Burn Baby Burn - Exponential Demand for Compute Supercycle begins

Gold, the demand for compute and the AI Supremacy wars.

Good morning,

This week we plan to have more Anthropic Claude related guides, so stay tuned. Welcome to the 184,400 + readers and thanks to you all who live in 213 countries (which sounds like a lot), where the state of California makes up 20% of my readers. Readers from New York and California states make up more than 30% of my paid readers. In total, the U.S. and UK make up more than 70% of my premium readers. I coulnd’t do this without your support:

This article is an infographics dump that eventually leads to Datacenter industry analysis. For some context:

Read our Primer on AI Datacenters.

I’m going to make the argument that rising debt will result from an exponential demand for compute super-cycle. Let’s begin.

Six hours ago (at the time of writing) it was announced that SoftBank has approved remaining $22.5 billion of OpenAI investment, the Information reports.

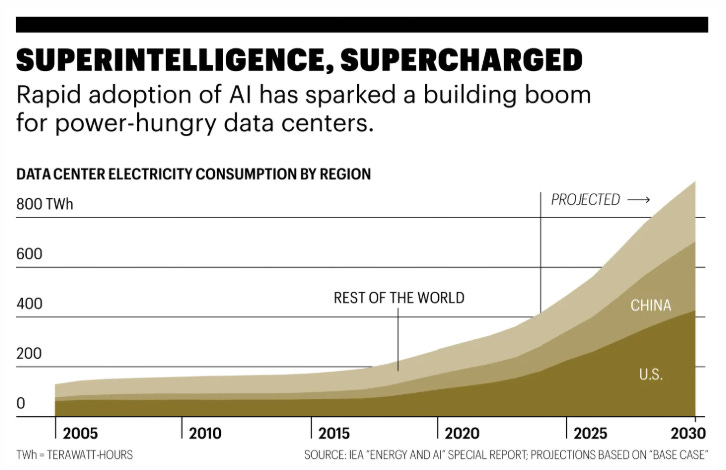

This means as China buys up gold, the U.S. is going to go into considerable debt to fund an exponential demand for compute supercycle. Just to meet this capacity I anticipate a lot of debt to power and build the required AI Infrastructure. As more Hyperscalers and Neo Clouds come “online” just to meet capacity starts to become a real problem (“capital crunch”) in the years ahead.

As Palisade Research released a paper last month which found that certain advanced AI models appear resistant to being turned off, at times even sabotaging shutdown mechanisms, things are heating up in more ways than one. 🔥 OpenAI has written about the importance of this property, which they call interruptibility—the ability to “turn an agent off” but is anyone taking it seriously? The real problem economically is how do you turn off the debt that will be required to fund the exponential demand for compute that’s coming?

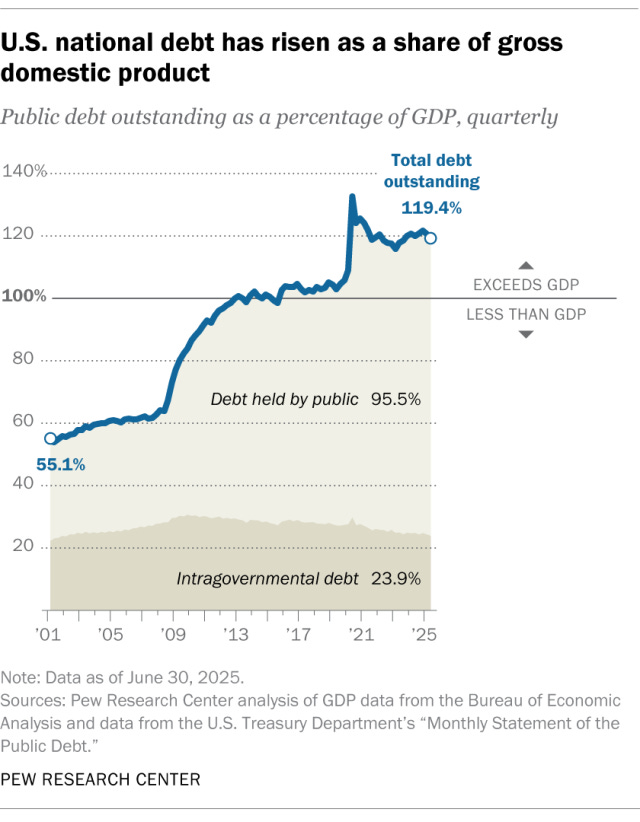

The United States is so far behind China in energy and especially renewable energy systems, building a massive amount of datacenters doesn’t solve the future, it just creates more leverage. It burns you up with the required capital allocation and debt. As we nudge closer to the 2030s debt is going to start to be a more lively chimera, especially as it relates to AI Infrastructure mandated and facilitated by the Trump Administration. Don’t hold your breath though, the U.S. national debt has surpassed $38 trillion and is increasing at a historic rate, adding about $1 trillion every five months, which is more than twice the rate of the past 25 years. Eventually (like soon-ish) the AI bubble and debt bubble converge. What happens then? I’m not an economist, but it isn’t likely good.

Debt to GDP Ratio is Reaching Unsustainable Levels in Trump’s 2nd Term in the United States

The rather zany capital allocation mismatch between fiscal sustainability and environmental sustainability is a real weakness of the approach the U.S. is taking here with regards to AI. Monopolistic corporations can fund parts of the on-ramp, but as the demand for compute accelerates that will be impossible.

Generational Wealth Much? 💰

Boomers who in 2025 still hold the majority of the wealth in America, are making some pretty outlandish bets that younger generations will have to reckon with, own and likely, to pay for in blood. Baby Boomer generation holds the most wealth among all the generational cohorts, with an estimated net worth of around $82 to $85 trillion, representing over half of all U.S. household wealth. But can you trust them to make good decisions for the future or the rest of us? Or are we doing down in a blaze of glory? 🤠😂

Neo Cloud Winners Chosen ☁︎

Peter Thiel backed Crusoe will go IPO in early 2026 and have even more access to debt leverage and partnering (vendor) financing just like CoreWeave has in 2025. The Denver based AI data centre startup Crusoe is raising $1.38 billion at a valuation of about $10 billion from an anticipated Series E funding round. Both Nvidia and OpenAI have equity stakes in CoreWeave, who was among the first to pivot from Bitcoin mining into AI workloads and datacenters to rent GPUs. We did a deep dive about these Neo Clouds here in case you missed it. Founder’s Fund led Crusoe’s 2024 funding investment. The companies with the most access to partner financing and debt leverage win and of course political connections in the Trump Administration. CoreWeave pivoted from cryptocurrency mining to AI infrastructure in 2019, a full four, five to six years before most of its Neo Cloud peers. Crusoe calls itself the “AI Factory” company.

AI Infrastructure will Increase Debt and Leverage in Classic Bubble 🌌

The Build Baby Build motif of U.S. capitalism building AI Infrastructure comes with risks. Meanwhile the Bank of England (among others) is probing the financing of datacenters and AI Infrastructure deals as debt is mounting. Due to the exponential demand for compute rising for Hyperscalers (we can count Oracle now among the Big Three, the Big Four now), lending and debt is going to skyrocket in the 2026 to 2032 period for this “We must Win” push by the Trump Administration backed by the incentives of its Venture Capital community. Who is steering the state anyways?

If the demand for compute rises exponentially like I think it will, datacenters will be like the “granaries of smart cities”. A real life entry into a Machine Economy era.

The “AI Deal” Era 🦄

In a rapid fire last six months we’ve seen huge partnerships by the likes of Nvidia, OpenAI, Oracle, Microsoft, CoreWeave and others. Late last week, Anthropic and Google officially announced their cloud partnership. Another deal estimated at tens of billions - Anthropic gets access to up to one million of Google’s custom-designed Tensor Processing Units, or TPUs. Alphabet and Amazon both have major equity stakes in Anthropic who are estimated to increase their ARR run rate the fastest among the BigAI startups. The deal will add around or over a gigawatt of compute capacity by 2026, supporting Anthropic’s surging $7 billion revenue run rate.

♨️ Burning the Future the American Way

While AI researchers literally burn out, datacenters will be overheating gozzling water near a U.S. states and country near you. The United States have started a race with China to build datacenters in other countries and leverage trade advantages that penalizes the other (while pitching Sovereign AI to buy Nvidia’s GPUs 😀) as Trump’s East-asian tour begins. I’m sure it will be accompanied by more AI Infrastructure deal announcements and more debt to back the projects.

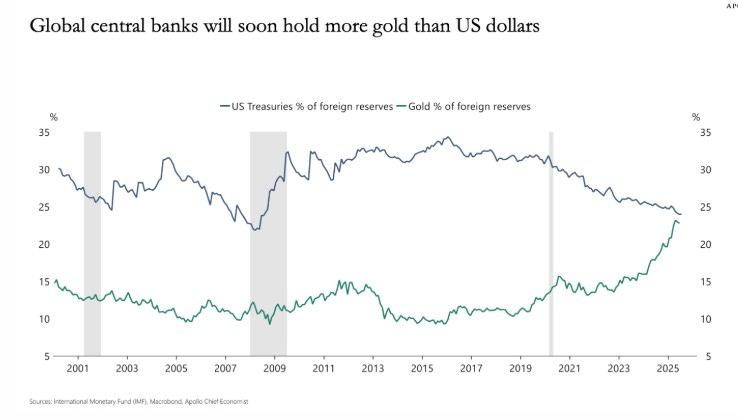

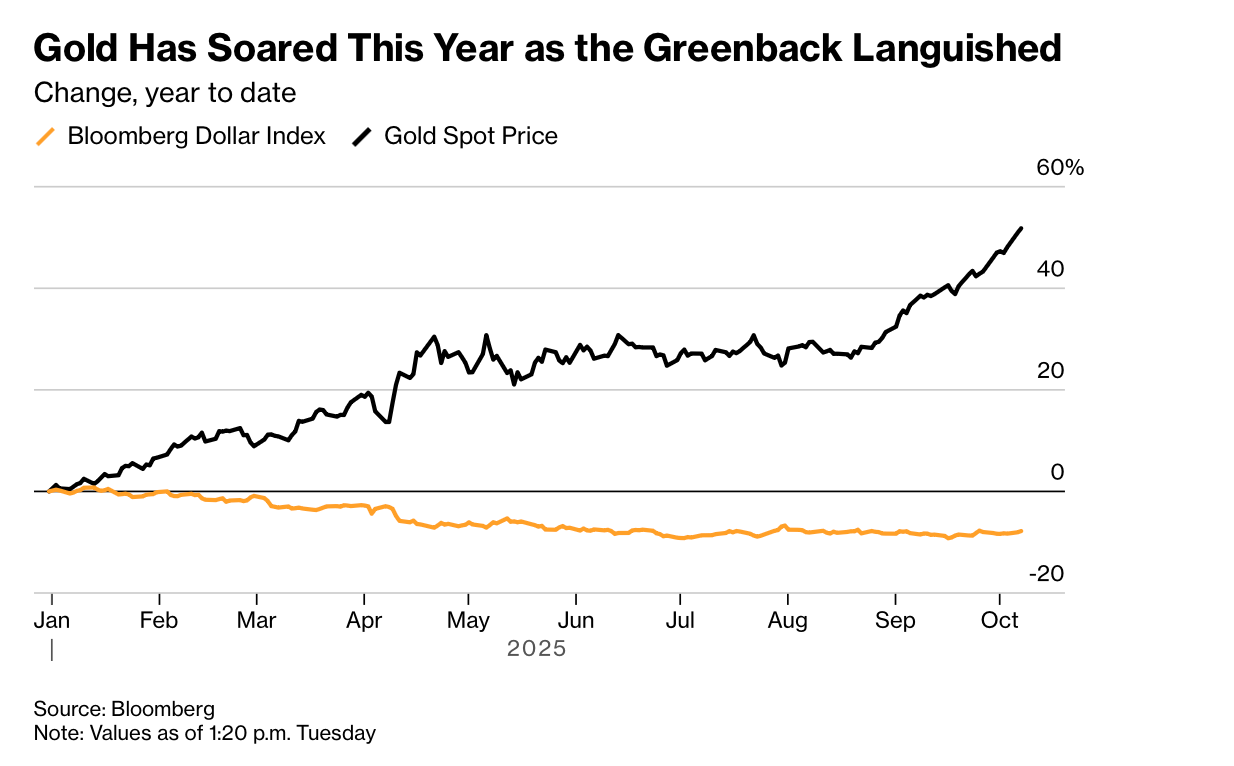

As the price of Gold and equities are at all-time highs, and in a dysfunctional federal government shutdown, the U.S. government’s gross national debt surpassed $38 trillion last week. The Trump administration’s performance? It’s the fastest accumulation of a trillion dollars in debt outside of the COVID-19 pandemic — the U.S. hit $37 trillion in gross national debt in August this year. If only policy makers understood the AI Infrastructure’s exponential cost of the demand for compute that will keep rising! It’s dangerous to awaken the machine, but not the ghosts that you’ve been told about.

Trump’s Trade Tariffs has led to a Gold Rush that could accelerate the delisting of the U.S. dollar as the global reserve currency 🧈

You don’t need to be Ray Dalio to see the problem in the above chart.

You mess with China and well, they buy gold. Not good!

This is not Good News for U.S. Fiscal Stability 🚨

The U.S. isn’t just behind on renewable energy and its power grid, but on producing the crucial rare earth metals needed for things like EVs, robotics and national defense technologies. We’ll know more about the trade deal with China hopefully later today or this week.

What a spender, what a dreamer! Trump’s AI plan, outlined in the July 2025 “Winning the AI Race” Action Plan, is based on three pillars: accelerating innovation, building American AI infrastructure, and leading in international diplomacy and security. A fine job he’s been doing as the handmaiden of others. A lot of talk and debt, if you ask me. A geopolitics of imperialistic trade policy and where AI Infrastructure colonialism overshadows democratic values and traditional American allies (like neighbors! 🍁). This fractured geopolitics and elitist leadership also has risks. Where is the liberty and fiscal, industrial and economic leadership in the AI bubble? A world where AI Infrastructure build-outs props up American GDP while the downstream consumer is mangled?

In 2026, I suspect it’s going to get pretty awful.

Major Signs of Flawed Economic Leadership 👑 🇺🇸

Free Speech? Trump thinks he can clamp down on critical media. Is that really what Americans want? How do you even trust this older generation in power when even economic data is fudged with a wishful AI policy? Innovation isn’t built on political deception, nevermind that immigration policy which torpedos talent and that science funding that is plummeting is no accident. The scaffolding of how America’s significant capital advantage is being allocated is a ruse or a dynastic order and magnitude.

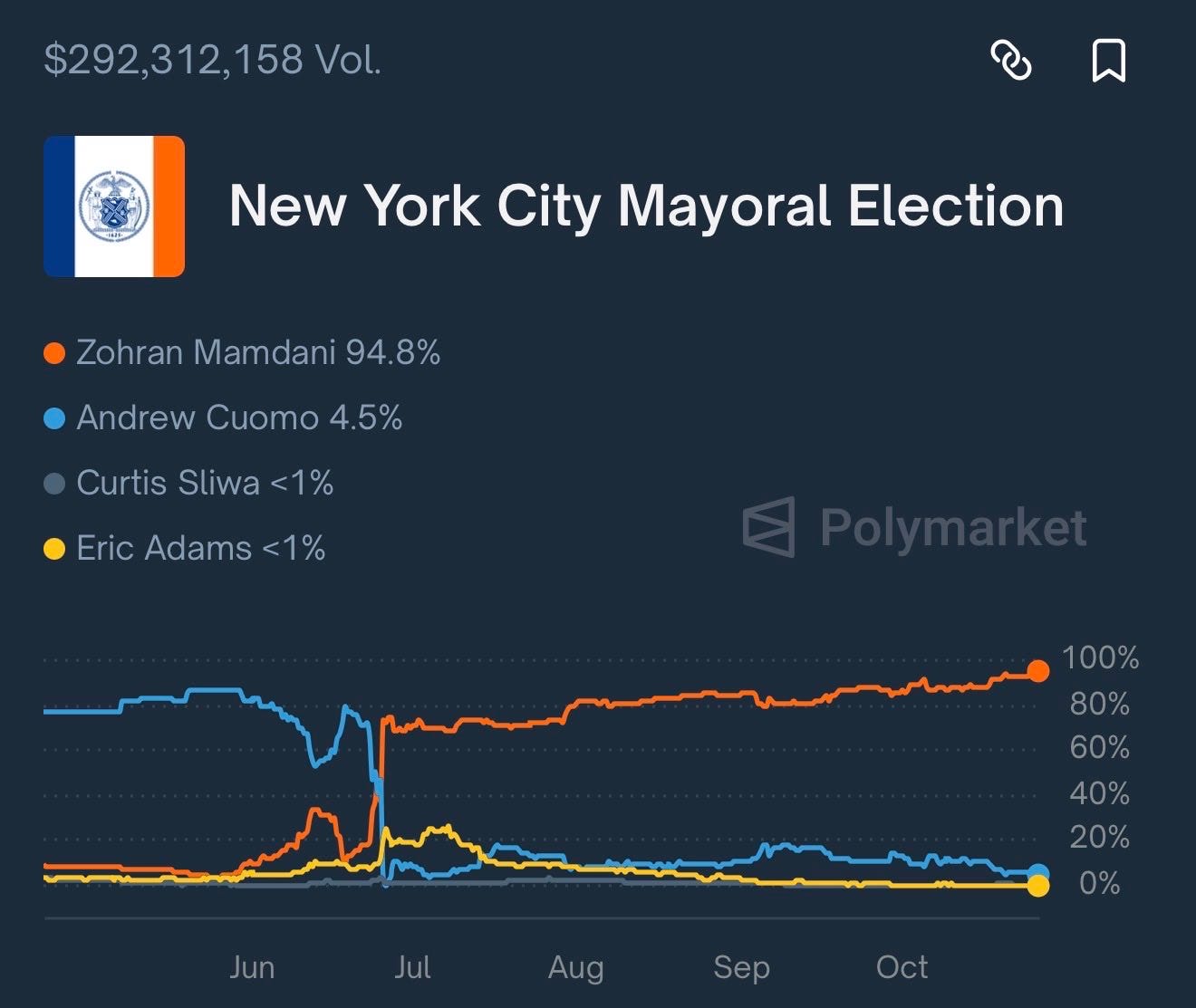

If U.S. voters aren’t happy with the economic conditions of the Trump Administration’s leadership, weird things result - like a Mamdani coup. This is reactionary democracy. But who can blame them if they (Young New York voters - Zohran Mamdani is 34, Trump is 79) are witnessing the collapse of global order? What’s going on in the world is bigger than a “No Kings” protest.

As of September, 2025 we learned that - in the first half of 2025, AI-related capital expenditures contributed 1.1% to GDP growth, outpacing the U.S. consumer as an engine of expansion.

If the U.S. loses “Fed independence” like the Trump Administration threatens, it could be very bad for markets. So many new risks in the future of the United States that threatens rule of law and economic stability including an actual cliff of robotic automation that was planned all along.

How much will Debt financing around AI Infrastructure surge the U.S. National Debt Crisis?

The U.S. is facing the prospect of an Energy (power, electricity) wall and debt crisis convergence simultaneously in the last 2020s or early 2030s driven by the exponential demand for compute supercycle BigTech capex (in datacenters) and that the Trump Administration acceleration has produced. And why is nobody talking about this?

🎯 Thesis: We are underestimating how exponential the demand for compute will become in the 2026 to 2036 period.

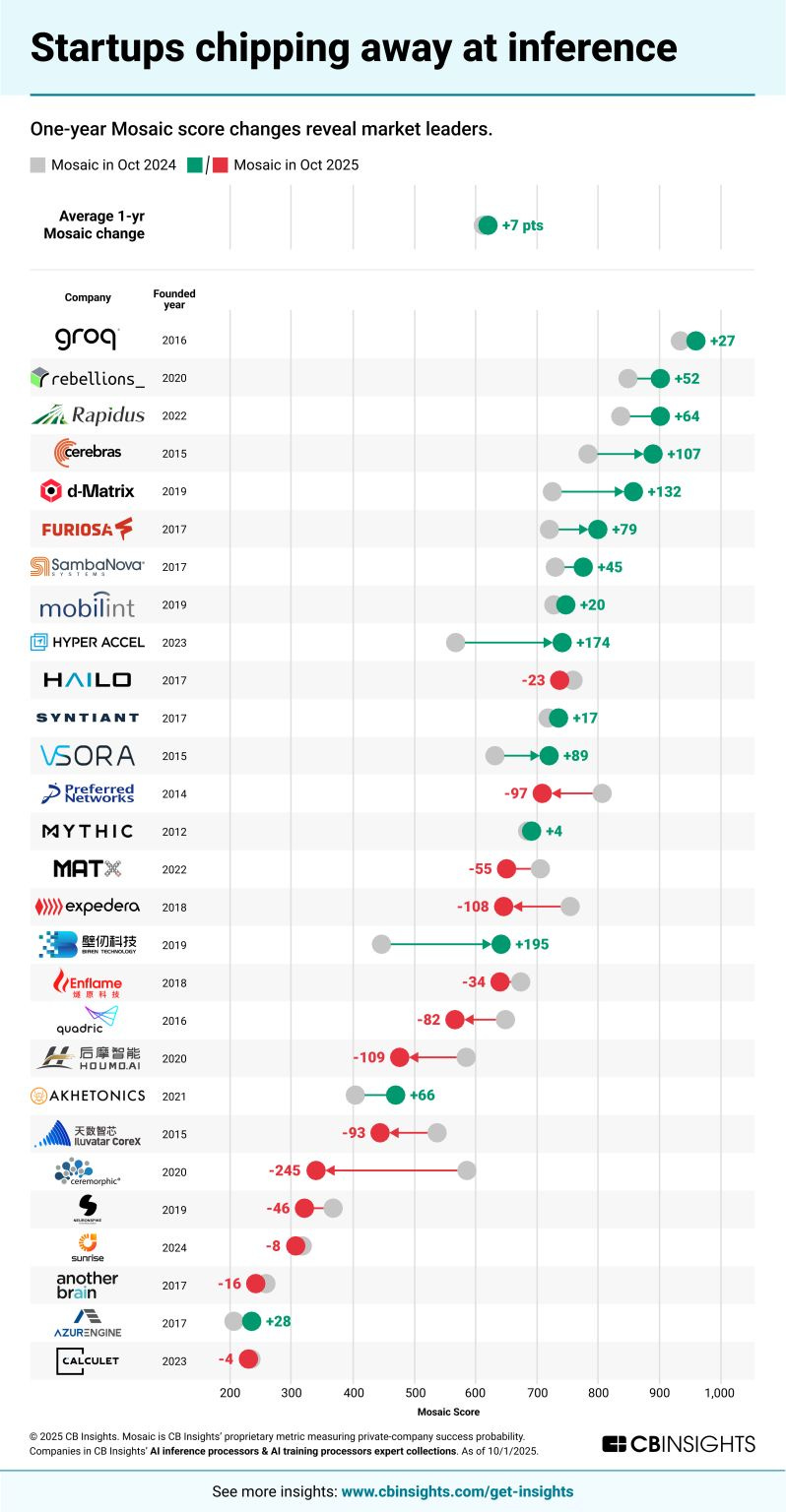

“Reasoning AI, demanding 100-1000x more compute than simple chatbots, faces a bottleneck: GPUs optimized for parallel training struggle with sequential inference workloads. NVIDIA projects a $3-4T AI infrastructure market by 2030, where inference capabilities and cost economics will be the determinants of AI application viability at scale.” - Jason Saltzman, CB Insights.

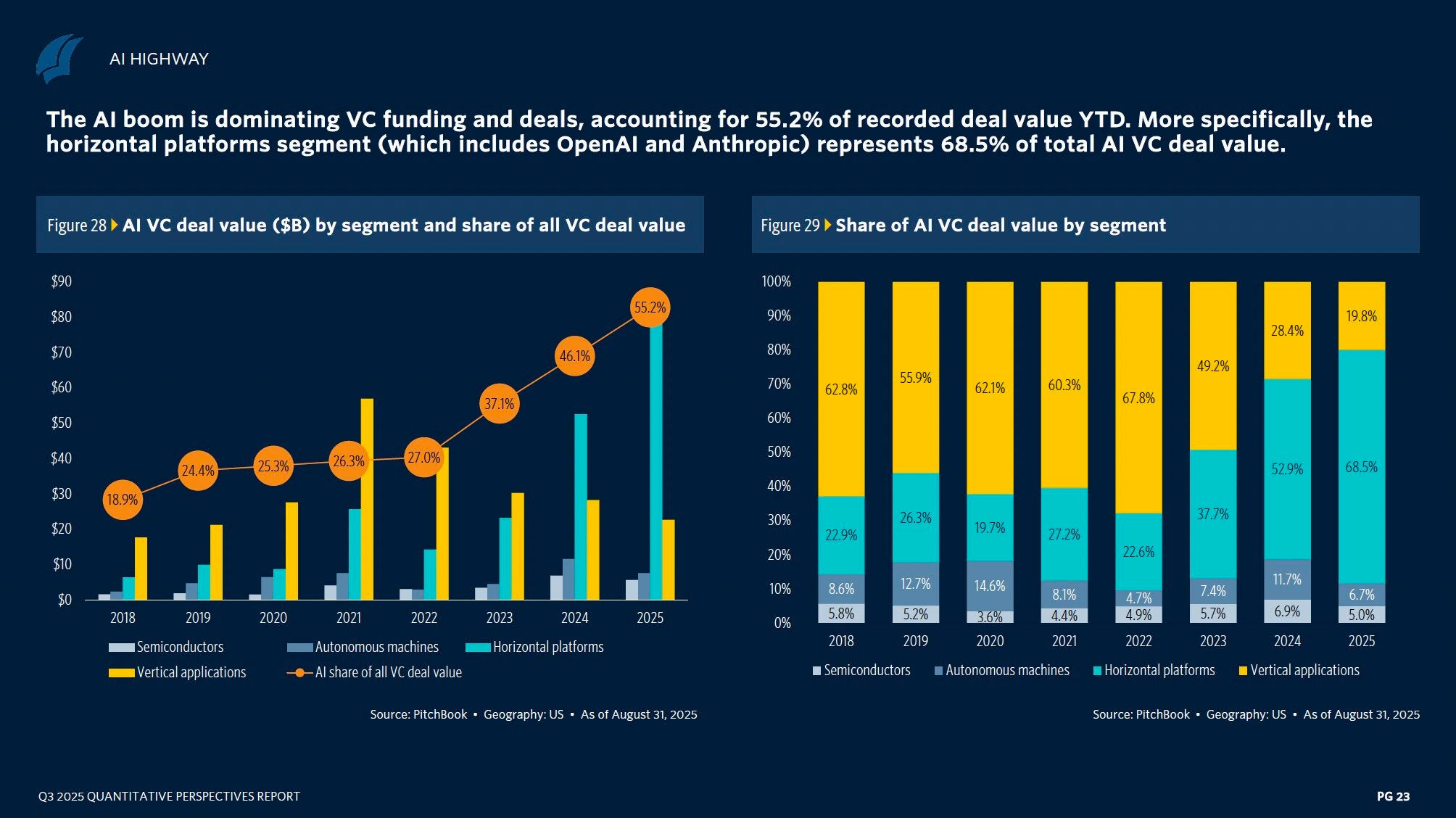

Venture Capital funding in AI startups and more compute and interference intensive reasoning, video, deep thinking and AI agententic tools will super charge demand for compute faster than hyperscalers can build capacity. They will need to take out huge amounts of debt just to keep up!

This is the biggest problem for the United States, Silicon Valley and Wall Street to consider moving forwards into 2026.

What is a Datacenter right?

Data centers are large buildings that house rows of computer servers, data storage systems and networking equipment, as well as the power and cooling systems that keep them running. This infrastructure is essential for companies that provide digital services and increasingly: AI products being heralded as impacting the everything-future. Over the top sales much? 😎

BigVC - Major American Venture Capital is Pumping up Demand for Compute

More AI Startups, more Models and more AI products means drastically more demand for compute. 🚀

An Inference Age you say?

The age of “inference” will drive up compute exponentially. Investors poured over $9.5B into AI inference and training processor startups in 2024 alone:

The ‘Nvidia of China’ is Rising

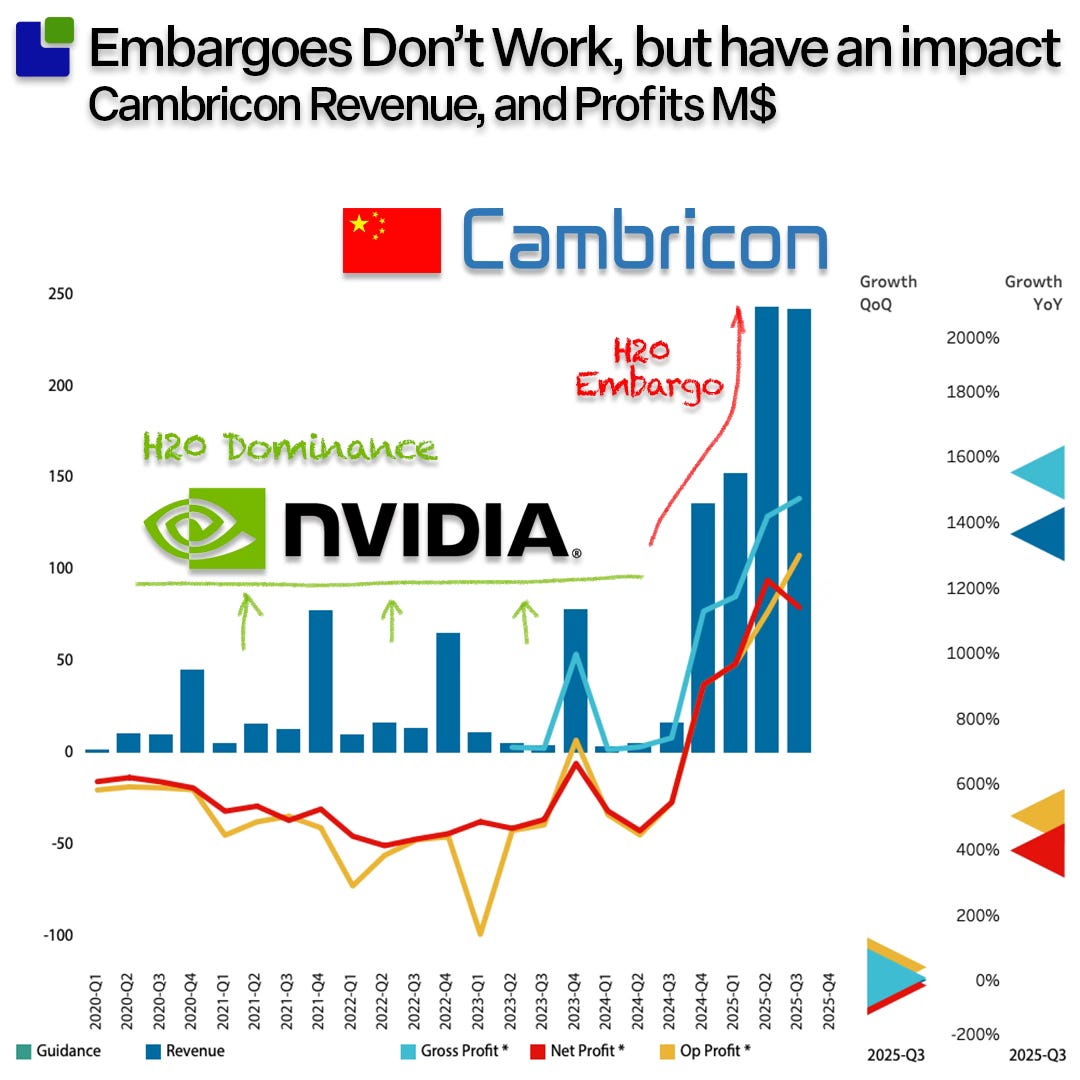

Cambricon a.k.a. ‘China’s Nvidia’ says revenue spiked 14-fold last quarter.

Cambricon Technologies, China’s prominent AI chipmaker often likened to Nvidia, has been added to the U.S. Department of Commerce’s Entity List over national security fears that its chips could support China’s military modernization. This move restricts the firm’s access to U.S. technology, potentially stalling its AI development and heightening U.S.-China tech tensions.

If Cambricon or Huawei actually do eventually emerge as a threat to Nvidia’s monopoly on AI chips, it’s going to be a problem for the United States and their first-mover AI advantage. Claus Aasholm isn’t wrong: (AI policy and the AI chip export bans on China have created situations that they wanted to prevent). Are the folk in the Trump Admin really China Hawks? 🤯 Serious question though.

AI Export Ban on AI chips has Led to More Dangerous Competition

The future doesn’t work in gated regimes and unilateral trade tariffs don’t build allies. So is this a turning point?