How the AI Bubble is Bad News for the U.S. Economy

The Bitter Lesson, a Tightening Labor market and AI Capex "roaring like the 1920s." A Machine economy setup with too much U.S. talent retiring amid an AI Bubble.

Today I’m going to cover the intersection of the U.S. economy and the AI bubble, that is, the impact of Generative AI and AI Infrastructure Capex on the U.S. economy. Last time we dealt with some of the warning signs that we are in an AI bubble. But the experience of the economy also impacts our view of the hype around an incapable AI manifestation.

What will history say was the Bitter Lesson for Generative AI? That it deskilled some of us, hurt the labor market or, that it was over-hyped to benefit the few over the many? The U.S. economy could get very painful in 2026 as the lack of hiring and stark lack of entry level positions open is already and will abruptly demonstrate.

Walmart employs approximately 1.6 million associates in the U.S. as of the end of fiscal year 2025. “It’s very clear that AI is going to change literally every job,” Chief Executive Doug McMillon said this week in one of the most pointed assessments to date from a big-company CEO on AI’s likely impact on employment.

From The Wall Street Journal:

Head count at Walmart (the largest private employer in the U.S.) expected to stay flat over next three years, despite growth plans, as AI eliminates or transforms roles. Amazon feels the same way according to its CEO.

The “Bitter Lesson” essay by Rich Sutton, published in 2019, distills a core insight from 70 years of AI research: general methods that leverage massive amounts of computation. The AI Infrastructure bubble1 is our very own 2020s version of the Bitter Lesson, a deepfake of the Roaring Twenties if I ever saw one. While it may not be game-over for pure LLMs quite yet, clearly humanity will invent better AI architectures soon compared to the myriad failures of LLMs being adopted in the real world.

Think about the real damage Generative AI is causing to the world even outside of the insane and reckless spending on AI Infrastructure, capital that could be going to more worthwhile things! This monstrosity of capex has warping cognitive decline in its back pocket:

In a climate where American executives are hyping up FUD around AI2, the rise of thinking machines are the least of our worries3. Renowned roboticist Rodney Brooks also thinks we’re in a humanoid robot bubble4, and capital is being spent as it it were the Roaring Twenties. The problem? This ain’t no electricity, war economy and automobiles era though. Comparing an era of AI slop to electricity is almost as absurd as comparing chatbots to PhDs. The stark geopolitical reality closer to the truth means the AI arms race might push us to the brink of world war 3 and have unexpected consequences on the global economy and in particular the U.S. economy. Where’s the cost benefit analysis that this is actually a good thing? How quickly FOMO can turn to FUD in American sentiment. Let’s also note that increasingly the United States’ Real GDP increased at a 3.8% annual rate (or 0.9% quarterly rate) in the second quarter of 2025 does not correspond with the economic reality of most Americans. I anticipate this to get worse and more skewed in the 2026 to 2030 period.

UK Influencer Says No Trouble Here 😂

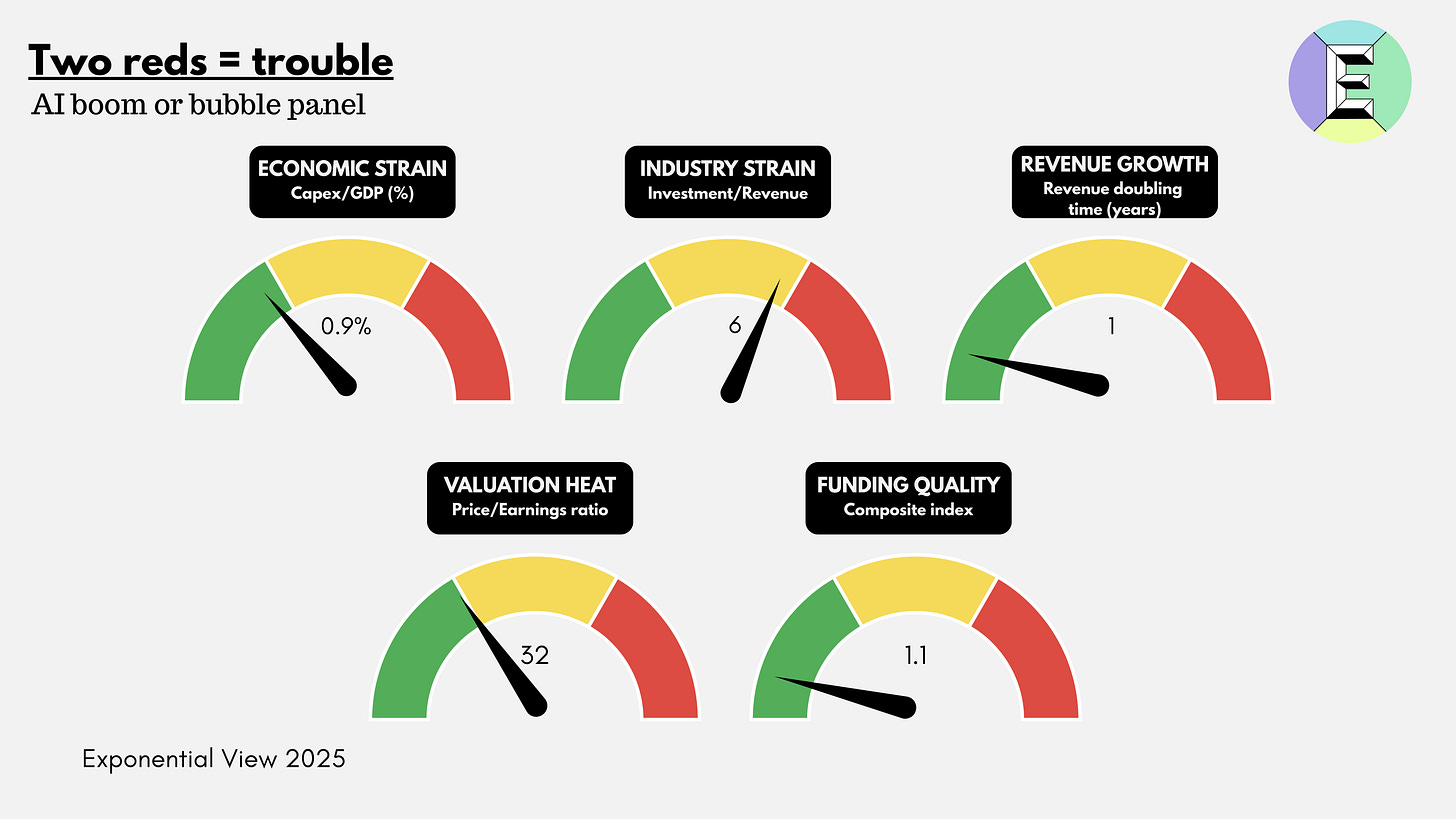

EV built a five-gauge dashboard to help see where AI stands against history’s bubbles.5. But no red signals? 🤯 Things look great in their framework. Azeem said: “Bubbles and booms look similar at the start. The difference is whether fundamentals catch up. These gauges help you track that over time.” To the contrary, the grossly overvalued private market valuations of AI startups in the U.S. is one of the classic signs and signals that we are indeed in an AI bubble. Thinking Machines ($10 Billion) or Figure AI ($39 Billion) worth $Billions with no product or sales is just what you’d expect in an AI bubble. Meanwhile the UK, where Azeem is based is frantically trying to scale up their own version of CoreWeave, called Nscale which is the very picture of industrial strain trying to meet (speculative) future demand.

“Comparing an era of AI slop to electricity is almost as absurd as comparing chatbots to PhDs.”

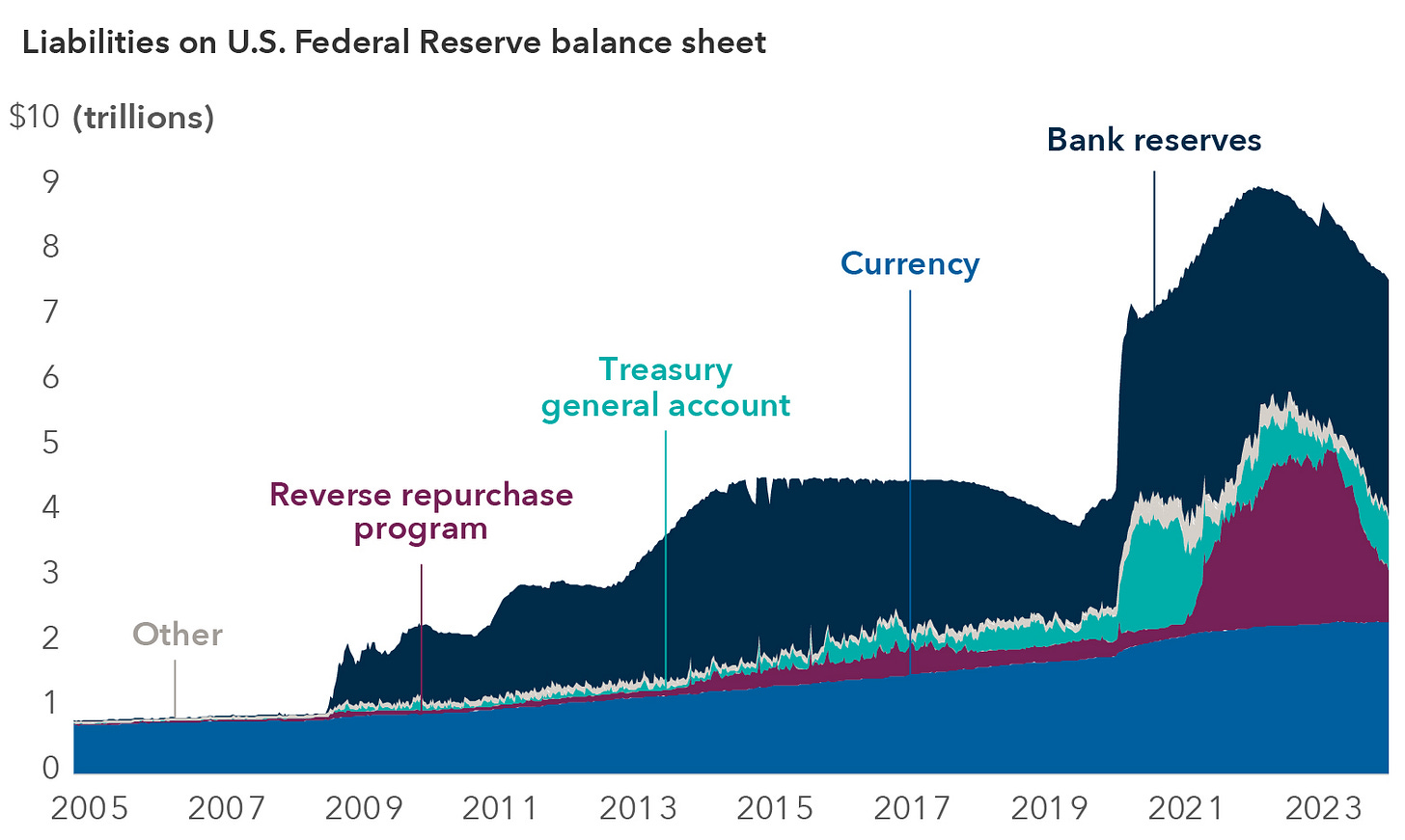

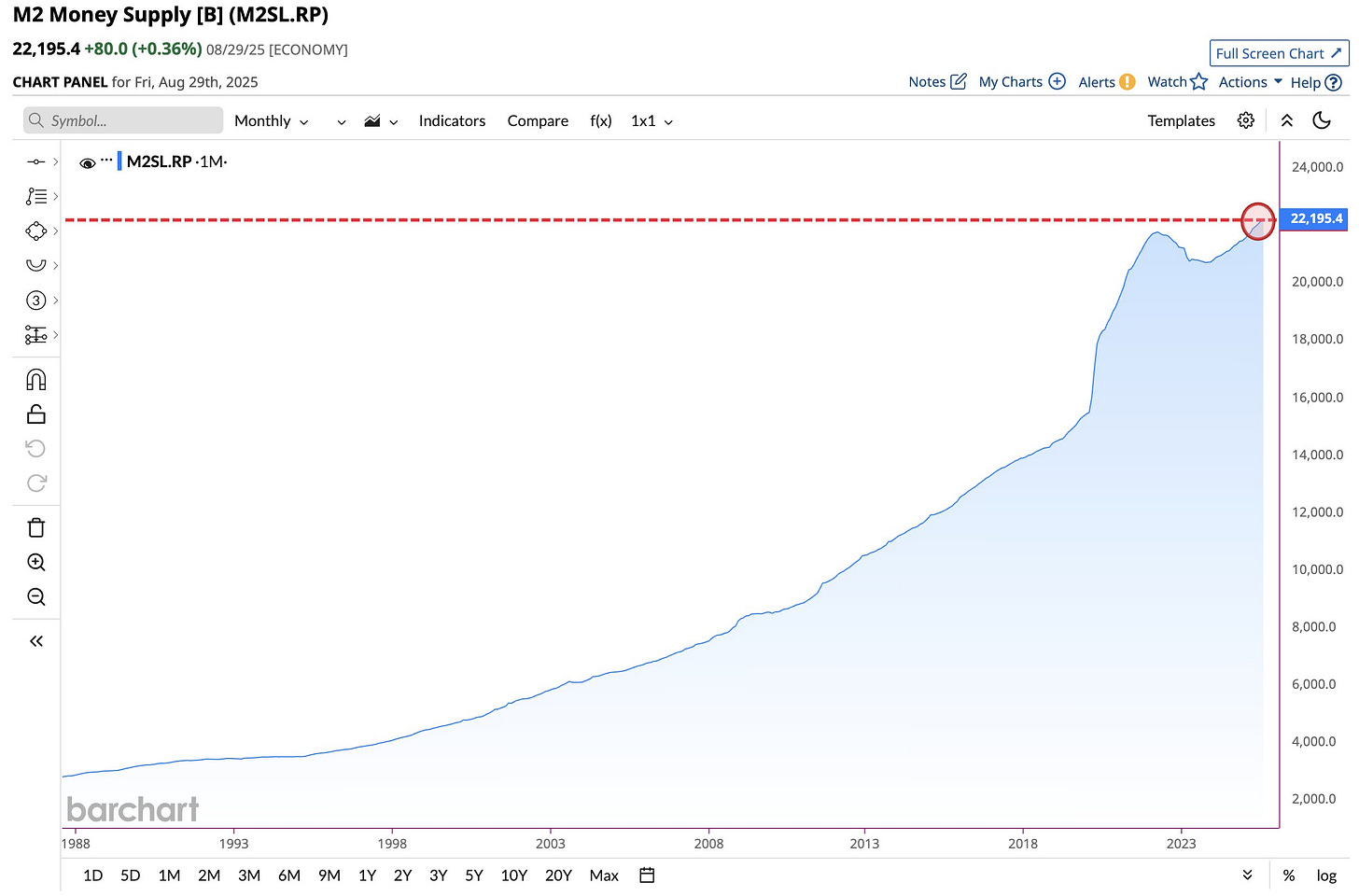

Generative AI’s attempts to brute-force AI into our lives6 is like a Silicon Valley monopoly game that must have seen the incredible QE glut of cash on the sidelines where the K-shaped recovery from the pandemic now in 2025 looks more like an i-shaped recovery (the dot of the “i” are the top 20% of consumers that keep driving the economy in mid to late 2025 while many of the rest of us have already conceded defeat and with pinched wallets or worse): The backdrop? Peaking at $9 Trillion (in 2022) in Quantitative Easing (QE), a monetary policy that set up the AI hype bubble, to perfection. Almost as if it was coordinated or premedicated.

M2 Money Over Supply and the AI Hype Cycle

Such a radical surge in QE leads us to M2. This means a world with too much liquidity for its own good: U.S. M2 Money Supply reaches new all-time high of $22.2 trillion7. This isn’t your Grandfather’s economy: LLMs become a vehicle to erode the middle class even faster than previously possible because of the incredible divergence in the distribution of wealth that they cause. The damages to the U.S. economy, labor market, demographics acts like a blanket of a stagflationary low-hiring prolonged period that is going to be brutal and certainly worse than a rolling recession.

The AI bubble compounds this new kind of American economy that works for the top 20% of American consumers, but not well for the bottom 80%.

M2 indicates how much money is available for spending and investment within the economy and capex in AI and a higher inflation (“stagflationary”) economy will have predictable outcomes on wealth inequality, and its acceleration which is bad for the economic fortunes of the average Americans.

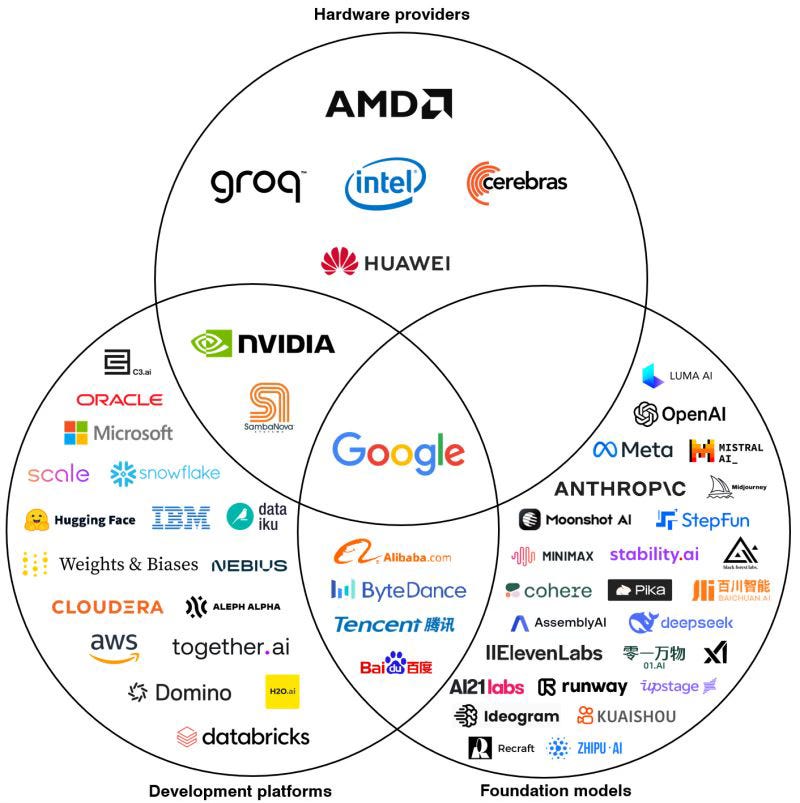

In 2025, it’s not OpenAI that leads but the new and familiar companies like Nvidia (header image) and Google, leading to an AI driven bull-market (in stocks) the likes of which we haven’t seen for decades. More concentration in markets will lead to an even bigger Tech bubble in a self-fulfilling prophecy and reinforcing cycle. To call the impact of AI capex as real on actually GDP is deeply flawed.

The Full-Stack AI Arms Race

That there’s so much concentration with that added QE financing coming off the sidelines into Index funds | ETFs | passive investing looks fairly contrived and paces (or places) Generative AI as one of the biggest Technological bubbles in history. Read this paragraph again.

We are teetering into a digital8, debt and crisis of American leadership, and Generative AI is the perfect weaponizing force. CEOs are reducing their hiring ambitions at the supposed dawn of AI and it’s already hurting Americans, labor demand and a mismatch between too many retiring Americans and an immigration talent pool that is about to dry up even before the impacts of tariffs are even fully felt. It’s a toxic combination for the U.S. economy.

The Compute Fallacy 🤖

“One thing that should be learned from the bitter lesson is the great power of general purpose methods, of methods that continue to scale with increased computation even as the available computation becomes very great.9”

Listen to the full podcast of Richard Sutton on Dwarkesh’s show10.

But a half-baked hallucinating technology like LLMs that is good enough to increase efficiency enough to automate jobs, but not good enough to create new ones, is a disaster for America’s economy and its ability to lead in innovation. The AI bros are going to have some explaining to do. The AI bubble as it turns out, is adding to an already uncertain climate around the economy in a comedy of errors by the Trump Administration that might damage the core foundations of the United States as the former unipolar leader of the world. As “rule of law” degrades, capex in AI Infrastructure is masking the economic gravity of the situation.

Rising Youth Unemployment and an Eroding Consumer

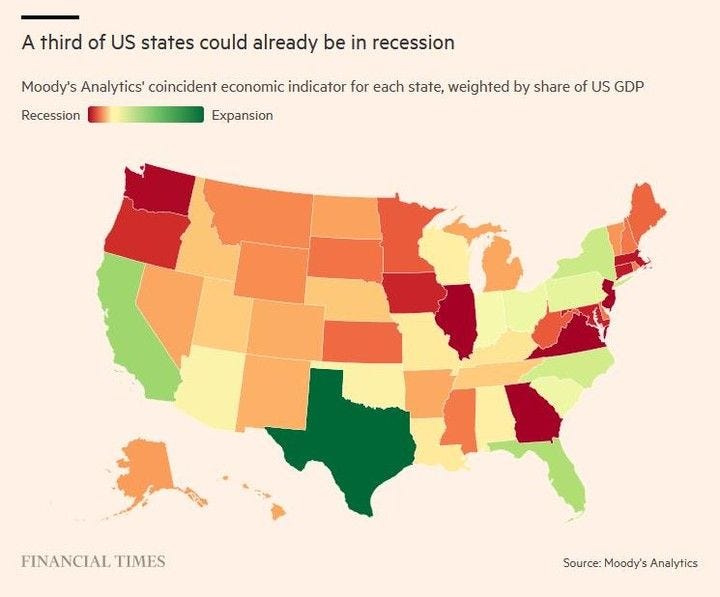

Mark Zandi, chief economist at Moody’s, warned that one-third of the country is already in recession11.

The AI Bubble is already hurting American jobs and especially youth unemployment, women who are over-represented in the bottom 60%, blacks and the usual suspects.

Partnerships in Mafia Capitalism

Silicon Valley Venture Capital (for example Sam Altman’s) games are a culprit not just to our well-being, now increasingly to our livelihoods and our very real economic survival: (these are not the good guys). Let’s do some vendor financing and call it a great partnership with a big number. OpenAI’s aggressive lobbying is a cause for alarm, not respect. Yet another AI Bubble warning sign, exaggerated promises and under-delivering. Vendor financing at this scale implies anti-competitive practices, certainly from the perspective of an AMD or an Anthropic.

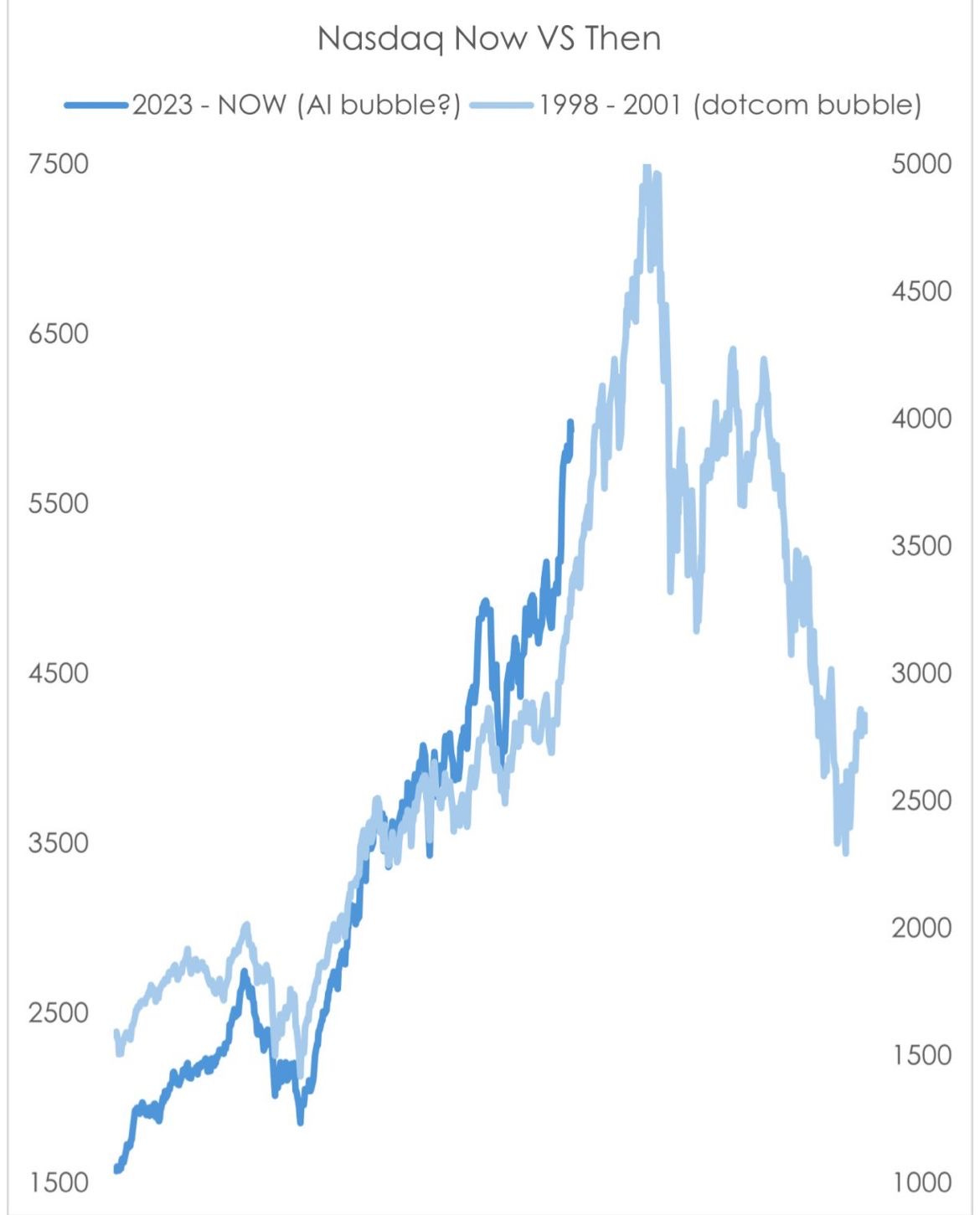

The AI Bull Market keeps climbing: 🚨 (we’ve seen this before)

Is scale all you need? Damned if it hurts Americans.

Prioritize scale (AI Infrastructure) at your own risk. Is consensus that LLMs are an AGI dead-end mounting12 ? Well the odds aren’t moving higher. Even white-collar and highly educated folk were fooled by the AGI pitch. The outcome of the AI bubble on the prospects of their kids and grandchildren won’t be just about AI philosophy, history or academic speculation.

Foreign, Industrial and Immigration Policy - the Trifecta of Economic Executive Blunders

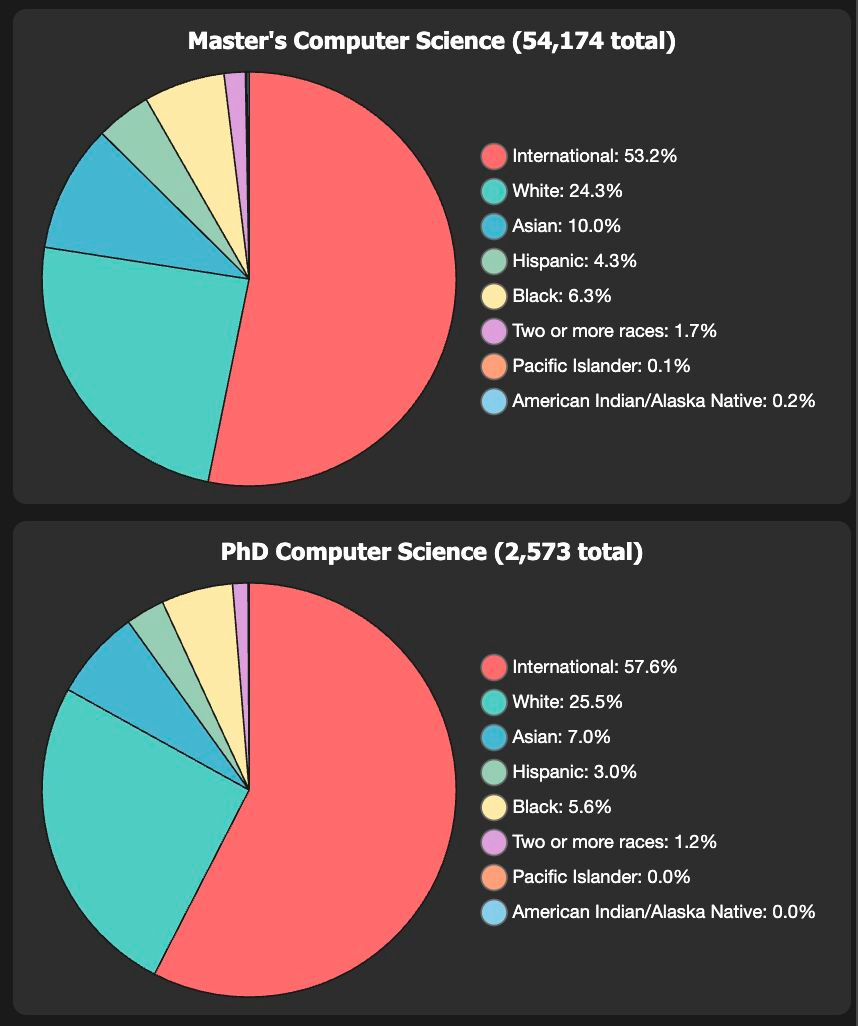

That Trump’s own Immigration and foreign trade policies of course only sets up more dangers for the U.S. economy that is going to squeeze the middle class even with the impotent impact of LLMs driven by a demand for compute hungry machine economy principled acceleration: (taxing H-1B dependent employers is a tariff soup of centralization that favors larger firms over smaller ones what will become a competition for a more scarce foreign talent resource 13):

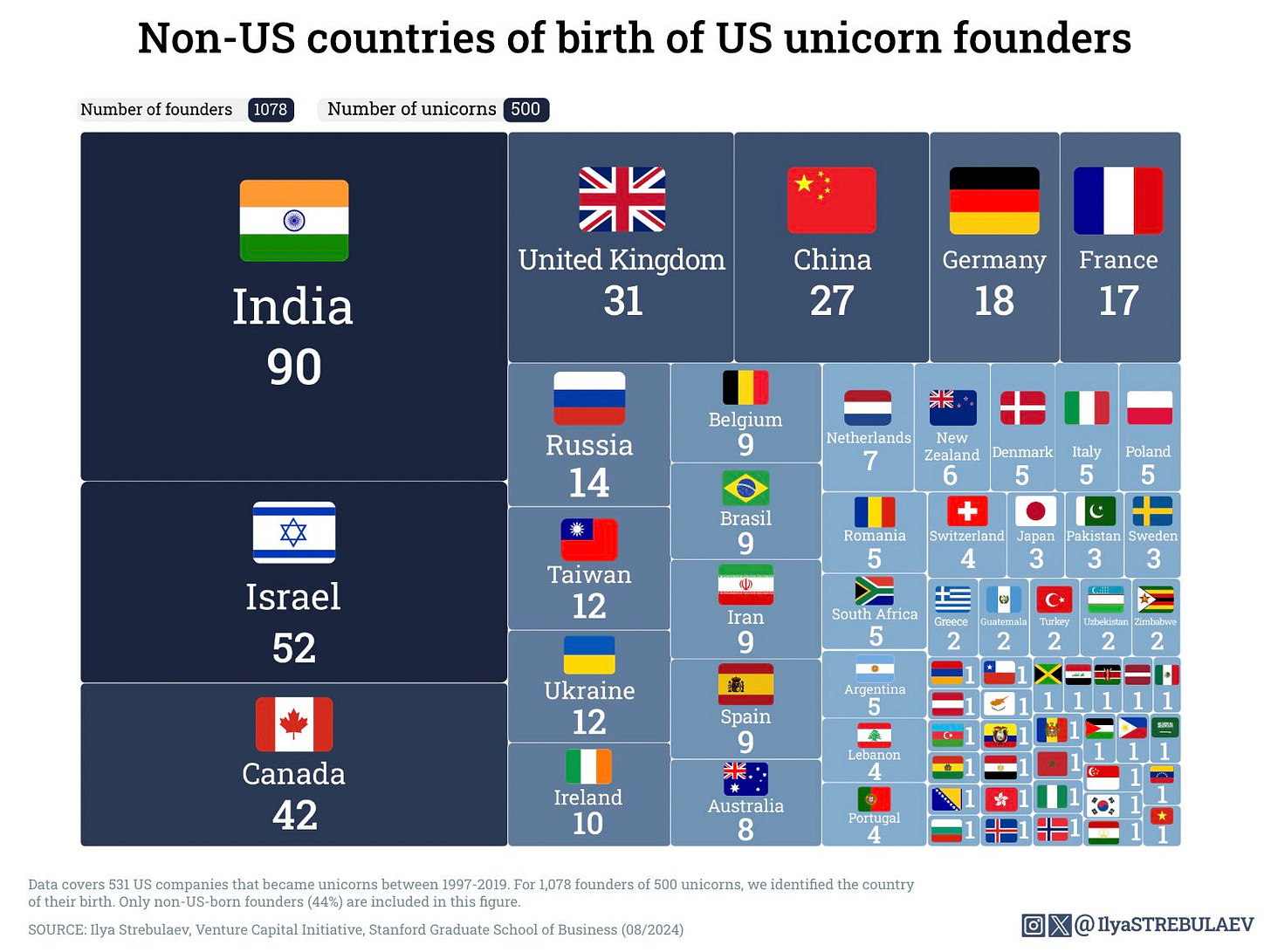

Talent Retiring Just as the Talent Pool Degrades

In short, 60% of CS PhDs in the US are not American. 53% of CS Masters grads in the US are not American. Immigration has been the backbone of U.S. innovation for decades. How about Unicorn founders? As you probably know, nearly half of US Unicorn Founders were born outside the US 14. The U.S. is on the path to a technological dark age that is highly likely to further hurt and inflict pain on the the U.S. economy, labor market and the prospects of our most important resource, young people.

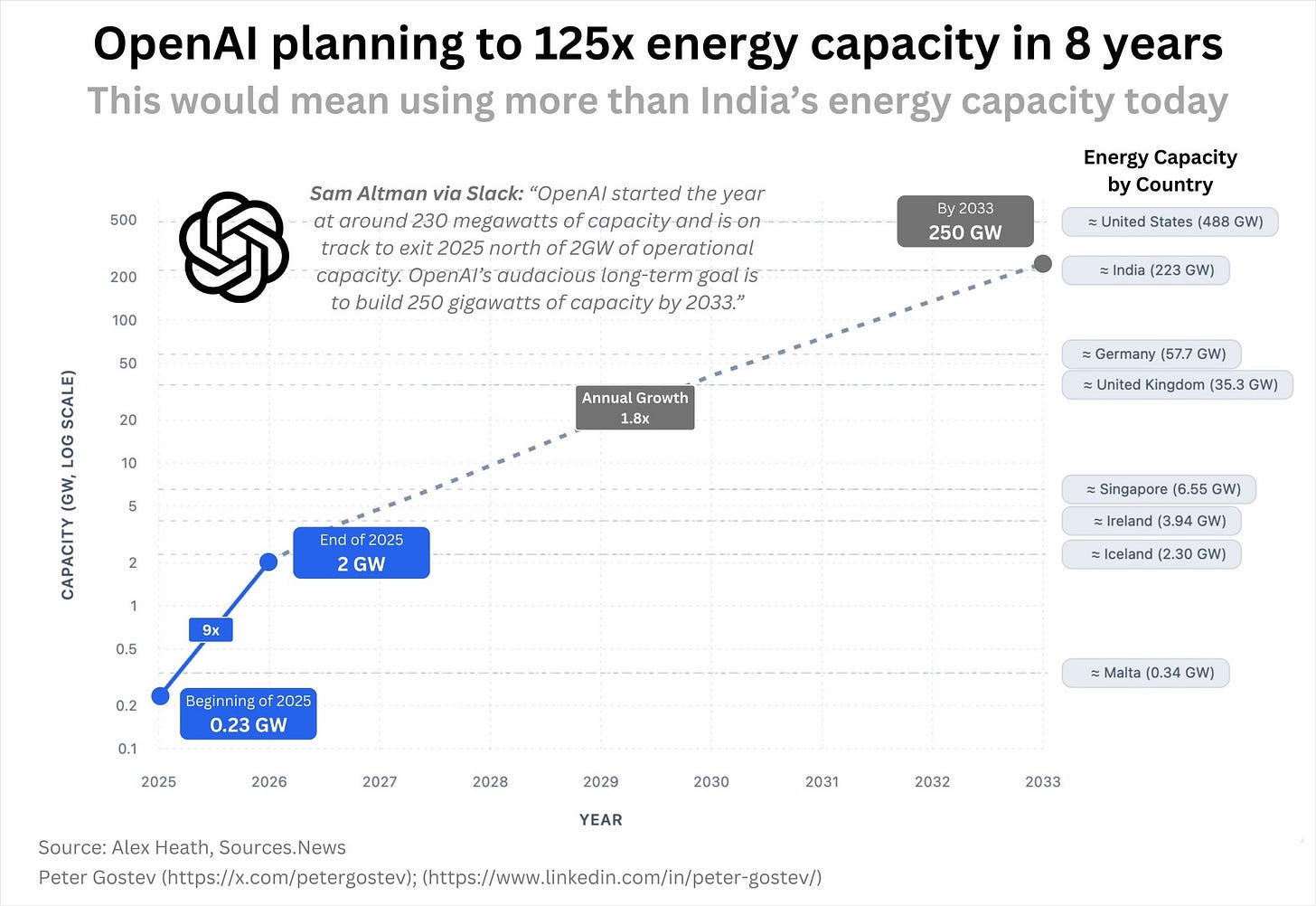

Bad industrial policy interventions and poor foreign global affairs doesn’t lead to a great U.S. economy, especially with an AI bubble that’s unable to show ROI compared to the machine economy commitment in the Trillions of investment in AI Infrastructure and an unfathomably high demand for compute of hyperscaler capacity now that needs to be served like a clockwork of building more datacenters. BigTech hyperscalers are now locked into a vicious cycle of their own making!

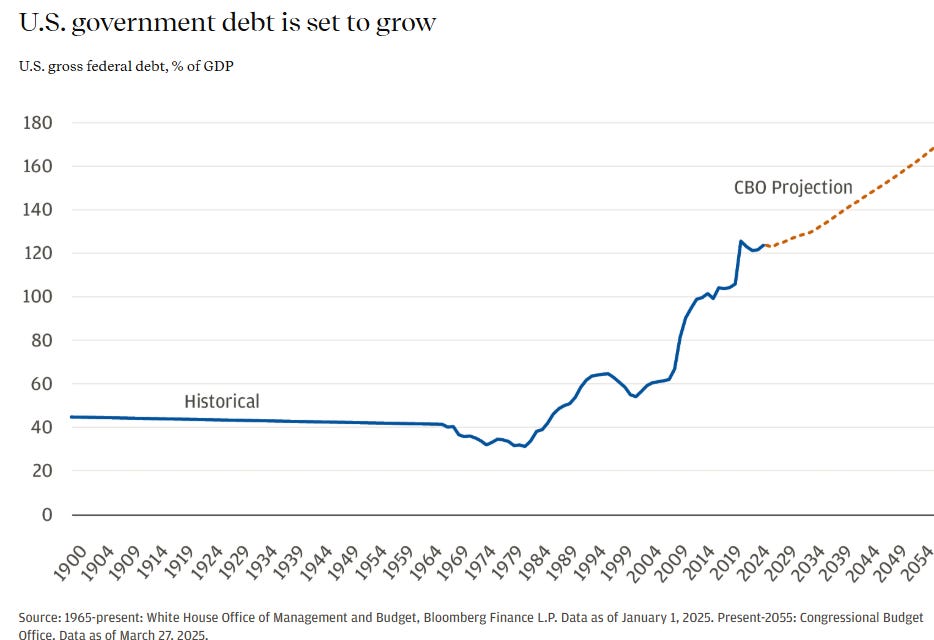

The Coming Fertility Bust, the GenZ Consumer and U.S. Debt Crisis

The importance of demographics on the U.S. economy cannot be overstated either. All of this combined with a GenZ culture where by 2030, 45% of prime working age women in the US, defined as women aged between 25 and 44, will be single according to Census Bureau historical data and Morgan Stanley forecasts – the largest share in history15. The fertility bust, combined with the inevitable rising healthcare costs of an aging population, and the AI deskilling of a so-called “Generative AI” is going to warp the outlook of young people even further through the 2030s. The labor crunch of more Americans retiring than immigration under Trump will allow to come in16, means a setting up yet another labor crisis. This is not even talking about the coming debt crisis of the U.S. Government that’s quickly approaching.

The AI Infrastructure capex that the U.S. has decided to pursue is so massive and the demand for compute will become so hungry (in the second half of the 2020s and first half of the 2030s), it will accelerate the arrival of the U.S. debt crisis by many years. This isn’t commonly pointed out or widely understood.

Not conditions a healthy society implements for its own U.S. economy. The damage to the U.S. economy of LLMs and Trump’s understanding of macroeconomics might actually be irreversible by 2027. Aspects of technological accelerationism might be hardcoded and so ingrained into the playbooks of (BigTech) incumbents it will be difficult for them to back out.

We do still have a deep dive to get to today and here is the related topic:

Cisco, Nvidia, and the Economics of Tech Bubbles

What the dot-com buildout and the AI expansion reveal about state policy, investor hype, and the burdens of infrastructure.

Justin Kollar writes Techno-Statecraft:

Mapping the intersections of technology, governance, and power and it’s a chronically under-rated Newsletter:

His contributions to the analysis of the AI Bubble or Boom are already considerable:

Author’s Bio

Justin Kollar writes about the politics of technology, infrastructure, and the environment. His work explores how data centers, semiconductors, and industrial policy reshape landscapes, resources, and everyday life. A planner and scholar of political economy, he draws on both research and practice to make sense of the forces driving today’s digital boom. His newsletter, Techno-Statecraft, connects history, policy, and critical analysis to the future being built around us.

Five relevant articles:

Justin’s work has said and contributed a lot about the discourse on technology bubbles:

I asked one of the best people to ask what he thought about Nvidia and Tech Bubbles17.

Comparing Cisco and Nvidia

At the height of the dot-com boom, Cisco Systems briefly became the world’s most valuable company. Its routers and switches were seen as indispensable to the internet, and its stock rose nearly fortyfold in the 1990s. When the bubble burst, demand collapsed, carriers defaulted under massive debts, and Cisco’s market value plunged by almost 90%. Investors, pension funds, and workers bore the losses. Yet the infrastructure endured. The glut of idle “dark fiber” from the crash eventually lowered bandwidth costs and supported the growth of broadband and the cloud. Cisco’s trajectory revealed how speculative booms can destroy financial capital while leaving lasting material legacies and a powerful firm intact.

Two decades later, Nvidia occupies a comparable position in the artificial intelligence surge. Originally known for gaming chips, its GPUs became the essential hardware for training large AI models—controlling more than 98% of the AI accelerator market by 2023. By 2025 its valuation had climbed past $4 trillion (about 14% of U.S. GDP). As concerns about a bubble mounted, the financial press drew constant parallels to Cisco:

Financial Times, Aug 13, 2023: “Nvidia circa 2023, Cisco circa 2000”

Morningstar, December 7, 2023: “Nvidia 2023 vs. Cisco 1999: Will History Repeat?”

Financial Times (again), Feb 13 2024: “AI hype has echoes of the telecoms boom and bust”

Bloomberg, March 11, 2024: “Nvidia Vs. Cisco — A Bubble by Any Other Metric”

The Wall Street Journal, June 22, 2024: “Nvidia Is No Cisco, but It Is Getting Expensive”

A great then and now analysis of the dot.com and today follows: