4 Startup Funding Models in the Age of AI

The Future of Venture Capital is about to change due to AI and the flood of capital going to AI startups. MCP and A2A will enable Seed Strapping to have a bright reincarnation for startup futures. 🚀

Hey Everyone,

With uncertain macro conditions, AI startups and startups in general are shifting their strategies and building companies completely differently. But how? While I don’t write on Venture capital at the intersection of AI and startups often, it’s one of my favorite things to track as an emerging tech analyst.

The idea of seed-strapping and the dream of solopreneurs being able to scale startups in a more lean and agile manner with less employees with AI is fairly fascinating. New cases studies are emerging to inform the founders of today and the future.

In the era of Generative AI, the way founders and solopreneurs are bootstrapping is very different where there are many examples of AI founders who are able to scale revenue faster, be more agile and rely less on traditional equity dilution to grow fast in a more sustainable and in a less high-risk manner. Is this the beginning of a fundamentally different future of entrepreneurship with AI?

Let’s try and find out. You might have seen this quote:

“🚨 25% of today's YC Demo Day startups have codebases that are 95% AI-generated.”

Are smaller AI-augmented teams the future of agile startups? How would they function and raise funds differently?

What is Seed Strapping?

"Seed-strapping," or raising one round of funding and scaling profitably from there, is gaining popularity among startup founders amid a downturn in venture capital markets. Artificial intelligence is helping startup founders become more efficient for less money, thus minimizing the need to raise venture capital.

In the AI hype bubble, VCs are going after AI startups and throwing capital at them like never before. In early April, 2025 it’s come out that even a16z Andreessen Horowitz is reportedly seeking to raise $20 billion for a tech investment fund focused on growth-stage investments in American artificial intelligence startups.

Top Newsletters for Founders?

Now on Substack recently there are suddenly really great Newsletters at the intersection of Venture Capital, startups and AI for founders. Let me name some of them here (these are mostly ideal for founders, entrepreneurs and solopreneurs especially those who are looking for resources):

Product Newsletters that talk about AI are also highly recommended because they draw on tactics, strategy and product mechanics that enable startups and their products to grow.

Tashi Dorjee from Sydney Australia has a really great YouTube introduction to what Seed Strapping is and why it’s becoming more popular here. Another great introduction to seed strapping is here.

However the founder that most impressed me with Seed Funding and his startup tips is actually Henry Shi. His viral posts on LinkedIn really caught my attention.

He’s a Waterloo alum who is technology entrepreneur, investor, and technologist, known for his work in AI, particularly for his role as an angel and seed investor in various AI startups, and for founding Super.com, which he grew to $150MM+ in annual revenue. Follow Henry Shi here on LinkedIn.

Henry’s Best Hits 🦄

If you are a founder, have an entrepreneurial itch or are a solopreneur you might want to follow his work.

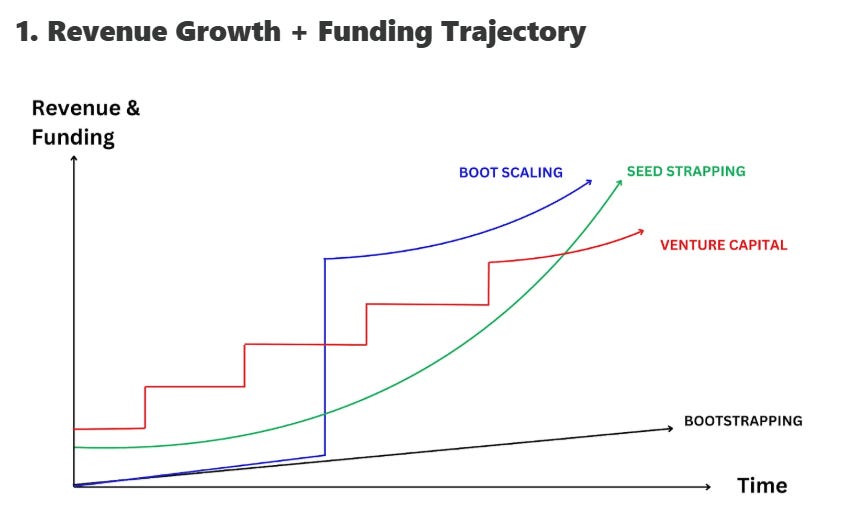

Seed-Strapping vs Boot-Scaling in the AI Native Era

Launching the Official Lean AI Leaderboard 🏆

Henry Shi’s AI Crash Course (Github)

The Complete Guide to OKRs

The idea that AI is changing the future of startups, growth and entrepreneurship is really evolving fast especially as AI becomes better at coding and as AI agents begin to find frameworks like MCP by Anthropic and A2A by Google.

The best intro to MCP is by Latent Space via swyx & Alessio. If you understand what MCP and A2A evolve into the idea of AI empowered entrepreneurship is much bigger and more important trend than vibe coding.

As agentic AI frameworks and models get better, the function of entrepreneurship and scaling of revenue growth in startups also begins to changes.

Who’s Henry? 💡

Henry Shi is a successful founder and entrepreneur. He is currently writing about AI and helping founders build and scale businesses through angel investing. Paying it forward and giving back, one interaction at a time.

Let’s get into his incredible deep dive now:

4 Startup Funding Models in Age of AI

A guest post compilation by Henry Shi (March, 2025)

I recently exited my $150MM annual revenue startup that’s raised $200MM in venture funding and discovered something shocking:

The way 90% of founders build companies is fundamentally broken.

For decades, we have been trapped in a false binary: bootstrap (and struggle for years) or raise VC (and give up control).

But in 2025, AI has changed everything.

I'm seeing a revolution in how companies are built, and the smartest founders are leveraging a new emerging model that almost nobody is talking about.

Here's the insider view of all four approaches to building and funding a company, with hard numbers from the trenches. I have gathered them after chatting with 100+ founders and learning from the smart founders on the Lean AI leaderboard:

The Traditional Options (That Are Failing Most Founders)

Option 1: Bootstrapping

You fund everything yourself, maxing out credit cards and emptying savings accounts.

You retain 100% ownership but face a lot of challenges:

90% of startups fail within the first 3 years, and the failure rate is even higher for bootstrapped companies. 8 out of 10 bootstrapped companies fail within 18 months due to cash constraints.

Your personal finances bleed red for years, with no guarantee of survival.

Even successful bootstrappers often take 5+ years to reach mere six-figure incomes (that too after working 80-hour weeks for less than minimum wage).

Option 2: Venture Capital

75% of VC-backed startups never return capital to investors.

Only 0.1% achieve the unicorn exits we read about in TechCrunch.

Yet the model forces ALL founders to operate as if they will be in that 0.1%.

Founders surrender chunks of equity at every round: 20% at Seed, 20% at Series A, 15-20% at Series B...and so on.

By Series C, founders typically own just 15% of their companies, and 99% never reach that milestone.3

A founder who builds a $50M company with VC often walks away with less personal wealth than one who builds a $10M company via bootstrapping.

Option 3: Boot-Scaling

You self-fund until you demonstrate meaningful traction, then take a massive funding round (often from private equity).

This approach preserves early ownership but comes with hidden costs:

You endure the cash-strapped struggle of bootstrapping for years.

Then, you dilute massively in a single event (often 40-50% of your company). You also lose control to micromanaging private equity buyers, who often ruin the company culture.

The risk profile is high: You burn personal runway and then bet everything on a single scaling event that fails 72% of the time.4