Nvidia's Brutal Start to 2025 Explained

🍊 Unpeeling the orange. Nvidia’s DeepSeek threat has snowballed into larger issues. Government scrutiny and a Singapore probe is one of them.

Welcome Back,

There are days where I feel like a business publication and not just a technology publication, this has to be one of those days. Some stories are too big not to tell.

The dot com bubble burst 25 years ago to the day. On March 10, 2000, the Nasdaq Composite index peaked at 5,048.62, more than double its value from just a year earlier. It’s hard to imagine, but eventually, the Nasdaq shed more than 75% of its value, wiping out $5 trillion in market capitalization.

In the Generative AI era, Nvidia’s stock has been seen as the bellwether of the movement since around 2022. Here we are suddenly in 2025 and what’s going on with Nvidia? I ask because it’s lost over $1 Trillion in market cap in just a few weeks. Nvidia is down over 30% from its highs. It’s not many days where the NASDAQ 100 is flirting with being down 3% in a single day, so how about nearly 4% (3.81%)? March 10th, 2025 will go down as one of these rare days.

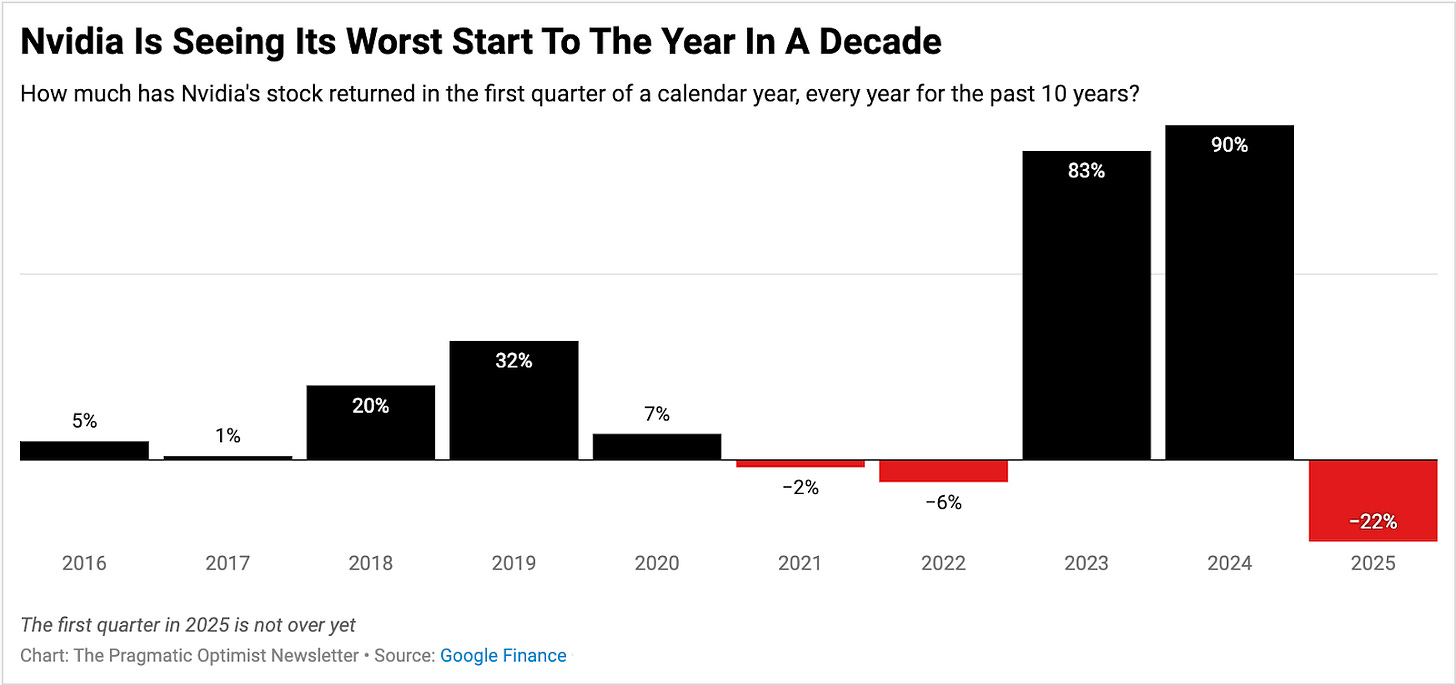

Nvidia is itself down 22.65% year to date on the stock market, likely closer to 25% after today. But who’s counting? Semiconductor companies are at the center of the AI boom and in freefall with Trump acting as an agent for chaos and confusion where economic uncertainty anxiety is flirting with recession fears. Nvidia as an AI stock is caught up in all of this.

Economists say Trump is proving to be an “agent of chaos” with his unpredictable trade tariff policies, but recession fears are overblown. Goldman Sachs recently cut its economic growth outlook due to the potential impact of Trump’s tariff policy and without a Fed put or a “Trump put”, there was a capitulation in the markets that was nearly unimaginable even a few short weeks ago. With tariffs looming, this could last a while.

Nvidia’s stock was down in a big way for the day on Monday March 10th, 2025, to the tune of 5% in a single trading day. There are many layers to Nvidia’s poor stock performance in 2025 and we need to peel the orange back to understand it better. 🍊 This is a day when understanding the stock market is part of how we understand AI. So buckle up if the topic interests you.

I turn to my Nvidia expert Uttam Dey for a quick take. I offer more color to his points after the guest contribution.

Nvidia Is Having A Rough Start to 2025. It's Not Just DeepSeek

“Nothing lasts forever” is what Nvidia’s $NVDA shareholders may be thinking as the stock fails to see any revival this year.

Nvidia’s stock is possibly seeing its worst start to the calendar year in over a decade as a range of headwinds keep forming dark clouds over the GPU maker’s outlook this year.

DeepSeek, chip export regulations, scrutiny over sales of its accelerator chips or GPUs, and competitive pressures have all converged together, digging its heels firmly in the sand and draining all the exuberance out of Nvidia’s stock.

Of course, Nvidia’s bulls will laugh off any mention of competitive pressures that the stock sees.

But that still doesn’t justify why Nvidia’s investors have scaled back their investments in the stock with the company losing $870 billion in market capitalization from Nvidia’s market cap peak in November. This is a stark reversal of fortunes for Nvidia, its investors, admirers, and its rockstar CEO, Jensen Huang, who, at one of the many peaks of Nvidia’s exuberance last year, was signing t-shirt(s) for his fans.

Nvidia’s headwinds show no sign of dissipating yet, especially DeepSeek, which emerged as one of the earliest, deadliest threats to Nvidia this year.

This Is How DeepSeek Sparked Nvidia’s Selloff

Every AI enthusiast knows that the fierce competition for dominance in GenAI has centered around the idea of “scaling laws.”

Large models have large volumes of model parameters and are typically trained on larger amounts of data, measured in tokens, which often require copious amounts of compute resources (more computing chips and power), thus enabling the model to get more “capable,” a.k.a. perform more complex tasks and score better on benchmarks.

Training these models costs millions of dollars due to the vast scale of GPUs needed to train models. That’s why Nvidia benefited because every AI company was rushing to make their AI models more “capable.”

But when OpenAI launched the o1 reasoning model last year, a paradigm shift occurred in the narrative with experts debating that scaling laws don't scale enough.

Recent works

Nvidia’s Q4 Earnings Review: Chip Wars Are Heating Up Feb ‘25

The One Hyperscaler That Stands Out Among Rising AI Capex Concerns Feb ‘25

🟠 Check out the Pragmatic Optimist to receive “alpha generating investment ideas” in the AI value chain.

For less than $2 a week, get my very best coverage and those of the emerging writers that go deeper.