Will it be a Home Run for Alibaba?

Commerce, Cloud, Model, Agents, and Apps

Good Morning,

I have a strong conviction that Alibaba is important in the future of AI. While I recognize that many of my readers are in the United States, Canada and Europe and might not care about China AI (which is fine), I’m a Canadian living in Taiwan and aspire to a global coverage of AI unlike what is found in most publications. As such, my obsession with Alibaba continues unabated and obsessive and may continue to evolve. China by the end of 2025 dominates open-weight LLMs and there are many interesting consequences in AI product due to this.

The Chinese consumer, developer, entrepreneur, AI researcher and AI engineer will also shape the characteristics of AI in a unique ways that have yet to fully trickle down into the product. We are at a unique moment in the history of technology.

“On November 12th, 2025 Alibaba Cloud announced today it deployed over 10 million CPU cores and a 10,000-GPU cluster for Singles’ Day. Qwen powered product translation, analytics, and customer service at scale. Performance gains exceeded 30% for core recommendation systems.” - Poe Zhao

Expect more Alibaba Takes 🚀

If you have been reading AI Supremacy for any length of time you will find many Alibaba articles, this is due to my own limitless curiosity for the global leaders in the space. I just want to make that clear (it’s not a business relationship or sponsor). I consider Alibaba’s Qwen the global leader in Open-source LLMs and Agentic AI models for developers. Moonshot AI and Zhipu AI (now Z dot AI) are both literally funded by Alibaba. With DeepSeek’s next flagship model decidedly late, Qwen (Alibaba Cloud) has really raced ahead. But what does it mean?

Model Releases are Trending 🚨

A week ago Moonshot AI released Kimi-2 Thinking, now OpenAI has released its expected GPT-5.1 Thinking. Google Gemini 3 and Claude Opus 4.5 and xAI’s Grok 5 can’t be far away. It will be an exciting next six weeks in AI. In Q1 2025 Alibaba Cloud had a 33% marketshare (some sources say this is now 38.5%) of China’s Cloud computing sector. That’s bigger than AWS’s (Amazon) marketshare in the United States. Some takes on China AI (with packaging) do sound like PR, but journalists in China proper (including Hong Kong) do have to tread carefully. We need to give these talented analysts leeway, few sources are truly independent or agnostic in AI and Tech coverage. But that’s not to say that what China is doing isn’t incredible and deeply relevant to the future.

Aiming for Global Coverage of AI Supremacy

🌍 On AI Supremacy I do my best to bring attention to the China AI stories and topics I think are most relevant to the world. I’ll also note that China Tech coverage remains moderately weak (or nascent shall we say) on Sustack in comparison to the amount of “China News” related content. Bill Bishop changed that trajectory many years ago. Gradually more legit sources are coming on the platform covering China’s Tech scene in more detail. Of these Poe Zhao and Grace Shao are among the best. I can still only count the good ones on two hands (it’s early).

Why “AI Supremacy” - what does that stand for?

If you are ever confused, the term AI Supremacy for me primarily relates to the U.S. vs. China pushing innovation forward in their strategic rivalry. The competition is good for human civilization because it encompsses a wide range of emerging technologies forward like robotics, energy systems, biotech, quantum, space-tech and agentic commerce. So watching China is fairly central to my mission statement as a whole.

Alibaba Pieces

Alibaba’s Capex is one of the closest things I’ll be watching later this November:

China’s Answer to Silicon Valley: Alibaba’s $53 Billion Challenge to Big Tech

Alibaba Q3 FY25: Forget About ROI, Let’s Talk About AGI

China AI Capex: State vs. Corporate Capital Injection

Topology of “China AI”

Alibaba Cloud’s Hypergrowth, China Industrial Prowess, AI Video Editing Wows

Will China Keep up in AI Infrastructure?

The U.S. and BigTech radically accelerating capital allocation (capex) will be difficult for BBAT companies to follow. Will they try anyways?

“The giants are playing the infrastructure game. Alibaba, Tencent, ByteDance, and Baidu are releasing foundation models at every conceivable parameter size. Alibaba is particularly aggressive here, covering the entire spectrum from edge devices to data centers.” - Poe Zhao Zhou

Grace Shao started a Podcast - “Differentiated Understanding” 🔮

Grace’s guests are highly compelling if you are into China Tech.

Watch the promo: 4 min 52 seconds.

Grace’s relatively new podcast series, is called Differentiated Understanding, where she brings together analysts, journalists, investors, as well as founders and builders in the tech and AI space across the APAC region, with a focus on China. The guest lineup is truly phenomenal and insightful, so do give it a listen. The podcast is available on Substack, YouTube, Spotify, and Apple.

Spotify | YouTube | Apple

Example: Jing Yang, Asia Bureau Chief of Information, a former WSJ reporter, discusses the evolution of China’s tech landscape over the past decade.

Will it be a Home Run for Alibaba?

By Grace Shao of AI Proem Newsletter, November, 2025.

Commerce, Cloud, Model, Agents, and Apps

Double 11 has just wrapped up this Tuesday, and it’s now only a week before the company’s next earnings announcement. Let’s take a good look at what Alibaba has been up to and what to expect.

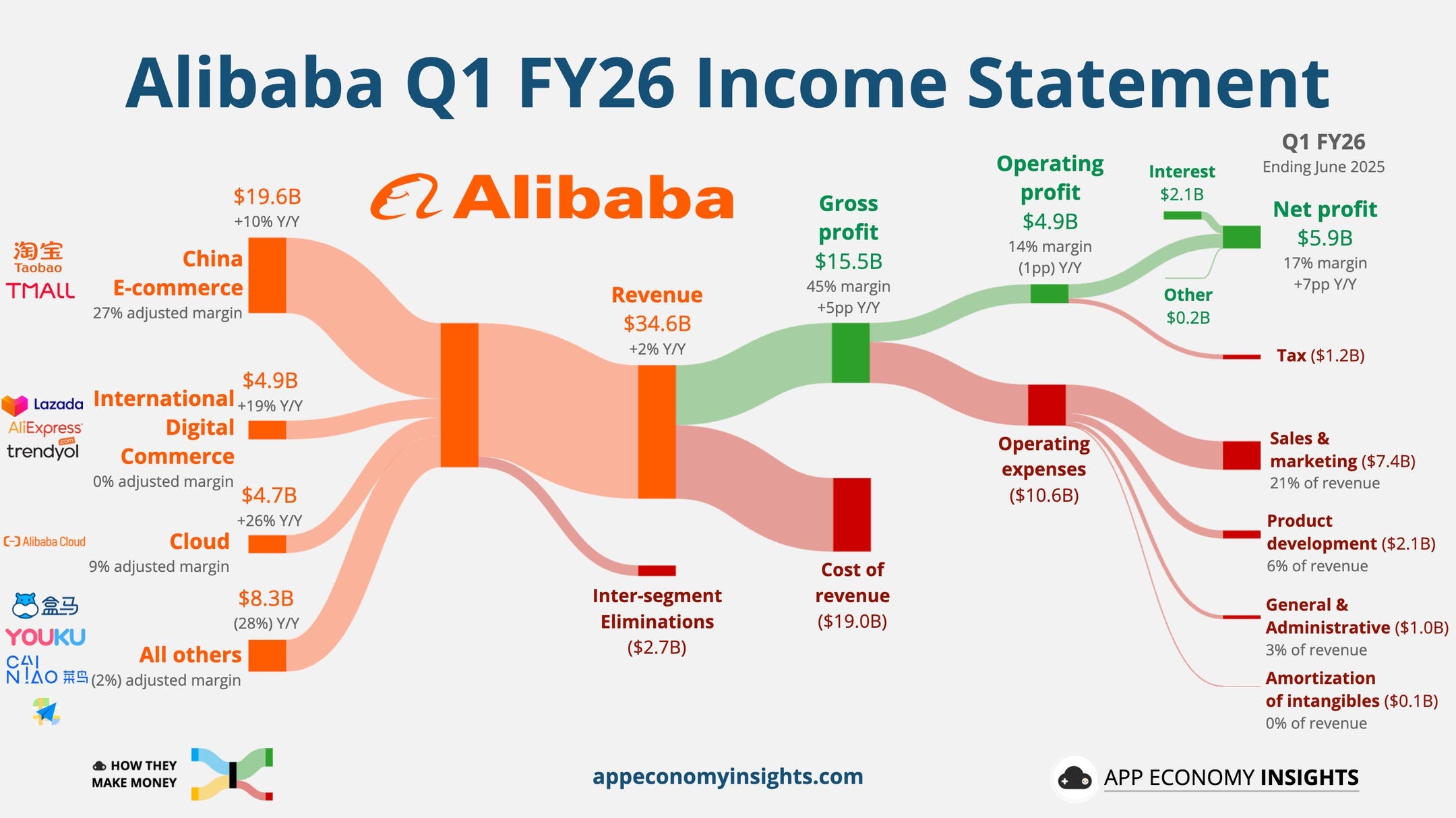

“This quarter, our strategic focus on consumption and AI + Cloud delivered strong growth……Looking ahead, we remain committed to investing in our two strategic pillars of consumption and AI + Cloud to capture historic opportunities and drive long-term growth,” said Eddie Wu, Chief Executive Officer of Alibaba Group.

That was the opening statement Alibaba’s CEO Eddie Wu said during its June Quarter 2025 earnings call. Stating a clear message: Alibaba is making a comeback, and it’s approaching AI with two strategies. So, for this quarter, the main question I have now is whether the consumption flywheel can continue to turn, and whether AI and cloud can translate into durable revenue drivers.

What’s Alibaba doing? Well, pretty much everything. So today, we’ll break it down.

Alibaba’s capex spending is leading in China, but lags significantly behind U.S. peers.

Commerce business making a comeback and integrating AI across all steps from intent to transaction

Alibaba Cloud, ranked 4th globally, 1st in Asia, is doubling down on its enterprise strategy

Open-weight Qwen models and the Tongyi ecosystem continue to bring businesses in

2C applications are pretty much embedded in every touchpoint under the sun & real-life business data is its true advantage in the agentic era

AI Capex

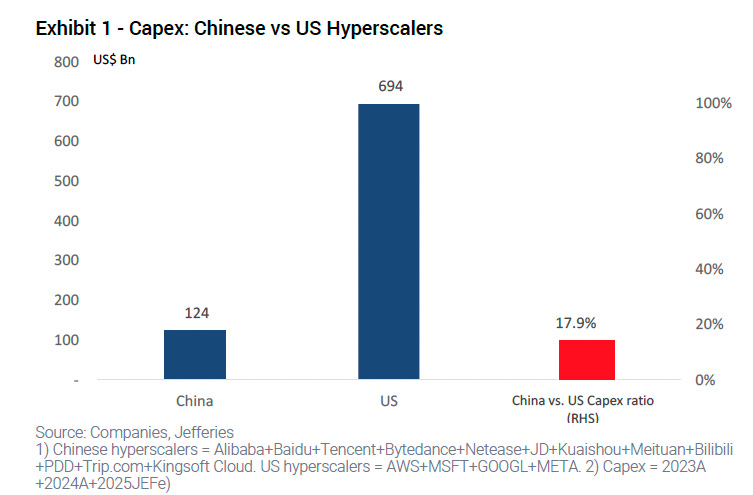

First, let’s look at spending. The company hasn’t adjusted its RMB 380 billion (~ USD 53 billion) capex spend over the next three years since its initial announcement in February. As we wrote half a year ago, Alibaba’s massive capital allocation has been heavily spent on building its chip capabilities and growing its cloud capacity. However, it pales in comparison to those in the U.S.

Actually, for context, if you look at the total capex amount, Chinese hyperscalers’ combined capex in 2023, 2024, and 2025, as expected, will be ~ USD 124 billion, which is 82% lower than that of its U.S. peers at roughly USD 694 billion, according to Jefferies’ latest China Tech report.

Over the past six months, the build-out of AI infrastructure has contributed more to the growth of the U.S. economy than all consumer spending. In the past three months alone, the magnificent seven have spent more than USD 100 billion (!) on data centers and related infrastructure.

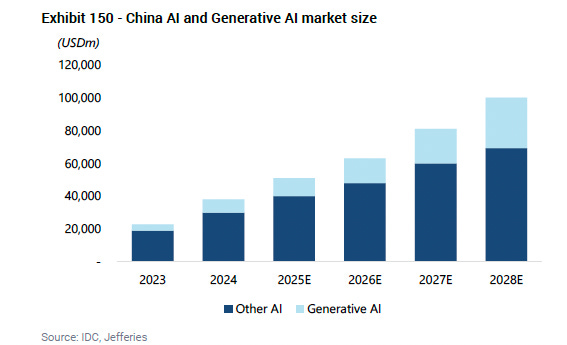

According to IDC’s April forecast numbers, global IT investment in AI is projected to reach ~USD 815.6 billion in 2028 (THESE ARE MAD NUMBERS). The generative AI market is expected to reach USD 284.2 billion by 2028, accounting for 35% of the overall AI market investment.

Comparing the China numbers, the U.S. hyperscalers are definitely spending way more, and are projected to be creating a much larger market.

Specifically, IDC highlights China’s continued leadership in the APAC AI market, with its spending exceeding 50% of the region’s total. IDC further projected that China’s total AI investment would surpass USD 100 billion by 2028, and its generative AI market would exceed USD 30 billion in the same year.

❓ Feedback 🗳️

Giving me added feedback on which articles you prefer, helps me decide how to better serve you my reader.

Commerce

The 17th Double 11 just concluded. Starting on Oct 15, the big sale lasted for nearly a month. Although the festival felt a little underwhelming for Alibaba compared to its heyday, when it even had T-Swift leading live concerts and countdowns, we cannot deny its impact on retail as a whole. Brands from Lululemon to Sephora have all released their own versions of 11.11 over the last week.

However, the era of competing solely with flash numbers and traffic wars is now behind us. a16z recently suggested that the traditional “search-compare-buy” model is being replaced by AI agent-driven purchasing—essentially, search on steroids. At the same time, Precedence Research projects that the global AI-enabled e-commerce market will grow from USD 725 billion in 2024 to USD 64.03 billion by 2034, over the next decade.

In Alibaba’s own corporate blog, it boasted that “LLMs have been integrated to core search and recommendation engines,” supposedly leading to “double-digit improvement in result relevance for complex queries and a double-digit lift in click-through for certain recommendation scenarios.” But frankly, I’m not sure how that is measured.

Kaifu Zhang, Head of AI Initiative at Alibaba International Digital Commerce, said, “Useful AI” is the benchmark for Taobao’s AI applications. And we’re really seeing this recent Double 11 serve as the first major showcase for this quiet revolution, where Taobao (the leading e-commerce platform in China) has applied AI comprehensively across traffic distribution, consumer experience, and merchant operations to drive efficiency and improve the user experience for transactions.

AI is now no longer a supplementary tool but a core variable embedded into every环节 (link/ step) of the e-commerce system, driving smarter operations, growth, and GMV.

e-commerce

The evolution from traditional to multimodal recommendation systems represents a fundamental strategic upgrade that transforms a key part of the digital platform experience, evolving it from a reactive utility into a proactive growth engine.

Traditionally, recommendation engines have acted like junior sales clerks, relying solely on historical purchase data to suggest items. This approach severely limited business strategy by failing to effectively promote new products with no sales history (the “cold start” problem) and by missing opportunities in niche, “long-tail” markets.

The new paradigm of multimodal AI shatters these limitations by acting like a master sales expert who can actually see and understand your product catalog. By analyzing product images and reading descriptions, the system grasps the intrinsic qualities of items, allowing it to intelligently recommend a new restaurant based on its appealing food photography or connect a user with a unique culinary interest to a particular dish they’ve never tried before.

This directly enhances business strategy by accelerating the successful launch of new products, unlocking new revenue streams in specialized markets, and creating a more intuitive and satisfying customer experience that fosters loyalty.

By building this product intelligence and connecting it to user intent, Alibaba achieved direct bottom-line results, including a significant increase in orders and total sales volume. Looking ahead, the move toward generative recommendation will further deepen this strategic advantage, enabling the system to explain its reasoning in plain language, thereby building unprecedented trust and personalization that can dramatically increase a customer’s lifetime value.

Sidenote: Today, we won’t delve into the nitty-gritty of a side commerce business that showed an unexpected twist - that is, seeing Ele.me and AMap, two struggling businesses, revive and not only resurrect but thrive. You can check out The Great Wall Street, which explains it well here.

https://substack.com/home/post/p-178050511

Now that’s the consumer side of the story. The other half is about Cloud + Qwen.