The Biggest real AI Opportunity

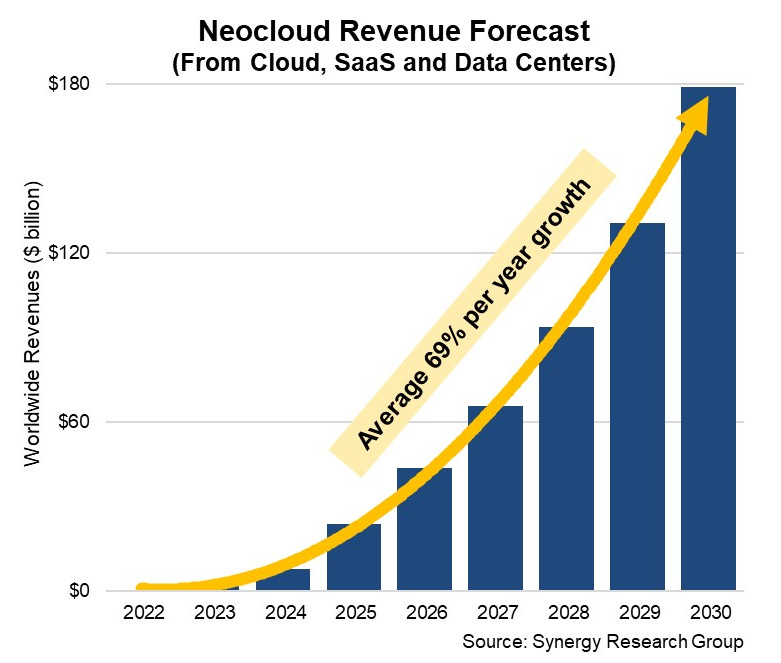

Using AI or agents is still early, investing in the future is forever. 💰 Neo Clouds Are Becoming the Fastest-Growing Layer of the Cloud Economy.

Good Morning,

The biggest AI opportunity in 2025 isn’t using AI tools, AI agents or starting a company that’s AI-native even. For 99% of people, it’s investing in the AI boom. And don’t let anyone tell you otherwise (they are probably grifting you). The demand for compute is designed to go up, think about how chatbots and LLMs have scaled already in terms of compute requirements: basic text in chatbots to “reasoning models” and now Deep Thinking and then AI agentic compute demands all point to an accelerating demand (for compute).

While adoption of Reasoning models, Deep Thinking and AI agents is still small overall, they are bound to go higher even as multiple chatbots get more widely adopted leading to even more compute-intensive AI products. More video generation alone would lead to far more intense compute demands on Cloud capacity. Even adoption of AI browsers would lead to more compute demands.

As of mid 2025, Deep Research uses 10,000X more compute than Reasoning right now. Agentic AI will use orders of magnitude more than current applications of LLMs.

As more major (AI startup) companies get funding (ChatGPT for Doctors, new kinds of Conversational AI or the AI for Science push), that will mean more companies like Anthropic and xAI need to scale up globally - so far only OpenAI has scaled up a little, so this will mean years of capacity and compute challenges ahead for the AI Infrastructure era. Capex by BigTech all means surging demand - all pointing to Neo Clouds becoming a surging AI cloud sector choked full of GPU burning (🔥) “growth” stocks. For every Microsoft, Google or Oracle, you will need an army of Neo Clouds, essentially what amounts to an unstoppable trend. Think carefully about what part of the AI stack you want to invest in. It could be a generational wealth decision.

For Hyperscalers what will this require from datacenter roll-outs as they are always near capacity? What’s this mean on the ground? Perhaps you’ve heard of Coreweave and Nebius? CoreWeave is an American AI cloud-computing company headquartered in Livingston, New Jersey, specializing (renting GPUs), that is they provide purpose-built GPU infrastructure and cloud services optimized for large-scale AI workloads, such as training and deploying generative AI models.

Founded in 2017 as Atlantic Crypto by four commodities traders (Michael Intrator, Brian Venturo, Brannin McBee, and Peter Salanki), the company initially focused on cryptocurrency mining using GPUs. After the 2018 crypto crash, it rebranded to CoreWeave in 2019 and pivoted to high-performance cloud computing. CoreWeave is also backed by Nvidia and has relied on Microsoft is their major customer. Nebius has its own story that is even weirder (hint: it’s Russian). Nvidia owns a stake in CoreWeave representing approximately 24.3 million shares, which was valued at about $3 billion as of late September 2025. Don’t be surprised if hyperscalers invest in these “Neo Cloud” companies.

I asked Sergey 🇰🇿 (see LinkedIn), one of the investing Newsletter writers I’m following, Compounding Your Wealth Newsletter for a detailed deep dive into the topic. His infographics and insights are invaluable of you think AI is a trend worth investing in. His notes about companies, earnings and their (stock) metrics are incredible.

Compounding Your Wealth

It’s a great time to read more Finance and investing related Newsletters: Sergey is a voice whose data-driven analysis has caught my attention.

Related Themes

Articles by Sergey related to today’s topic: (Tech stocks have earnings a week from now, pay attention to his coverage of Earnings in November).

The AI Supercycle: Top 15 AI Companies

CRWD: guides Back-Half ARR +40% — valuation Still Justified or Getting Pricey?

NVDA Q2 2025 Earnings Analysis

This is not investing advice, do your own due diligence. However if you believe the demand for compute will go up, some of the following names could be major winners three, five or ten years down the line. The capex in AI infrastructure alone is unbelievable from BigTech and Sovereign nations alone. Even if aspects of the AI boom are a bubble, Jevons paradox will still drive demand for compute likely accelerating faster than current projections are able to reliably estimate.

But consider carefully which companies to invest in if you believe that the AI Infrastructure trend has just begun in 2025.

Crypto miners like CoreWeave (and now a dozen more) have pivoted and are in the process of pivoting into AI workloads and renting GPUs as the price of Bitcoin means Bitcoin mining is more volatile and less profitable. The invention of Bitcoin in 2009 has played a not insignificant role in the rise of Nvidia and AI Infrastructure. Even as Equities and Gold are at or near all-time highs as you read this. The AI bull market in stocks (equities, projected 2023 to 2029) is going to be something, and if you think it’s near the top - you haven’t seen anything yet. It’s very difficult for Nvidia’s stock to correct, since the demand for AI chips is so intense. This Semiconductor AI boom is thus highly likely to make Neo Clouds among the most investable growth stories of the AI cloud age, in my humble opinion.

Everything from Nvidia’s vendor financing schemes to OpenAI’s manipulation of PR around AI Infrastructure partnerships deals to BigTech revenue growth and loaded earnings (passive investing ETF centralization) points to multiple drivers for Neo Clouds in the years to come. This is the “picks and shovels” of the Machine Economy, and outside of Nvidia, TSMC and a few others, Neo Clouds (around 20 names) are the obvious smaller players perhap worth investigating and finally maybe worth investing in. It really depends on multiple factors in your personal situation. I’m not a stock analyst, so take all of this with a grain of salt. But consider carefully which companies to invest in if you believe that the AI Infrastructure trend has just begun in 2025.

This full post is never going to free readers (also due to the speculative and sensitive nature of the material covered). But I could not let this go without at least sharing my thoughts and some research on Neo Clouds. You can use this information to go deeper and possibly make valuable choices in your personal finances.