Where to start? I’m interested in giving global macro coverage of AI trends and that wouldn’t be possible without talking about China’s progress in 2025. Tony Peng is one of my favorite sources: he’s ex-Baidu Global Head of Comms and a former AI reporter; a longtime AI observer with a keen focus on China’s AI development.

If you aren’t premium and want to read his entire 2025 rundown, please subscribe to his Newsletter below. He’ll be publishing it (this deep dive) at end of 2025 in a few days.

Recode China AI

China AI Spotlight: A weekly guide to China’s AI Breakthroughs, trends and stories. By Tony Peng.

Who is ready for another DeepSeek-R2 flagship model launch? I suspect we might have another interesting time of it soon (within weeks).

Tony’s writing is clear and his range of topics is vast. His coverage of China BigTech advances in AI is itself notable:

Meet Tesla FSD’s Fiercest Competitors in China

💪🏻AI Makes Alibaba Great Again

👀TikTok’s Parent ByteDance Quietly Builds Its AI Empire

Highlights of China in AI in the year 2025

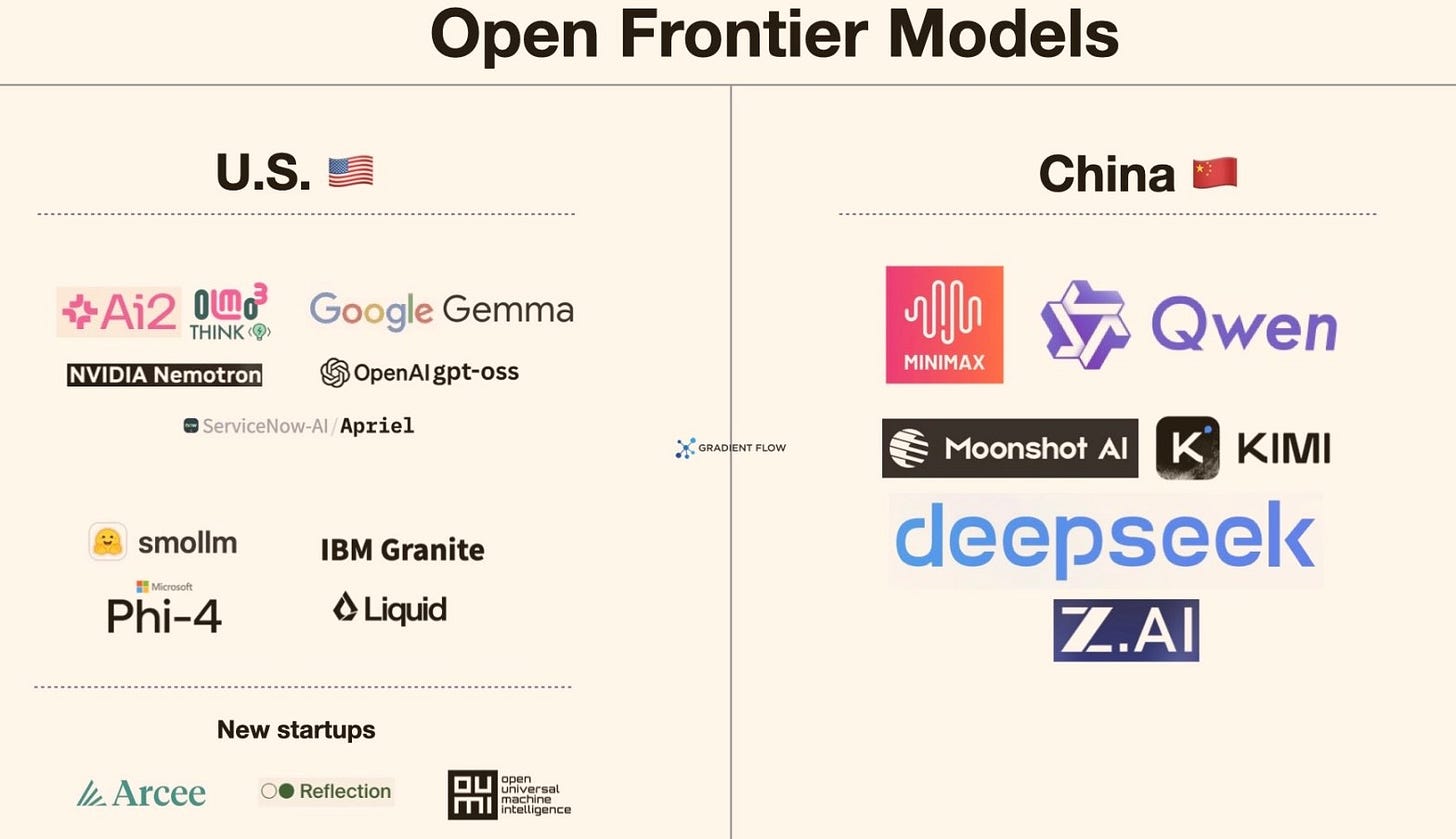

Here are some of my notes: open-weight models, agentic AI and reasoning model upgrades takes the prize. China also is early on the AI IPO front with many significant physical AI and humanoid robotics companies.

If you know anyone curious about what China is up to in AI, this could prove helpful:

China managed to do this with little access to leading AI chips and with a fraction of the capital allocation (capex) of the U.S. We do know that the likes of Alibaba and ByteDance are starting to enter the capex territory of the global leaders in AI. China’s progress in artificial intelligence in 2025 is like a global undercurrent of the future.

Some Themes I noticed

⚫ Open-Source Dominance: For the first time, Chinese open-source AI models accounted for 17.1% of global downloads, surpassing the U.S. to rank first in the world.

🟠 Ecosystem Adoption: Massive User Adoption: By February 2025, China’s generative AI user base hit an estimated 570 million, driven by "super-apps" like and new winners like Doubao and DeepSeek. To illustrate the momentum of DeepSeek’s moment - China’s user base of generative AI doubled in the first six months of 2025, a growth rate of 106.6%.

🟢 China’s Six Little Dragons of AI grew up a bit: Emergence of Advanced Reasoning Models that are open-weight: The releases like Kimi K2 (Moonshot AI), GLM-4 (Zhipu AI. now Z dot AI open-sourced GLM-4.7), and MiniMax models closed the gap with US frontiers in complex reasoning, with steady streams of free, high-performance updates attracting developers and builders.

🔵 China showed with startups like Manus and Genspark, they will develop AI agentic product companies. The "AI Agent" Year: 2025 is widely cited as the year AI agents moved from chat interfaces to autonomous task execution (e.g., the "Manus" agent achieving 57.7% accuracy on high-level GAIA benchmarks). China integrated reasoning models into products very quickly, including many catering to Western and global audiences.

🟣 AI chip startups and IPOs: While MiniMax and Zhipu dropped flagship models in December ahead of Hong Kong IPOs. China’s AI chip startups went or are about to go IPO too: Moore Threads Technology Co. saw its stock jump 425% on the first day of trading in Shanghai, followed by the 693% gain for MetaX Integrated Circuits Shanghai Co.’s listing. Cambricon Technologies also went public meanwhile Enflame, Biren and Kunlunxin will be early 2026 most likely as well. Huawei Ascend had about 35-40% of the Chinese market in 2025 as far as I can tell. Bernstein Research thinks this could look like 50% in 2026.

🟡 Sovereign Compute & Chips: Huawei’s Ascend 950/960 series and the return of Kirin chips (Kirin 9020) have begun powering over 50% of domestic data centers, reducing reliance on Nvidia. These are Huawei’s in-house AI chip efforts. Apparently AMD has a new order from Alibaba, so things are getting interesting as Nvidia’s efforts and GPU sales in China have come under many revisions.

⚪ China’s Semiconductor push: China is reportedly to have recently successfully built and is testing a prototype Extreme Ultraviolet (EUV) lithography machine capable of generating EUV light, a major milestone in its push for semiconductor self-sufficiency. The Chinese team, which includes former ASML (Netherlands) engineers recruited with large bonuses and working under aliases, used reverse-engineering on older ASML machines and components salvaged from secondhand markets. The prototype was developed in a high-security laboratory in Shenzhen as part of a six-year, government-led "Manhattan Project" initiative to bypass Western export controls (coordinated in large part by Huawei). While generating light, it hasn't produced working chips yet, with targets set for 2028 (government goal) or 2030 (more realistic estimate) for actual chip output, significantly faster than anticipated. China also has a hoard of humanoid robotics startups and robot prototypes that showed some rapid progress in Physical AI capabilities in 2025 as well. China’s native semiconductor ecosystem is still likely 6-12 years behind TSMC, Taiwan or the likes of Nvidia.

China’s Innovation Market is Dynamic

China’s ecosystem of AI startups, incumbents, academic AI researchers, and AI chip startups is likely more vibrant, manifold and dynamic than in the West where just a few BigAI companies tend to dominate. The physical AI spectrum will become more clear in 2026 as well. With China’s abundant energy grid, if they wanted to scale datacenters they could do so fairly cheaply as compared to the United States. Meanwhile Huawei is estimated to produce roughly 800,000 to 1,000,000 AI chip dies in 2025, with plans to double this output for the Ascend 910 series in 2026. From DeepSeek to Huawei to the incredible progress by Alibaba Cloud’s Qwen team, China suddenly looks like they are on an upwards trajectory worthy of their AI engineering prowess.

🔴 AI Smartphone Surge: AI-powered smartphones (for instance capable of real-time voice translation and on-device editing) now make up over 30% of all shipments in China. China’s AI innovation in mobile is often overlooked and how their super-apps have integrated it is fairly rapid and advanced. In autonomous vehicles, Baidu’s Apollo went global in 2025.

Do you enjoy podcasts?

Was DeepSeek-R1 China’s Sputnik moment?

2025 was the year watching China in AI, robotics and technology became a lot more interesting. Qwen (Alibaba) models basically took over the spot Meta (Llama) had that new foundational open-source models startups use.

I believe a lot of approaches by the United States and China are ultimately complementary for global consumers, software developers and innovation for human civilization.

While many leading U.S. labs like OpenAI and Google focus on proprietary, "closed-source" frontier models, Chinese firms have embraced a more "open" approach, making their models more accessible and customizable for developers. Chinese open-source models power nearly 30% of global AI usage, a significant jump from 1.2% in late 2024. How high can it go in 2026?

Now let’s turn to Tony’s deep dive:

Top 10 China AI Stories in 2025: A Year-End Review

By Tony Peng