The Q1 AI Capex Roundup: Further Loosening The Purse Strings

Hyperscalers are raising the stakes on their AI capex. DeepSeek’s R1 innovation is one more reason why.

Good Morning,

I like many of you have been pondering what DeepSeek, the AI Infrastructure datacenter boom and export controls means for Nvidia and BigTech equities. Many of my readers are also investors in the stock market.

Amrita and Uttam from the Pragmatic Optimist are back and have relaunched their Newsletter more for investors. I asked them for their take on the BigTech Capex story which is one of the biggest trends in spending directly related to AI in 2025 with potentially generational repercussions.

Capex on AI Infrastructure is Exploding in 2025

Meta, Amazon, Alphabet and Microsoft intend to invest as much as $320 billion this year into artificial intelligence technologies and if you count Stargate, they say they might be able to spend $100 billion more on Stargate in 2025, which would lead you to a total of $420 billion.

At the AI Summit in Paris this week, it was announced that the UAE ($31 to $51 Billion) and Canadian fund Brookfield Infrastructure Partners plans to spend €20 billion ($20.7bn) on AI infrastructure in France over the next five years. That’s another likely roughly $45 Billion just for France. Clearly capex on Datacenters and AI compute is accelerating tremendously in 2025.

Let’s dive into their Newsletter Launch and the deep dive.

🎧 Audio version is available for premium readers below.

💡 Pragmatic Optimist Selections: 📈

Known for macro overviews and investing deep dives:

Our S&P 500 Target For 2025 Jan ‘25

A related take to our topic today is Eric Flaningam’s Q4' 24 Hyperscaler Report: AI Supply & AI Demand.

The Q1 AI Capex Roundup: Further Loosening The Purse Strings

Hyperscalers are raising the stakes on their AI capex. DeepSeek’s R1 innovation is one more reason why.

By Amrita Roy February, 2025.

Introducing The Pragmatic Optimist 2.0 🚀

If you are a reader with investing inclinations, I asked them to pitch their Newsletter launch.

Up until now, the content strategy at The Pragmatic Optimist (which we started in September 2023) was about connecting the dots in macroeconomics, technology, and culture in a jargon-free language to help readers understand the big picture.

Looking forward to 2025 and ahead, we have narrowed down our focus to the AI value chain, where our objective is to help readers and investors navigate the evolving innovation landscape, identify rock-solid businesses with strong growth trajectories, and make long-term investments in the space with a high probability of success.

As a result, our content strategy will involve understanding how different industries and companies fit into the overall AI ecosystem, how their product innovation roadmap impacts their revenue and profit cycles, and assessing industry crosscurrents and how that impacts forward valuations.

The Pragmatic Optimist 2.0 will be a paid publication, where a paid subscriber gets the following:

🌐 1 Monday Macro per quarter

🤖 9-12 industry research posts per quarter with a focus on relevant stocks 🗠 in the AI ecosystem.

💬 Subscriber chat that contains all live trades with commentary on key events that signal an acceleration/deceleration in the companies’ profit cycles

📨 Post comments and/or DM us with any questions.

📈 Access to The Pragmatic Optimist’s portfolio (coming up in H2)

⏰⏰As an extension of our gratitude, all existing and new paid members until the end of March will be able to lock in our annual rate of $80 for a lifetime.

(Go Premium for $80 annually FOREVER)

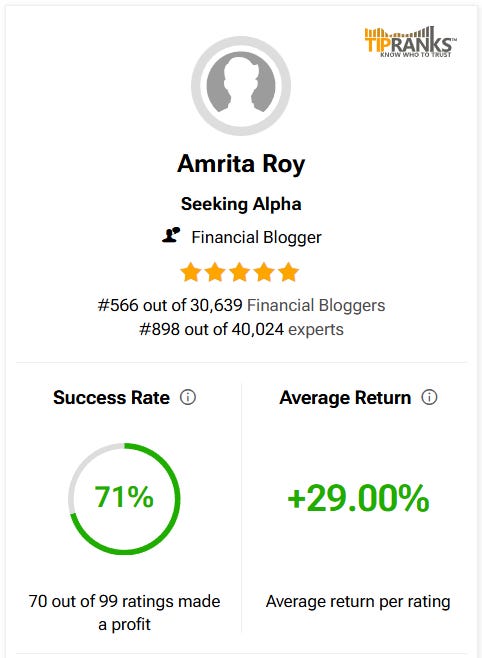

I (Amrita) also rank in the Top 2% of all analysts, with a 71% success rate and an average return of 29% per rating, with some of my most successful long calls that include Palantir PLTR 0.00%↑ , Twilio TWLO 0.00%↑ , Reddit RDDT 0.00%↑ , Cloudflare NET 0.00%↑ , Atlassian TEAM 0.00%↑ and Wix WIX 0.00%↑ .

The Q1 AI Capex Roundup: Further Loosening The Purse Strings

One word to summarize the AI developments from the last few weeks—whirlwind.