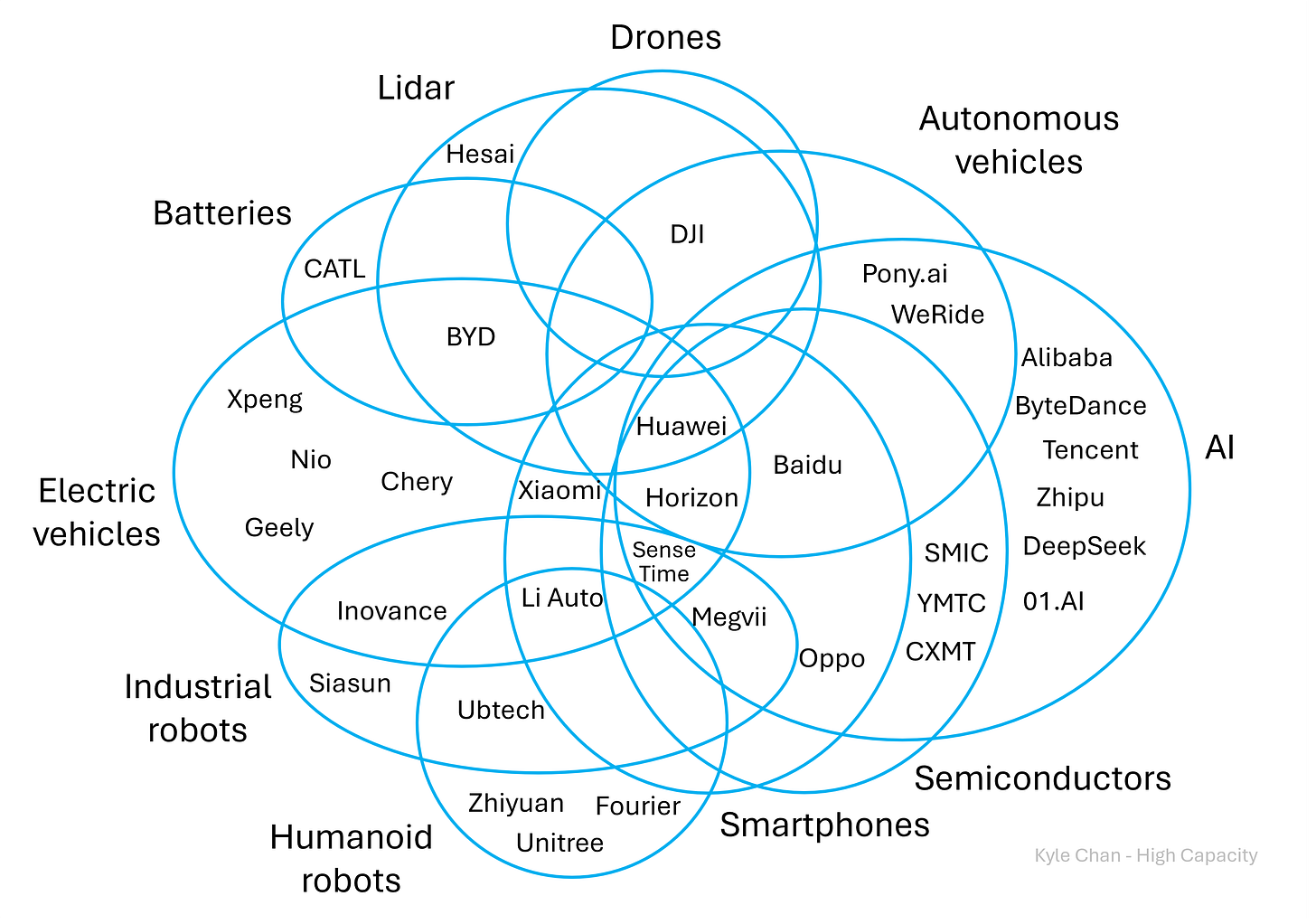

China's Technological Advantage -overlapping tech-industrial ecosystems

EVs, batteries, lidar, drones, robotics, smartphones, AI. China's progress across a range of overlapping industries creates a mutually reinforcing feedback loop.

If you think this story is worth knowing about, feel free to share it and support the emerging featured writer and their original research and writing.

This week is highly unusual in the AI News cycle, and I apologize for my high frequency of articles, I will try to correct this behavior as soon as possible. 🦸♂️ It’s temporary. 🙏🏻

With all the DeepSeek madness going on, I wanted to mention the incredible work of Kyle Chan over at High Capacity Newsletter. In 2025 it appears like China Tech coverage is getting a lot better on Substack, which was already fairly strong in China News and geopolitics. There’s a new breed of academics here that we need to pay more attention to. I’m all about trying to understand innovation in emerging technologies at a global level.

🚅 Read High Capacity

The infographic and Subtitle of this article, makes a brilliant point, so I asked Kyle if we could re-share his work.

🍃 Featured HC Articles

I consider the guest author an expert on China innovation. Do note, he tells both sides of the story and his easy to read work is full of clarity, concise insights backed by data, research and even field-work inspired angles.

🐳 DeepSeek Roundup

DeepSeek has inspired panic in the app store, JS Tan of Value Added argues DeepSeek's success shouldn't be understood as emerging because of China’s innovation system but in spite of it. Even the Pentagon is scrabbling to try to understand what’s going on. You nearly have to wonder if this is the great undermining of the American AI industry (Blood in the Machine). There’s not enough time in the day to read all the takes on this super weird AI event, which we will end up having covered three times this week. Sorry if that’s a little much!

Let’s Recap:

Is DeepSeek the new DeepMind?

🌊 China’s DeepSeek AI Shakes Up the Game

Our DeepSeek emergency series continues tomorrow. (I’m supposed to be on my Lunar Year break.)

🗿 Recent “trending” articles on AI Supremacy

The AI Semiconductor Landscape

How to Use Google's Deep Research, Learn About and NotebookLM Together

How to use NotebookLM for personalized knowledge synthesis

Top AI Tools of 2024

Note to Our Energy Sucking Overlords

Now for some brief catch-up on DeepSeek’s latest news:

🚨 DeepSeek’s National Security Risk situation

Trump has described DeepSeek's rapid advancement as a "wake-up call" for American tech companies. One of the primary concerns is that DeepSeek collects and stores user data in China. This raises alarms about the potential for sensitive information to be accessed by the Chinese government, posing risks to U.S. national security and user privacy.

While Meta and Microsoft double their AI Infrastructure spend in 2025, Microsoft is probing if DeepSeek-linked (check on BNN) group improperly obtained OpenAI data. Both companies report Earnings on Wednesday, and the return they’re getting from AI will be a key theme and make many of us want to listen to their earnings calls.

Julien Dumoulin-Smith at Jefferies wrote in a note on Monday. AI represents about 75% of overall US power demand forecasts through 2035 in most projections, Jefferies said. DeepSeek’s breakthrough puts all of this into question.

Also related the U.S. Navy issued a warning to its members to avoid using DeepSeek “in any capacity,” due to “potential security and ethical concerns.” The FT reported a few hours ago that OpenAI says it has evidence China’s DeepSeek used its model to train competitor, which I think was fairly obvious from the get-go since DeepSeek at times refers to itself as ChatGPT.

🛠️ Hardware Implications

DeepSeek’s breakthrough was achieved by implementing tons of fine-grained optimizations and usage of Nvidia's assembly-like PTX (Parallel Thread Execution) programming instead of Nvidia's CUDA, according to an analysis from Mirae Asset Securities Korea cited by Jukanlosreve on X. This is relevant because it means DeepSeek bypasses industry-standard CUDA, uses Nvidia's assembly-like PTX programming instead. This news was especially viral on Reddit. By leveraging PTX, DeepSeek can achieve fine-grained optimizations that are often not possible with CUDA.

This also connects with our topic of today:

Does China have foundational Innovation advantages?

In innovation, China has enormous advantages in how they can tackle emerging technologies. I’m always on the lookout for great examples of these as this publication in part has a mandate to track U.S. vs. China dynamics in AI and emergent technology more broadly. This article published about a week ago by Kyle, went a bit viral. We publish it again here today.

Thesis:

“China's tech-industrial ecosystems are characterized by a high degree of interconnectivity among various industries, which include smartphones, electric vehicles (EVs), batteries, artificial intelligence (AI), and robotics. This interconnectedness allows for the sharing of technology, skills, and resources across sectors, creating a synergistic environment that fosters innovation and rapid development.”

The Techno-Industrial compounding advantage of interconnectivity

Multi-Industry Overlap

Rapid Innovation Cycles

Government Support and Policy Framework

Collaborative Networks

Competitive Advantage

Supply Chain Resilience

Global influence

Supply Chain Resilience

About the Author ~ 💨

Kyle Chan is a postdoctoral researcher in the Sociology Department at Princeton University and the author of the popular newsletter High Capacity. His research focuses on industrial policy, clean technology, electric vehicles, infrastructure, and development with a regional focus on China and India. He has published articles in several peer-reviewed journals and has been quoted in major international media outlets, including the Financial Times, The New Yorker, Nikkei Asia, and Le Monde. Over the years, he has conducted extensive fieldwork in China and India, previously focused on railway infrastructure development including the rise of China’s high-speed rail system. He is also active on X where he posts on related topics: @kyleichan.

So let’s get into it:

China's overlapping tech-industrial ecosystems

EVs, batteries, lidar, drones, robotics, smartphones, AI. China's progress across a range of overlapping industries creates a mutually reinforcing feedback loop.

Refer to the incredible infographic at the top of this article. 🚨

By Kyle Chan, first published Jan 22, 2025 - made available on this publication January 29th, 2025.

My rough sketch of China’s overlapping tech-industrial ecosystems

China has developed multiple tech-industrial ecosystems that overlap in terms of the firms and technologies involved. China doesn’t just have a smartphone industry or a battery industry or an electric vehicle industry. It has all of these industries and more. China’s strength across multiple overlapping industries creates a compounding effect for its industrial policy efforts.

Let me first explain what I mean in general and then look at the specific case of China’s EV industry. If you’re trying to develop a target industry, it helps to have the technology and manufacturing capacity in surrounding industrial domains. To expand on an analogy from Dylan Patel on ChinaTalk, industrial policy is like a jigsaw puzzle. The more pieces you already have in terms of technology and domestic manufacturing capacity, the closer you are to filling in the remaining gaps. And if you’re already strong in multiple overlapping industries, then this creates a mutually reinforcing feedback loop that further strengthens your position in all of these connected industries.

Put another way: China has created a system of interlocking industries. As China becomes stronger in some industries, this tightens its grip on others. What are the mechanisms by which overlapping tech-industrial ecosystems create this compounding or spillover effect?

Supply: Having existing domestic suppliers in upstream industries can make it easier to source parts and work directly with suppliers to modify specifications to suit industry needs.

Demand: Having an existing set of domestic buyers in downstream industries can provide a ready source of market demand and industry revenue. If downstream players are unwilling to buy domestically, they can be pushed to do so with policy measures, such as tariffs on foreign suppliers and local content requirements.

Technology: Technical knowledge and manufacturing know-how can be useful across industries. Investments in R&D and manufacturing techniques in one industry can have returns across other related industries. For example, knowledge of polysilicon production is useful for photovoltaic cell and semiconductor chip manufacturing. Being able to make inverters is useful for solar, EVs, railways, and telecom equipment.

Scale: If you have a product that’s an input for multiple industries, then having all of those industries domestically allows for greater economies of scale for that product. For example, China’s lithium battery industry can enjoy even greater economies of scale by supplying to China’s consumer electronics, EV, and energy storage industries.

Chinese EVs: building on overlapping industries ⚡

China’s success with its EV industry today is really the result of China’s strength in a range of overlapping industries, some of which “grew up” together with China’s EV industry. The flip side of this is just as important. China’s focus on its EV industry is not just about selling cars. It’s about using a key industrial node to push progress across a whole network of connected industries—the way that railroads were seen historically as driving broader industrial development.

Lithium batteries: China’s existing strength in manufacturing lithium batteries at scale for consumer electronics, such as computers and smartphones, gave Chinese battery makers like CATL and BYD an edge in later developing EV batteries.

Smartphones and consumer electronics: In addition to lithium batteries, China’s smartphone and broader consumer electronics industry provided Chinese EV makers with suppliers and know-how for making touchscreen displays, electronic control systems, and other related electronic hardware. Xiaomi is the most direct example of a smartphone and smart-home appliance maker rapidly parlaying its consumer electronics chops into EV success.

Traditional auto industry: Since the late 2000s, China has had the world’s largest traditional auto industry, including auto parts manufacturing. This provided Chinese EV makers with an existing supplier ecosystem for everything from braking and air conditioning systems to car seats and mirrors.

Industrial commodities: As the world’s largest producer of steel, aluminum, petrochemical products, and other industrial commodities, China has many domestic firms that can supply these inputs for the EV industry. (I’ve previously written about how these heavy industries in China support its clean tech industries more generally.)

Electric motors: China’s EV industry benefited from China’s existing industrial knowledge in AC motors, servo motors, and inverters. Early AC motors and motor control units (MCUs) for Chinese EVs were made by domestic firms like Shenzhen-based Inovance (aka “Little Huawei,” founded by former Huawei engineers), Shanghai-based Edrive, Beijing-based JJE (supplier to Xpeng), and Hefei-based JEE. United Automotive Electronic Systems (UAES), a joint venture with Bosch originally formed in Shanghai in the 1990s, has also played a key role as a motor and MCU supplier.

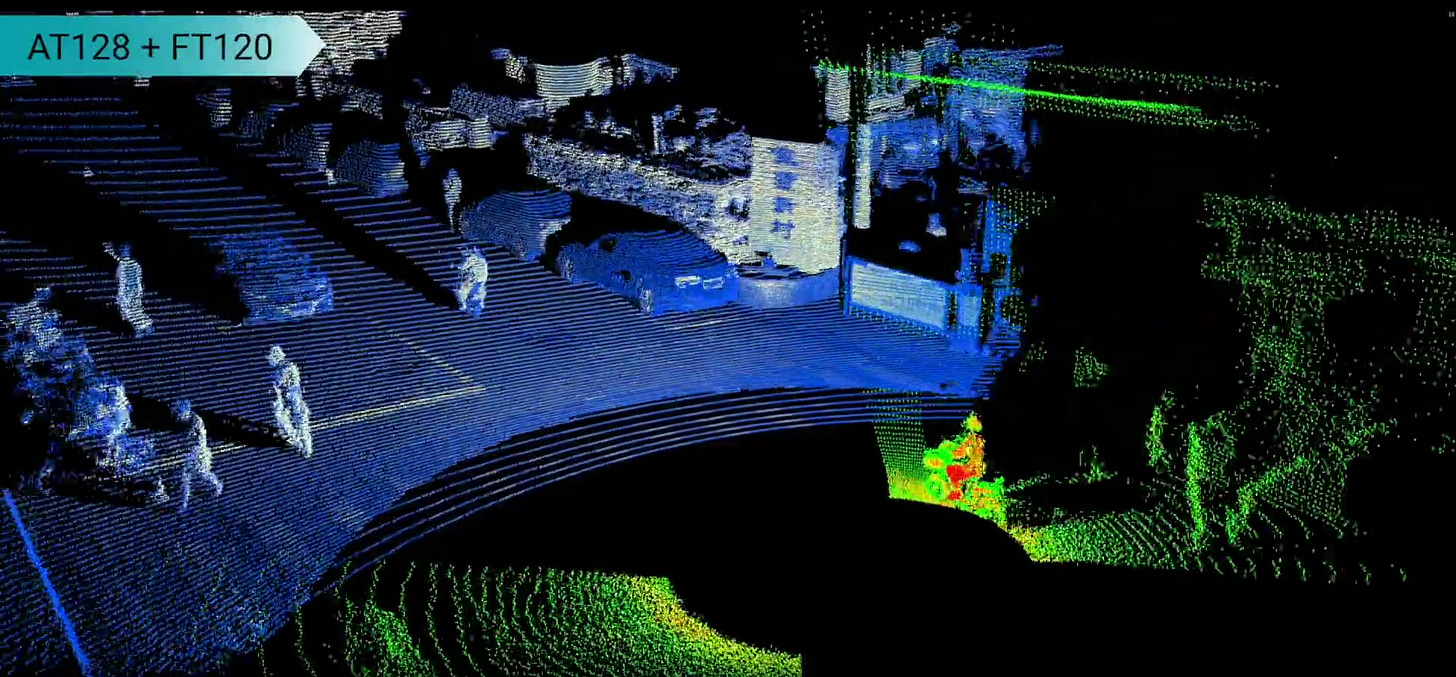

Lidar and other sensors: Chinese sensor firms such as Hesai, Robosense, and even DJI’s Livox provide lidar, radar, cameras, and other sensors as well as sensor fusion systems to integrate and process all this data that enable Chinese EVs to have advanced driver-assistance systems (ADAS).

Industrial robots and automation: China’s longstanding experience with using industrial robots, particularly in its traditional auto industry, gives Chinese EV makers an existing knowledge base for using similar industrial robots for EV manufacturing. China previously relied on foreign robot makers such as ABB and Fanuc but is now increasingly using domestic robot makers such as Inovance and Shenyang-based Siasun. These Chinese industrial automation companies also supply robotics solutions for China’s shipbuilding, solar, wind, electronics, food, medical, textile, and chemical industries, to name just a few.

Industrial coevolution ⚙️

In a number of cases, you have what I call “industrial coevolution” where two or more related industries develop together in an iterative, two-way process. This is happening now with China’s EV and battery industries, which makes sense given how deeply dependent these two industries are on one another. China’s EV industry leveraged the existing scale that China’s battery manufacturing industry enjoyed, which in turn gave China’s battery industry even more production volume and manufacturing experience. This is also happening with China’s battery industry and its solar industry where solar plants are increasingly being deployed with integrated battery energy storage systems (BESS).

Industrial coevolution can also happen across multiple industries simultaneously: for example, China’s lidar, EV, drone, and autonomous vehicle industries. And the co-development of this nexus of industries can have spillover effects into other industries, such as the proliferation of new kinds of autonomous equipment in agriculture, mining, construction, and energy. At the same time, if there’s a weak link, China’s central government (particularly the Ministry of Industry and Information Technology) might step in to support the lagging sector, even at the expense of connected industries. This is happening now with China’s push to get its automakers to reduce their heavy reliance on foreign automotive semiconductor chips and switch to domestic alternatives.

Tech-Industrial Convergence 🏭

Lastly, part of the reason why China is getting stronger across multiple overlapping tech-industrial ecosystems is because of a general convergence across these domains. Technologies and product categories that were previously viewed as distinct and separate—think telephones and cars—are increasingly merging in their underlying hardware and software—think smartphones and EVs or even autonomous vehicles. On the software side, you have operating systems, digital platforms, of course AI and the ability to process vast amounts of data and rapidly turn this into action. On the hardware side, you have a convergence of interrelated technologies including lithium batteries, electric motors, cameras and sensors, wireless communication, and of course semiconductor chips.

As a result, Chinese tech companies are increasingly becoming tech Swiss Army knives, starting in one industry but then quickly branching out into a range of adjacent tech domains: smartphones, EVs, autonomous vehicles, generative AI, drones, robotics. You have smartphone makers like Xiaomi jumping into EVs, drone makers like DJI jumping into lidar, EV makers like BYD jumping into semiconductors or Li Auto jumping into humanoid robots, and traditional internet companies like Baidu jumping into autonomous vehicles. These days, it’s almost strange if you’re a Chinese tech or electronics company and you don’t have your own cutting-edge large language model. Chinese tech companies used to model themselves after Google, Apple, or Facebook, but now they look more like Elon Musk’s Tesla/xAI. And of course, there is the ultimate Chinese tech generalist, at the center of so many of China’s tech-industrial ambitions: Huawei.

The success of DeepSeek’s recent AI models is a software version of everything I’ve just talked about. DeepSeek’s success appears to outsiders like it came out of nowhere, but in fact it built on China’s multiple overlapping AI and software ecosystems that include big tech firms like Baidu and Alibaba, upstarts like ByteDance, startups like 01.AI and Zhipu, AI research centers at universities like Tsinghua University and Nanjing University, and a wider circle of AI-connected players from Huawei to SenseTime. Moreover, DeepSeek’s ability to pivot from quant hedge fund to world-class AI company is yet another example of how Chinese firms can leverage their strengths in one industry to quickly rise to the top in another.

Join & Read - High Capacity 👨🔧💡🔌🪫⚡

High Capacity is a Newsletter about industrial policy, clean technology, infrastructure and development. His academic focus and specialization highlights China and India in particular.

High Capacity’s over 4,000 subscribers include government officials, researchers, policy analysts, journalists, and investors from 110 countries. High Capacity has been quoted or mentioned in The New Republic, the Financial Times’ Trade Secrets, Adam Tooze’s Chartbook, Noah Smith’s Noahpinion, Brad DeLong’s Grasping Reality, and Brazil’s leading newspaper Folha de S.Paulo.

Editor’s Postscript

There is a long list of China Tech experts I hope to feature on this publication to help us better understand the current state of global innovation while China remains important in the big picture.

Please carefully consider China’s approach to emerging technology and innovation as a unique ecosystem and how this compounds technological innovation in the years to come with their manufacturing advantages, STEM education based talent pool, long-term planning, global influence with global south countries and fastly evolving global go-to-market prowess. Areas where we might see this manifest that I’m particularly interested in include:

Robotics

Space-technologies

Biotechnology

Generative AI Products

Renewable and sustainable Energy systems (e.g. Battery tech)

Quantum computing and advanced materials

Drones, Military-tech and automated systems

Large scale infrastructure projects

Global relations with the developing world

So here once again is my favorite infographic so far of 2025 by Kyle Chan.

At a certain point I’ll make a list on these fresh new sources for China Tech insights visiting Substack and setting up shop here in a new development that augments the China news and geopolitical pundits already here with vibrant insights into the tech architectures, innovation ecosystems and corporate names we should know more about that in my mind don’t get enough attention. China’s tech and AI startup scene even with a VC exodus is as interesting and dynamic as ever.

That they are innovating in spite of the odds against them in capital, export controls, access to GPUs, Venture capital access, stringent national regulations, oversight and bureaucracy is a testament to their will, talent and ability to innovate. These bottlenecks are a gift to China’s ability to overcome significant limitations compared to the American VC startup scene and AI research scientists with sky high salaries and an ecosystem that is flooded with cash and who often work in BigTech monopolies that are literally wasting their true talent.