An AI Overview 2025 (by the numbers)

What AI reports are saying and where I agree and disagree. Do American teens really use AI chatbots? Not as much as you might think. Rise of Anthropic in Enterprise AI in Infographics. 📊

Good Morning,

As we have arrived in 2026, I’m thinking more about the progress made in AI and what might come next. This is a data dump and took me untold hours. I’ve been reading some AI related reports I have to share some major trends of the year and some infographics that have intrigued me.

While I usually shy away from AI reports by Venture Capital funds, the Enterprise AI related ones are trends I consider more concrete. Thus people like Tim Tully, Joff Redfern, Deedy Das, and Derek Xiao (Menlo Ventures) released this week their “2025: The State of Generative AI in the Enterprise” which we are going to talk about in the juxtaposition of AI reports that this article is going to look like. I will do my best to source the material with a lot of high quality links (clicking on some of the images leads to deeper sources on that topic):

I predict Anthropic will have an incredible 2026 and be a more impressive IPO than either SpaceX or OpenAI (not the size but the market confidence response to it), and the reason is Enterprise AI growth. Let me try again to make this point.

Things to Read 📖👀📚

🔆 2025: The State of Generative AI in the Enterprise

LMArena is a cancer on AI (Surge AI)

American Public, Investor, and Executive Perspectives on Responsible AI Deployment (Just Capital) - Report.

Sam Altman Has No Idea What He is Doing

Teens, Social Media and AI Chatbots 2025: Pew Research Center

America Has Become a Digital Narco-State (AI companions don’t help our youth)

Announcing Diffuse AI: by Clara Collier, Charles Yang and daniel bashir

✨ An Insider Interconnected Perspective: Building Olmo 3 Think (Ai2) (Slide deck)

OpenAI’s house of cards seems primed to collapse (Engadget)

Donating the Model Context Protocol (MCP) (Anthropic)

Google’s free Context Engineering Guide1.

Future of Life Institute: AI Safety Index, Winter 2025.

TBA, I will likely update this reading list with odd AI nuggets I find.

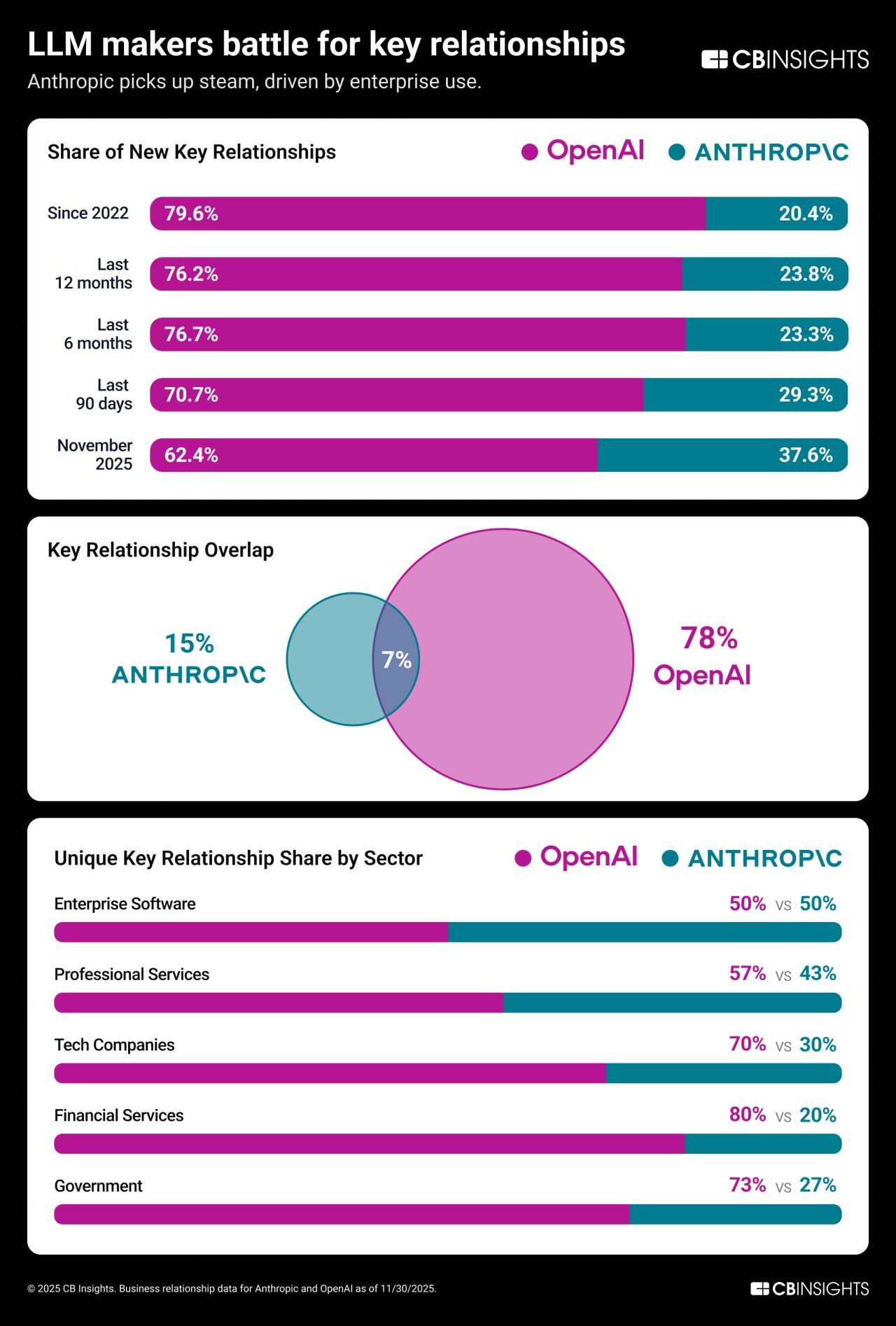

Anthropic is Growing Enterprise AI Globally Faster than its Peers

Anthropic just had its best month ever, capturing its highest share yet (37.6%) of new, key business relationships2. In my view 2026 is the key year for Anthropic’s growth to really accelerate while OpenAI’s growth stalls.

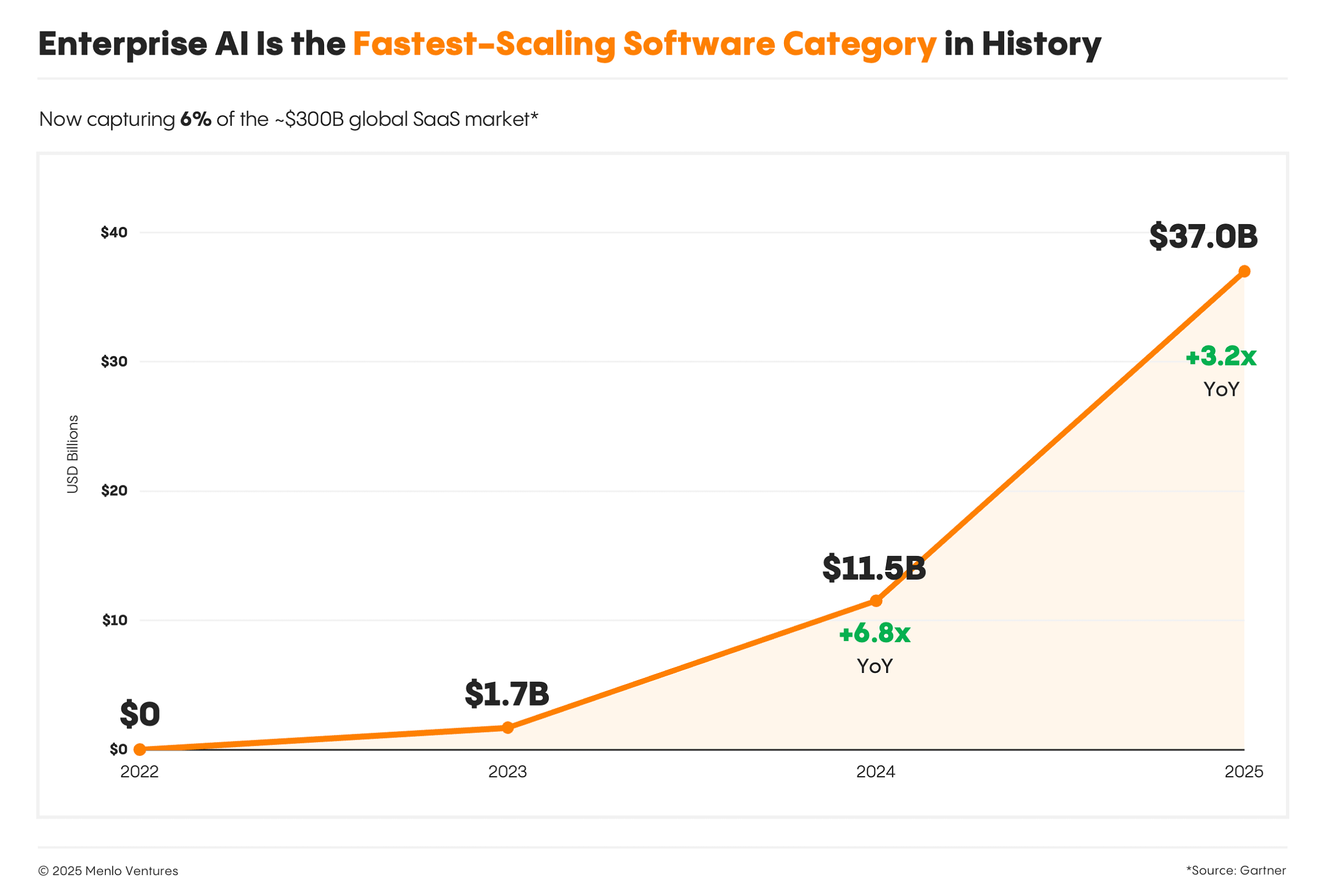

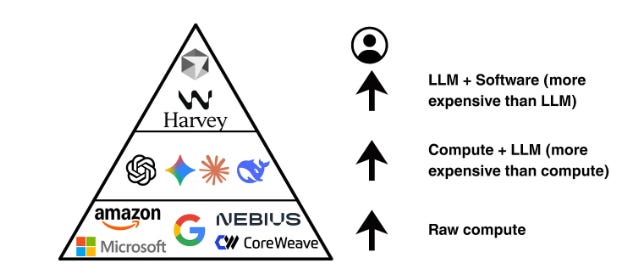

Enterprise AI is a Key sector of AI adoption to Watch

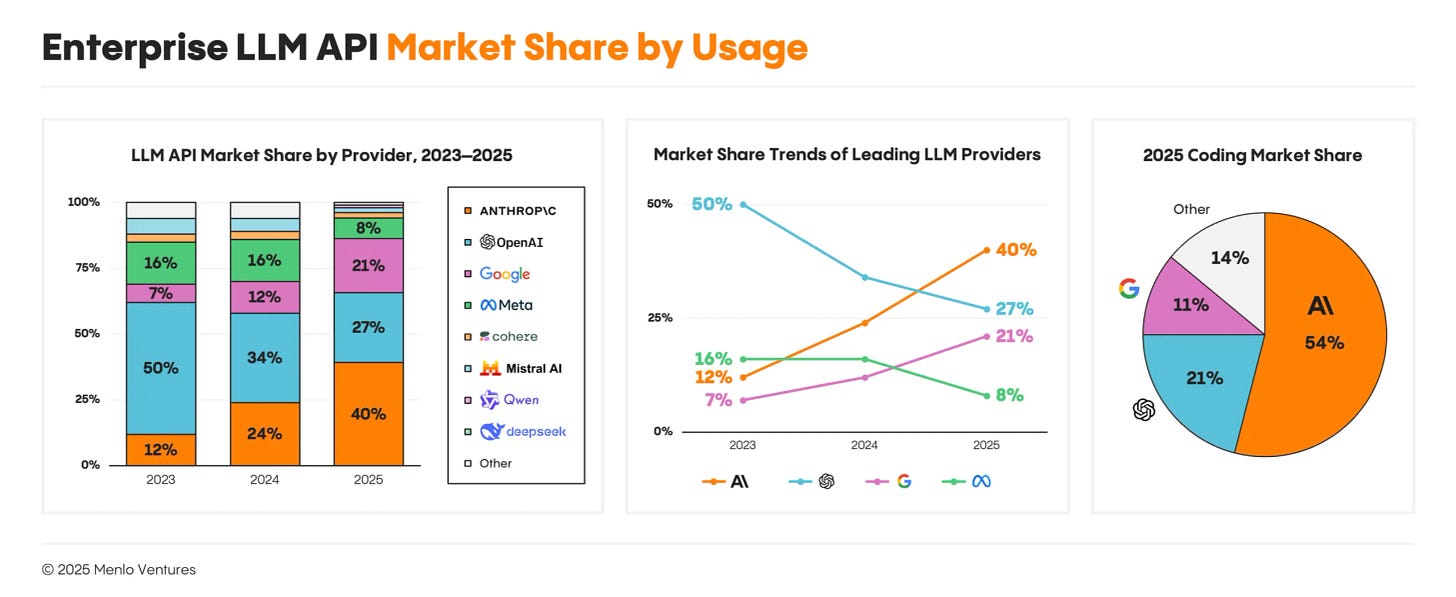

The big reveal? Not so surprising: Anthropic is the #1 model provider in the Enterprise, with 40% of ~$37B spend, with OpenAI dropping to #2. (Note: Menlo Venture is an investor in Anthropic).

“The more skills you build, the more useful Claude Code gets.” - Elvis Saravia3

The main reason Enterprise AI matters is simple: Enterprise AI is now a $37 billion market—the fastest-scaling category in software history.

As OpenAI fails to compete favorably with Gemini 3 and Google Deepmind’s suite of AI products, all that Sam Altman and Elon Musk feared all those years ago is coming to pass and OpenAI itself appears to be in trouble. This is before Meta, Thinking Machines and xAI have a big 2026 years as well.

In just three years, Generative AI has captured ~6% of software spend at $37B, growing ~3.2x YoY. Keep in mind IT makes up about 40% of the S&P.

There’s a 💭 Bubble in the AI Boom 🚀📈

Private AI startup valuations are a huge signal. I wish Michael Burry covered it.

This week we found out a two month old startup is miraculously valued at $4.5 Billion based on an incredibly speculative AI moonshot, more evidence that 2026 is going to be a spectacular year for the AI bubble facade4. Several high profile AI startups have extremely high valuations, without even having a product yet.

Startups like SSI, Thinking Machines and Unconventional AI defy traditional metrics of private startup valuations. They all have multi-Billion dollar valuations.

Anthropic is Dominating the LLM Enterprise API Market Share

One of the most telling sections of the Menlo Enterprise AI report:

The trajectory is obvious for how well Anthropic will do in 2026, listen carefully:

Anthropic now earns 40% (estimated) of enterprise LLM spend, up from 24% last year and 12% in 2023. This means they are significantly outcompeting OpenAI in this crucial area.

This trend appears to be accelerating in the second half of 2025. Click to view bigger:

OpenAI and Meta have lost significant API marketshare in 2025.

While Anthropic and Google have gained. More or less what’s you’d expect from the Model benchmarks as well.

Anthropic surged ahead in AI Coding in 2025

“Anthropic’s ascent has been driven by its remarkably durable dominance in the coding market, where it now commands an estimated 54% market share, compared to 21% for OpenAI.” - Menlo Ventures

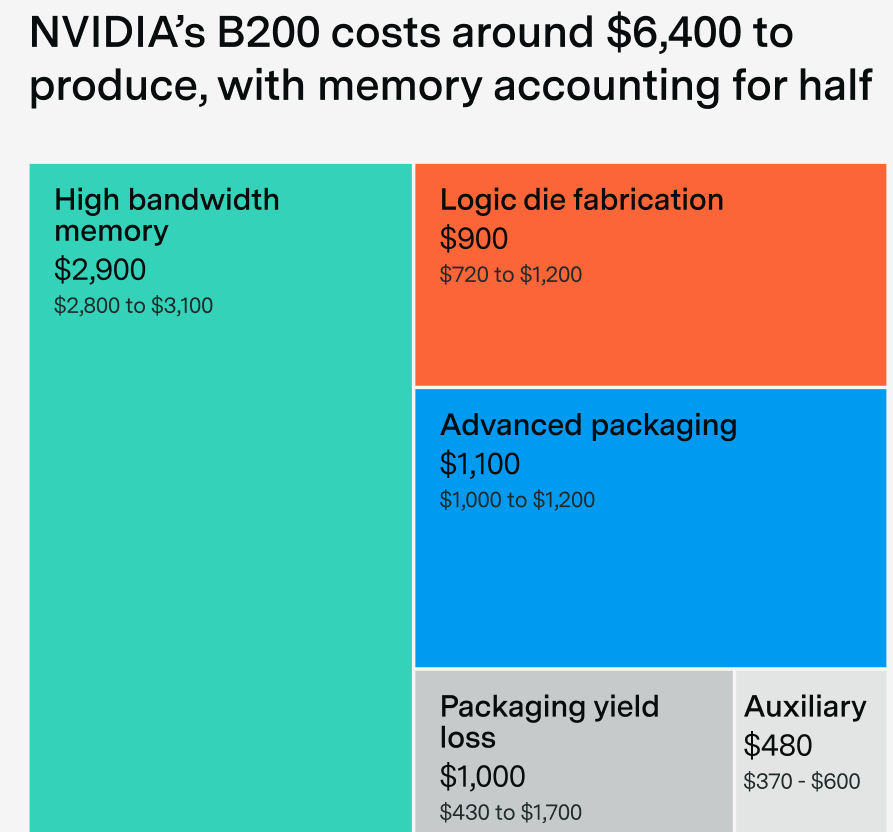

Nvidia’s High Margins can’t Last Forever

According to Epoch AI, Nvidia’s B200 GPU costs around $6,400 to make, implying chip-level gross margins of ~80%. As more AI chip players evolve, it will be difficult for Nvidia to maintain these crazy margins. The Semiconductor boom is being lifted by Nvidia’s success, but it won’t last forever.

* Google (TPUs) Tensor Processing Units and a lot of other contenders are coming. Including better AMD GPUs (Instinct MI350 Series).

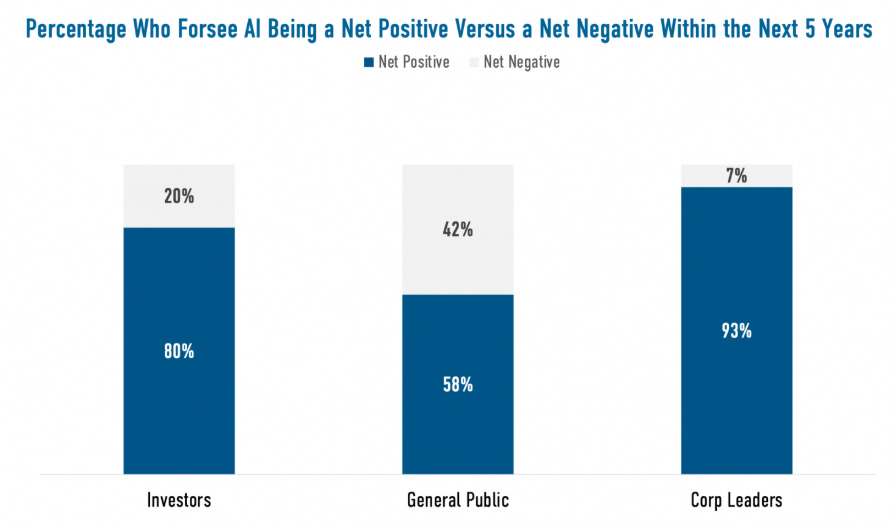

Elites and the general public view AI very differently, as illustrated in a new report by Just Capital.

Corporate leaders and investors are optimistic about the potential benefits of AI, while the general public remains less convinced, according to a report from Just Capital. The findings are pretty stark and align with several other similar reports I’ve shared in previous weeks.

Roughly 93% of corporate leaders and 80% of investors said they believe AI will have a net positive impact on society, compared to 58% of the general public.

Be mindful if you are reading media from any of these groups, because they will have very specific incentives.

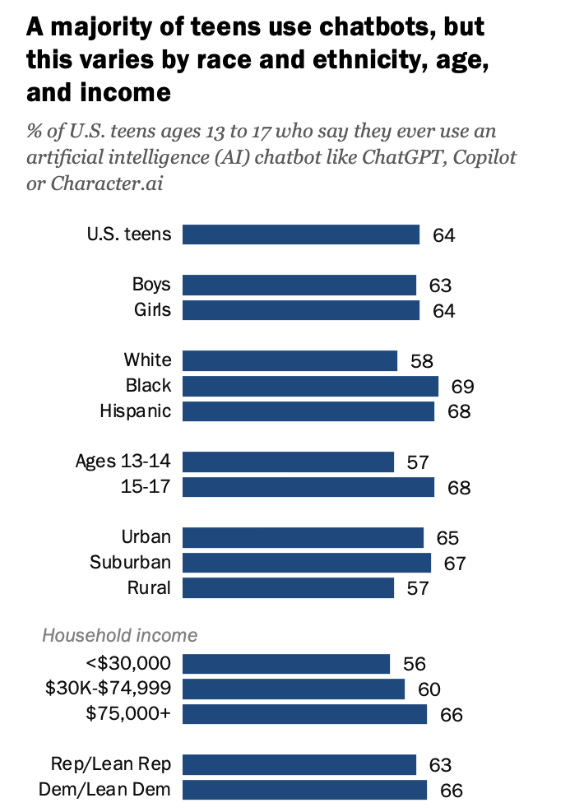

Most Heavy Chatbot Use is Concentrated in Young People

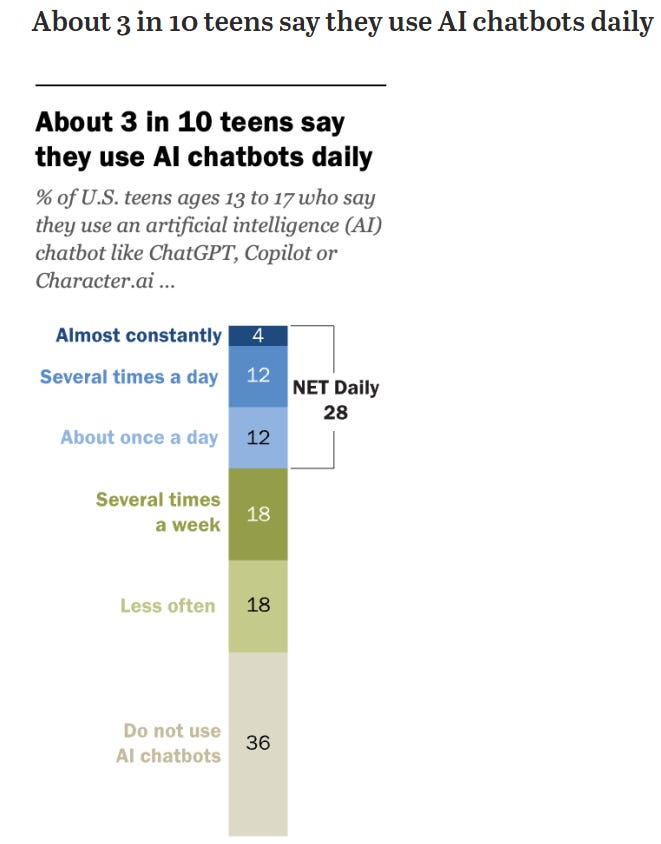

Another AI report that peaked my interest was again from the Pew Research Center:” Teens, Social Media and AI Chatbots 2025”. Three in 10 US teens use AI chatbots every day but it might be a risk to their mental health. Due to how OpenAI is being pressured by Gemini in B2C chatbot use, AI psychosis may become more common with the rise of more personalized chatbot sycophancy.

Curiously for OpenAI how they make money is contrary and at odds to one of their biggest goals (contributing to scientific progress and AGI):

One of the reasons I’m bearish on OpenAI is their product growth of monetizing chatbots is contrary to their mission statement. It doesn’t matter if you have 900 million weekly users, because it’s bad business where the distribution is not a valid moat in an emerging chabot ecosystem. I believe 2026 events will illustrate this trend.

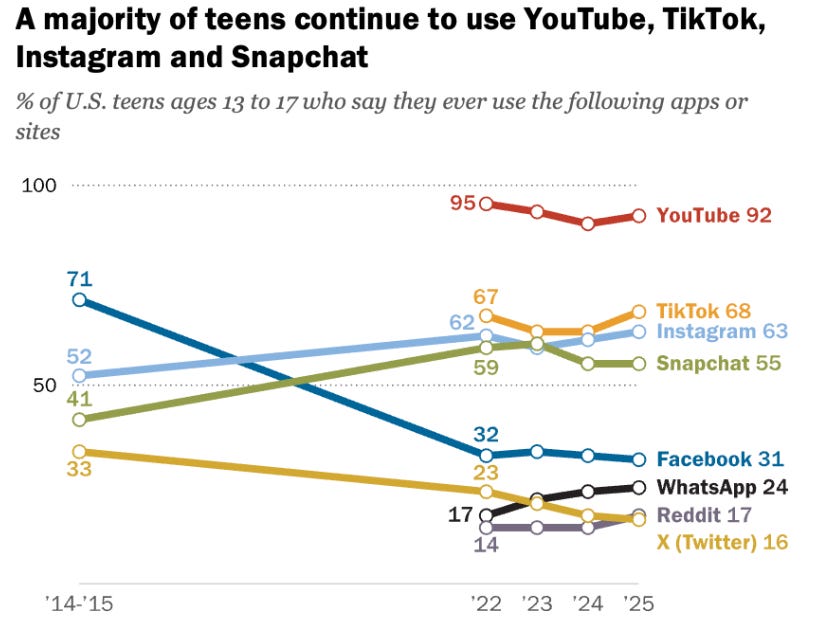

Teens, Social Media and AI Chatbots 2025

Chatbots just aren’t that Sticky

While AI adoption is often portrayed as significant via ChatGPT’s 3-year anniversary coming up, they aren’t very sticky when you compare them to social media or even Netflix. Keep in mind: Roughly 1 in 5 U.S. teens say they are on TikTok and YouTube almost constantly. Just 30% of these same teens use Chatbots even daily. Now that there are so many chatbots: ChatGPT, Gemini, Grok, Claude, Perplexity, Meta, Qwen, DeepSeek, etc…. it’s going to be nearly impossible for Open to continue to dominate in B2C or build an ecosystem around ChatGPT.

OPEN-SOURCE AI 🔓

Hugging Face now hosts over 2.2M models, big and small labs are contributing, startups are building on these models every day. Developers around the world are accelerating innovation via Open-source and open-weight LLMs that keep getting better and better.

The progress each year in Open-source AI has been and is going to be phenomenal.

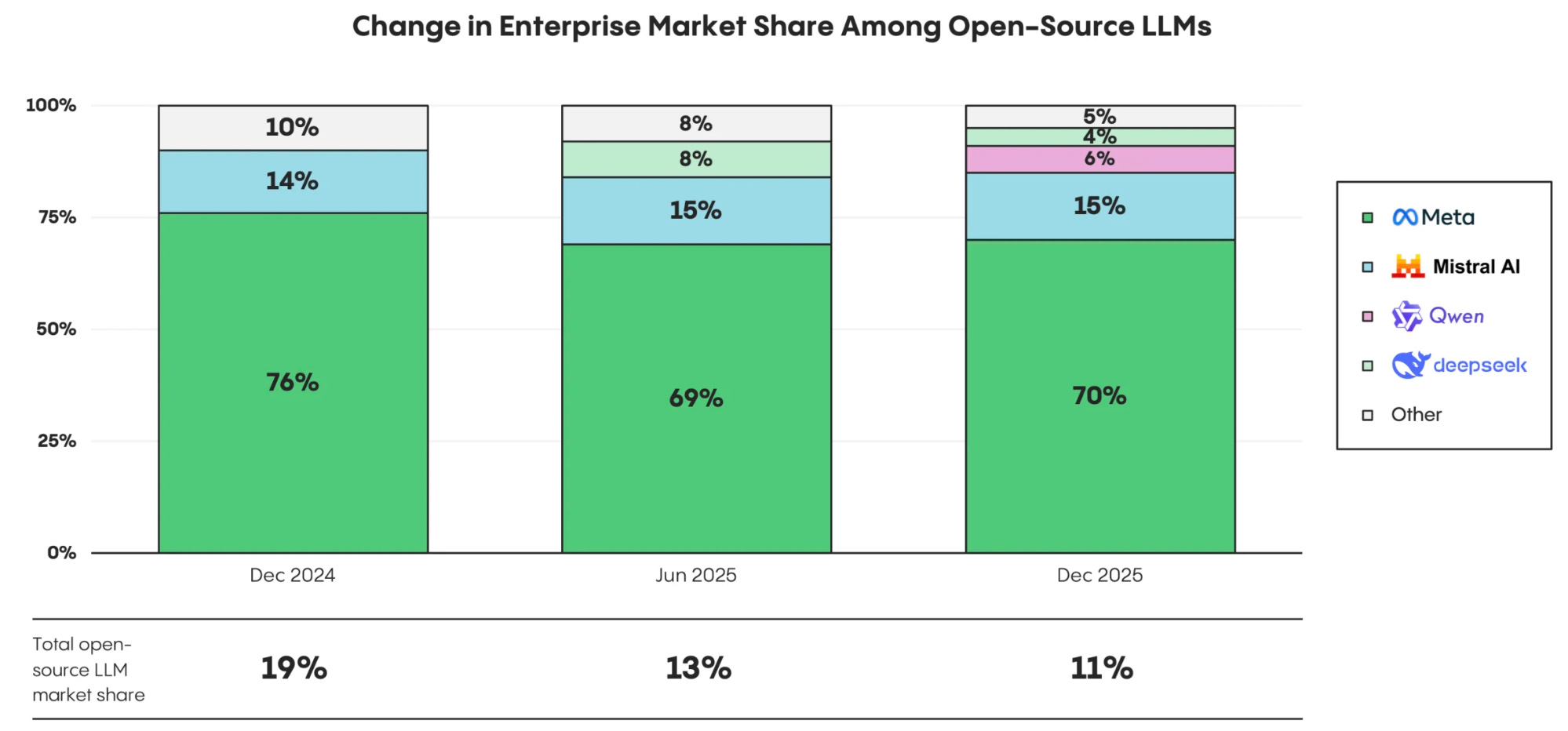

In Meta’s Absence of new Llama Models, Mistral is growing Open-source LLM Enterprise Adoption

ICYMI, Mistral recently released Mistral 3. Working in conjunction with vLLM and Red Hat, Mistral Large 3 is very accessible to the open-source community. Meanwhile, the Linux foundation announced the Agentic AI Foundation (AAIF), combined with the donation of MCP.

While Enterprise are cautious about Chinese open-weight LLMs, outside of Enterprise, developers and startups are much more keen about using them. So outside the enterprise (Menlo Reports), adoption looks very different. vLLM and OpenRouter*,13 two popular benchmarks for startup and indie developer usage, show rapidly rising adoption for Qwen, DeepSeek (V3, R1), Moonshot/Kimi, MiniMax, and Z AI’s GLM, though DeepSeek’s usage has moderated after an initial surge following its R1 launch. That could change rapidly however when DeepSeek-R2 is released likely in January 2026 around the same time as in 2025. In 2026 it appears Chinese open-weight models will continue their leadership and progress.

Capital is Flowing into Gen AI and AI Infrastructure

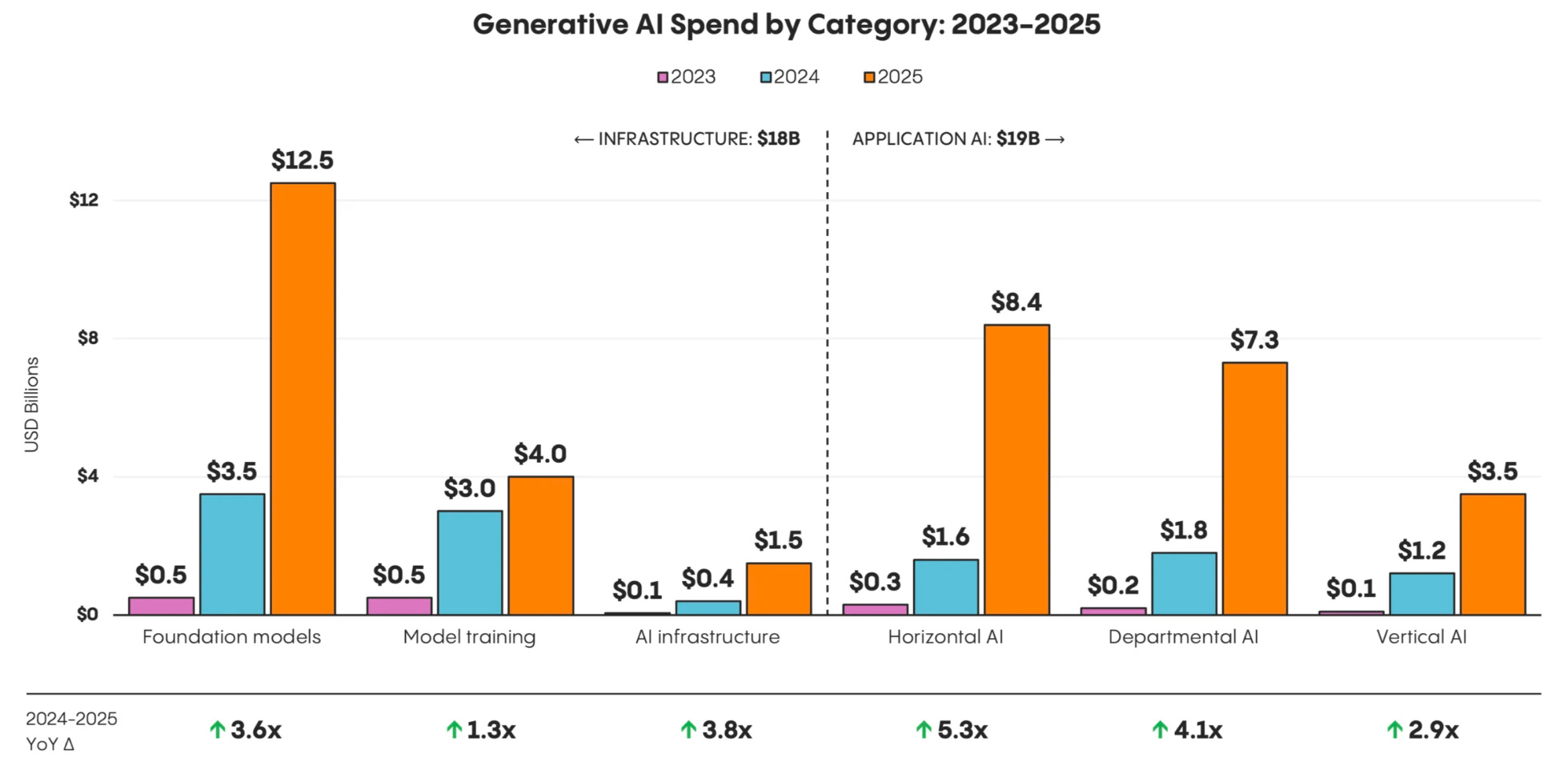

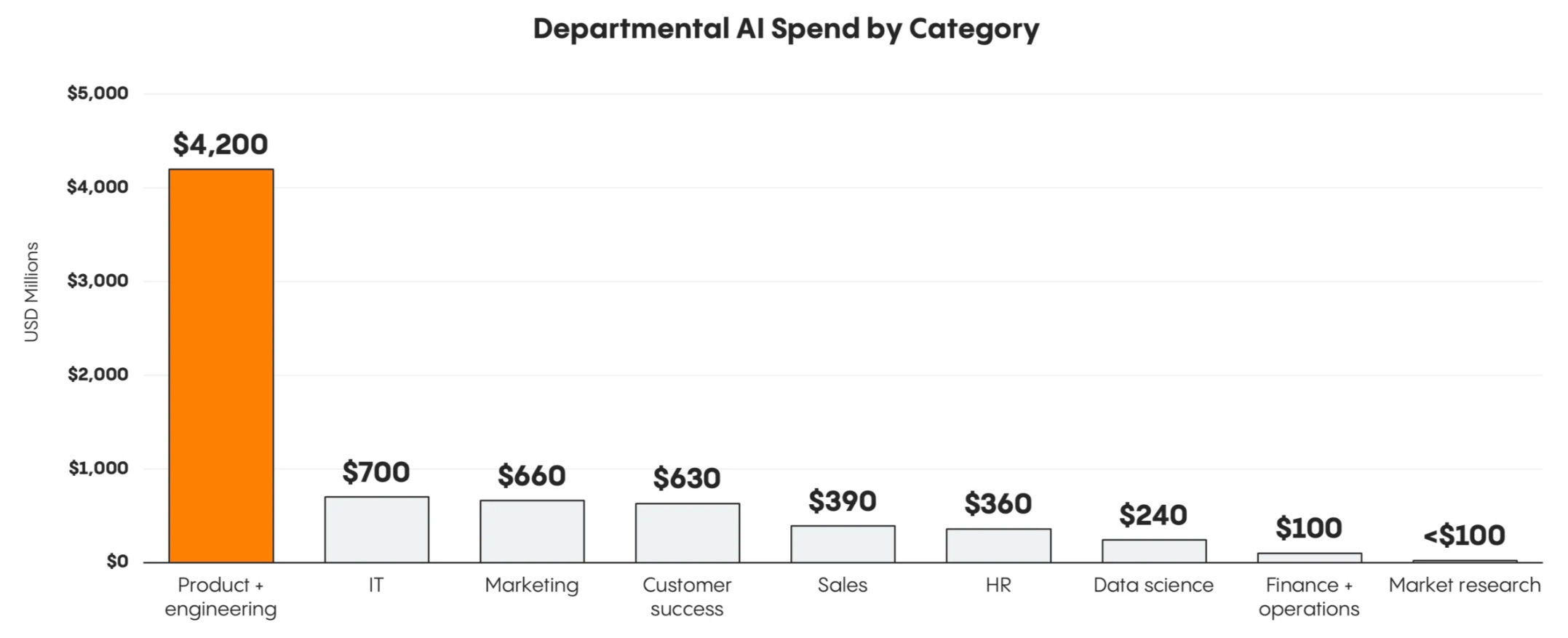

But Enterprise are spending specifically more in some areas like the following:

Application Layer gets Bulk of Enterprise Spend in Gen AI

In 2025, more than half of enterprise AI spend went to AI applications.

Companies spent $37 billion on generative AI in 2025, up from $11.5 billion in 2024, a 3.2x year-over-year increase.

51.4% of the Enterprise spend goes directly to ($19 billion), the user-facing products and software that leverage underlying AI models, aka the application layer.

Chatbots are not competing with Social Media for Teens

According to the Pew Research Center’s report, chatbots are’t even approaching social media levels of use and have, I might add, nearly zero entertainment value, and what utility they provide are more like AI companionship tools for young people. Gen AI might be compounding the mental health impacts and risks of mobile addiction (technological loneliness) for young people, rather than uplifting this cohort (as people like Ethan Mollick suggest).

As you might have read this week, Teen internet safety has remained a global hot topic, with Australia planning to enforce a social media ban for under-16s starting on December 10th, 2025.

Netflix and ChatGPT Compete with YouTube for Attention

How can ChatGPT or OpenAI compete with BigTech in Ads and an app ecosystem, (or AI hardware for that matter) when they are competing with the likes of YouTube for attention?

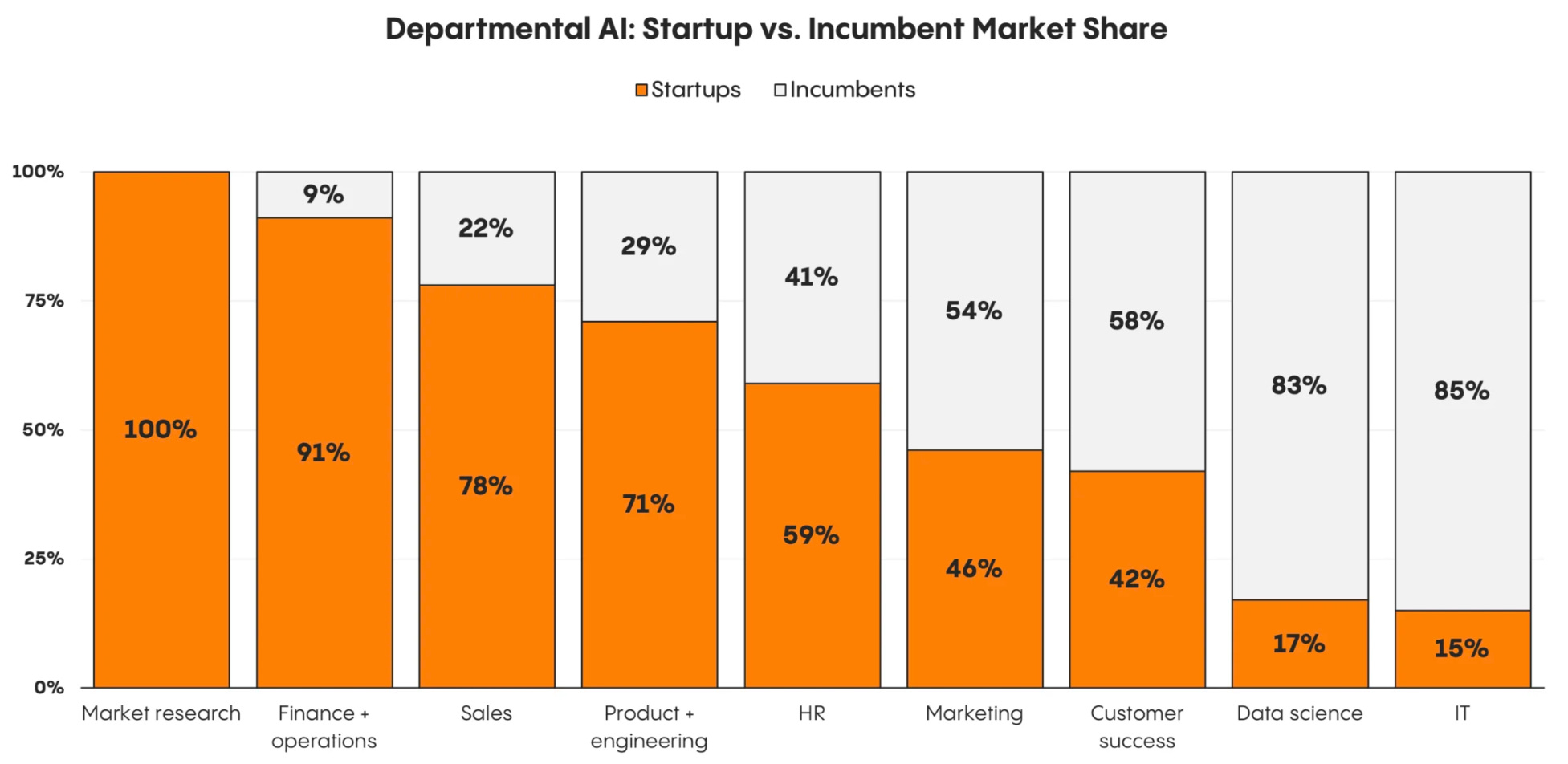

Incumbents vs. AI Startups

According to Menlo’s Enterprise AI Report, AI startups are out-competing the current leaders at the Application Layer. Of course they consider Anthorpic and OpenAI (both funded by BigTech AI startups in this context): I’d argue they are “BigAI”, a totally different kind of startup.

Product + engineering (71% startup share):

Sales (78% startup share):

Finance + operations (91% startup share)

It’s difficult to tell what the ROI of such Enterprise AI spend might be, but there are clear patterns in what companies are prioritizing on the Application layer:

“Startups captured 63% of AI application revenue, earning nearly $2 for every $1 by incumbents, up from 36% last year.” - Menlo Ventures

Market Research

Financial Ops

Sales

Product & SWE

Human Resources

Marketing

Customer (Service) Success

Even OpenAI thinks its a worthy and unbiased candidate to do an Enterprise AI Report (3 days ago). But an incumbent doing such a report is even less trustworthy than a VC. Especially one that is losing in the same domain to its own spin-off, Anthropic!

With reasoning models, Deep Thinking and Agentic AI of course the demand for compute is skyrocketing, it’s designed to do so token and inference wise. OpenAI maintains that ChatGPT Enterprise seats have increased approximately 9x year-over-year (2024 to 2025). Even while they have lost API marketshare to not just Anthropic and Google, but to Chinese open-source players like Qwen, Moonshot AI and Zhipu AI. But as OpenAI’s grew their ARR on impressive terms in 2025, the rest are catch up as well:

AI Coding is a $4 Billion Market

One area where Generative AI is showing ROI is coding and software engineering tasks where it continues to improve led by the likes of Claude Code and Cursor. Mistral recently launched Devstral 2. Nor do I consider Mistral or Ai2 real competitors to Chinese Open-source developer friendly ecosystems. Microsoft’s Github Copilot and OpenAI’s Codex appear to be losing ground. I have slightly higher hopes for Qwen Code.

Claude Code become generally available around May 22, 2025.

“Claude Code has generated USD 1 billon in revenue for Anthropic just 6 months after launch.”

One analysis suggests that 20% of Anthropic’s total 2025 revenue is attributable to Claude Code. One might assume Claude Code and Cursor will be the duopoly of AI coding, but Claude Code could also disrupt Cursor over time.

This means Anthropic’s Enterprise AI and AI Coding Supremacy is the real deal for 2026 ARR growth.

Main Gen AI ROI?

Three years later you sort of have to stretch to find where the value is being created that’s sustainable for Generative AI:

AI Coding

Revenue growth in Cloud and Ads

E-commerce sales lift (e.g. Amazon’s Rufus)

The U.S. GDP impacts of AI Infrastructure capex itself (somewhat deceptive since the inference and GPU costs are depreciating)

Chatbot subscriptions (what kinds of margins?)

Some use cases for customer success, sales and marketing automation

Some limited gains in legal, healthcare and physical sciences.

OpenAI’s paper on Enterprise AI really has to be taken with a grain of salt. Since they aren’t likely to be a major player in this space. OpenAI’s survey is entirely self-referential and doesn’t tell us a whole lot about the actual space.

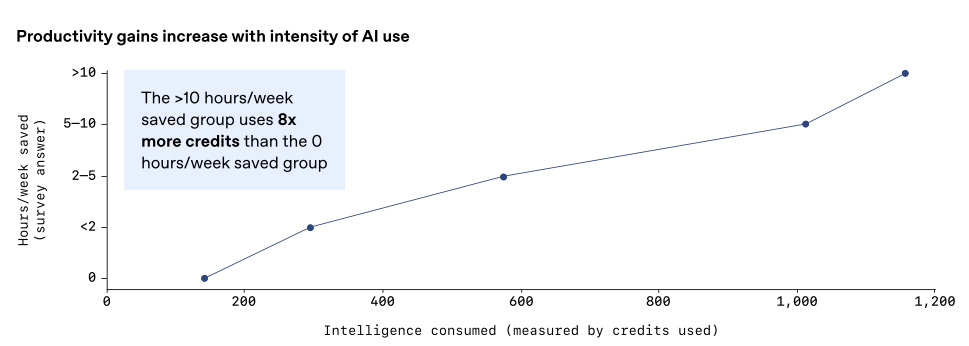

OpenAI seems to maintain that Heavy Use is Required to see Gains

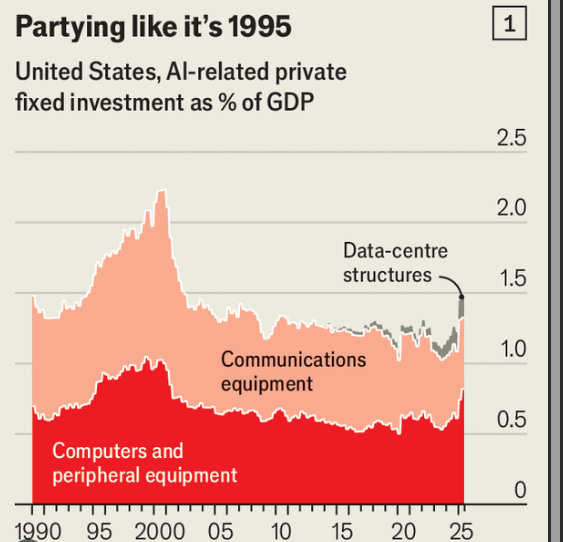

Semiconductor AI Boom Enters Gigacycle

2030 Watch: A growing body of forecasts from AMD, Nvidia, Broadcom, and major research firms now points toward a semiconductor market that passes the trillion-dollar threshold before the decade closes, driven by an AI infrastructure buildout several times larger than any previous expansion in the industry’s history, according to a new report by Creative Strategies.

$1 Trillion

Lisa Su (Taiwanese-American), AMD’s CEO, now views the AI hardware TAM—encompassing CPU, GPU, ASIC, and networking—as exceeding $1 trillion by 2030. At AMD’s November 2025 Analyst Day, she framed the opportunity bluntly: “The market is accelerating at a pace that we just did not understand until over the last few years. There’s no question, data center is the largest growth opportunity out there.”

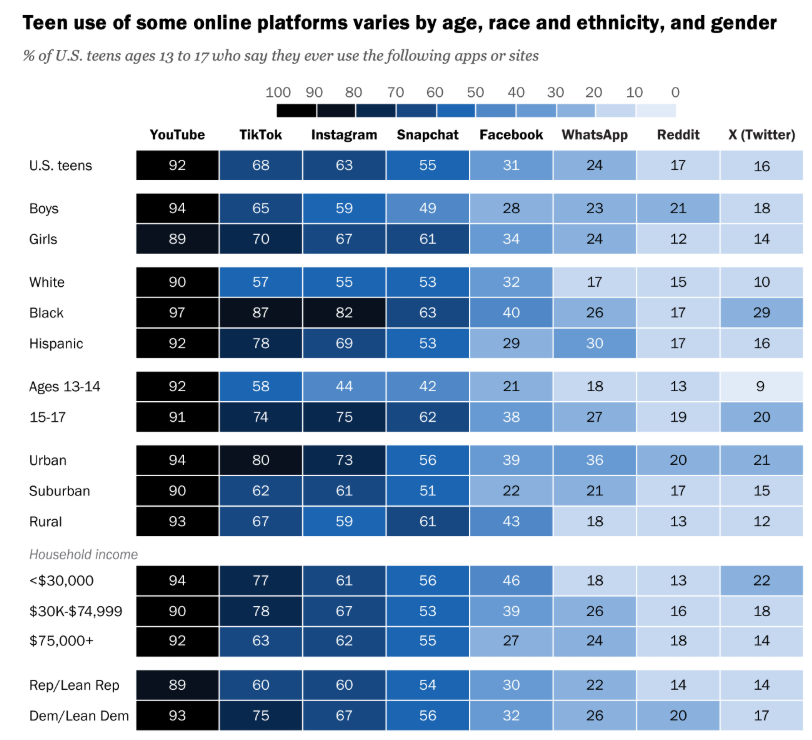

Going back to the Teen demographic study:

For some reason Black and Hispanic American teens are more addicted to social media, I wonder if it’s the same with their AI chatbot and companionship usage. As you might know these youth are unfortunately more likely to be in lower socio-economic brackets in the United States with its deep inequality.

White American Teens Use Chatbots a lot Less

Teen usage of AI chatbots isn’t as high as you might think in America.

Higher income households in urban areas tend to show higher usage of AI chatbots.

Why would white teens be using AI Chatbots like ChatGPT considerably less? 👀

Very Few U.S. Teens use AI Chatbots Very Frequently

If Chatbots were a sustainable business, you’d expect U.S. teens to be high power users, but they aren’t. They may be literally too busy on YouTube, TikTok, Instagram, Netflix and so forth. More than a third of U.S. teens simply don’t use ChatGPT or AI chatbots.

With the launch of Gemini 3 Pro, Google DeepMind really took a lot of mindshare, but you need that sort of full ecosystem for AI chatbots to have a place in a full-stack approach.

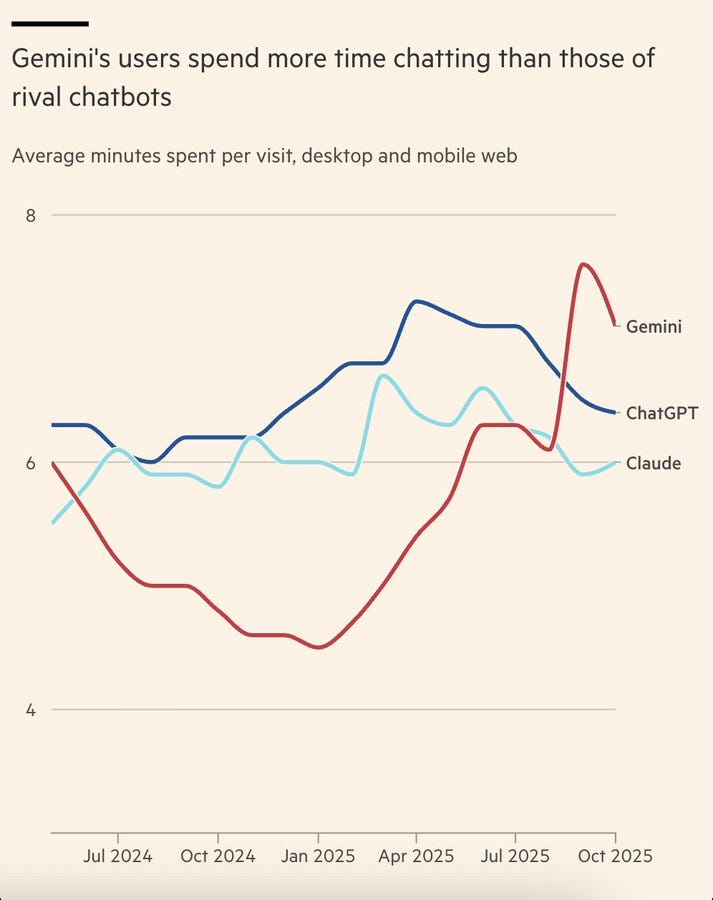

Did Gemini 3 Kill ChatGPT’s Momentum?

Users spend more time on Gemini than ChatGPT, per FT:

OpenAI’s entire business model revolves around well, just their ChatGPT chatbot.

Is AI in a Bubble?

One of the more interesting topics in mid to late 2025 has been the debate about the AI bubble dynamics of the current AI boom and Infrastructure Datacenter spending.

One of the greatest investors of all time just dropped an 18-page memo on AI, and it might be the most honest thing anyone has said about this industry. We are talking about Howard Marks.

→ Investors piling into companies with no product.

→ Founders raising $1-2B seed rounds on vibes.

→ Circular deals between hyperscalers.

→ Debt being used to finance massive AI infrastructure before profits exist.

→ And valuations anchored more in imagination than evidence.5

But hey, it only took Cisco 25 years to recover from the dot.com bubble6.

Bigger Liquidity Bigger Bubble

Gita Gopinath, former chief economist for the International Monetary Fund (IMF), recently estimated that if the AI bubble were to burst, it would wipe out $20 trillion in wealth held by American households. The Great Recession, considered the worst financial meltdown since the Great Depression, reduced US household net worth by $11.5 trillion, and it took years before for American families to rebuild their wealth to pre-recession levels. - Engadget article.

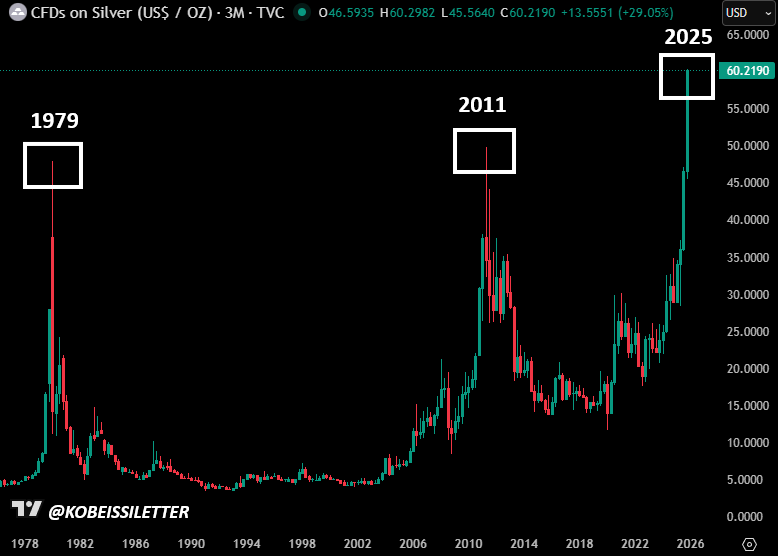

Something Very Weird is Going On

Both Gold and Silver are at or near all-time highs.

What we’re seeing in Silver is historic.

It’s now above the 1979 and 2011 highs, and above $60/oz for the first time in history. According to many analysts, Gold and silver always predicts what’s coming next7.

“ When the price of silver doubles quickly, it’s rarely a good sign. It almost always means people have lost faith in their money and their leaders.” Andrew Lokenauth - source.

But! 2026 could be the Biggest IPO Year in a Decade