The OpenAI Bubble Increases in 2026

An IPO frenzy, datacenter boom and an AI bull market creates an M&A environment with rapid consolidation to kickstart a Machine Economy era boom in 2026, that can last for years.

This Newsletter is about AI Supremacy. Between the U.S. and China, but also among the biggest AI Startups. OpenAI in 2026 is likely to be pressured by both incumbents and AI startups, by Giants and more nimble specialist companies.

.

.

We’ve never seen anything like it: OpenAI can go bust and it won’t even matter… I can’t stop thinking about OpenAI’s path ahead and how it might bifurcate from the real winners of AI in the year ahead of 2026. Some field notes follow. No napkin math but some opinions that might be relevant.

People don’t fully realize what an IPO frenzy 2026 is going to bring and how much capex, debt fueled AI infrastructure build-outs and private AI startups valuations will keep rising next year.

Circular financing of the 2025 variety is only going to increase, because Silicon Valley is betting on Generative AI to increase profits and earnings. With so much liquidity on the sidelines (due to years of QE and pandemic mismanagement by the Fed), the AI boom has yet to fully manifest (on the stock market) as the bull market prepares for AI frontier model, Chip and Neo Cloud companies to go IPOs in 2026.

IPOs, M&A and more AI startups with unrealistic valuations will mean a capital allocation binge like we’ve never seen before in the history of technology.

There is little signs of the AI boom slowing down - Hyperscale datacenter operators nearly tripled their spending on infrastructure over the past three years in response to the AI craze, while the amount of operational capacity added each quarter has increased by 170 percent.

OpenAI is in talks to raise up to $100 billion in a funding round that could value the ChatGPT maker at up to $830 billion, The Wall Street Journal reported last Thursday, however something doesn’t quite feel right. xAI, Thinking Machines and other AI startups founded by AI luminaries have equally unrealistic private market valuations.

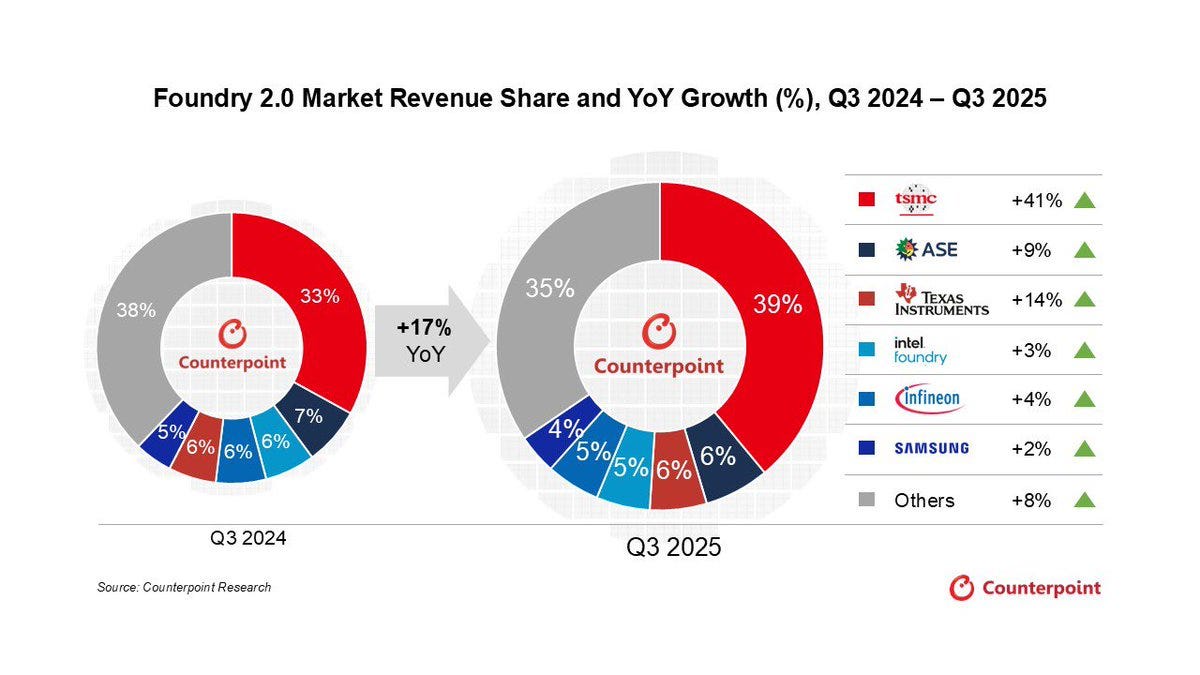

With about one week to go in 2025, More than $61 billion has flowed into the data center market. So why would OpenAI be committing Trillions in future deals when its Enterprise, API and even B2C chatbot marketshare has gone down fast in 2025? OpenAI is also censoring its own research. Meanwhile Nvidia with over 90% of the AI Chip market and TSMC on the way to capture 50% of Foundry 2.0 revenue worldwide, OpenAI is not shaping up to be a monopoly leader in its own space of chatbots.

OpenAI’s momentum begins to enter real challenging competition in 2026 as more rivals emerge and more sophisticated ones evolve faster.

This article mostly discusses OpenAI’s prospects in 2026.