Mary Meeker Report - Is this an AI Bubble?

Mary Meeker's Report and Looking at Market Data, Where Are We in the AI Cycle—Boom or Bust?

Good Morning,

I can’t stop thinking about the AI hype narrative and the momentum this technological wave has upon us. Thank you to all of my readers, we have appeared in Substack’s Technology rising leaderboard this past week.

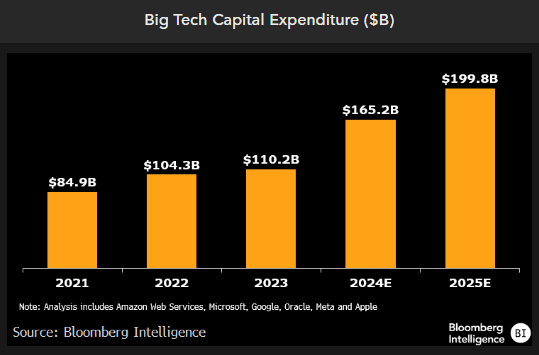

There are many who claim that AI looks exactly like the dot.com bubble. The level of enthusiasm and capital expenditures BigTech has put into AI chips, datacenters, AI infrastructure and AI talent is hard to even fathom. If you include OpenAI’s investments in Stargate we are talking about a quarter of a Trillion dollars in 2025 easily. This is not counting investments in Europe, the Middle East or China.

BigTech Capex is telling us this is a Generational Boom

Everyone remembers what a bubble looks like 💭

How do you even explain the AI hype bubble from an ROI perspective for most firms? The stock market looks expensive after one of the fastest rebounds in decades since Trump’s “Liberation day” of April 2nd. The AI market’s soaring valuations and speculative investment raise concerns of a potential bubble, despite its transformative potential. Cash rich corporations and Silicon Valley gate keepers are spending as if AGI is right around the corner. While Warren Buffett, Michael Burry and even Jamie Dimon look like they are getting nervous.

This must be “AI Compute Heaven” 🐇

CoreWeave, one of the first Generative era AI startup to go public, disappointed investors, ending its first day of trading with a market cap of $19 billion. The last time it raised funds as a private company, in May 2024, it was already valued at $19 billion, nearly triple its valuation just five months prior. Now in June, guess how much its worth now after six weeks of stock market frenzy? $69.3 Billion. This is the environment we are living in.

OpenAI and Nvidia power Enthusiasm higher 👑

Demand for compute looks insatiable even 2.5 years after ChatGPT went live. Nvidia’s data center sales jumped another 73%. OpenAI seems to raise cash at will now with a valuation of $300 Billion with just a single product, ChatGPT. Venture Capital have spent a lot of capital just to raise the AI narrative up to god-like status in 2025.

But what do VCs really think? The market is trading at a 23x multiple, expensive in any year. The DeepSeek scare of late January feels like a distant memory, now in June. A new AI pantheon including OpenAI, Anthropic, DeepSeek and Thinking Machines Lab may soon challenge the business models of BigTech incumbents. This is simply how markets work during technological shifts.

AI startups are eating Venture Capital budgets

James Wang is the author of the Newsletter Weight Thoughts, and is a General Partner at Creative Ventures & Co-Founder of Lioness. Even the most bullish VC or angel investor must wonder about the influx of AI startups eating the industry what this will rationally lead to. AI was eating VC for breakfast in 2024 when it accounted for over 50% of global VC dollars. In 2025, this is starting to become a problem.

Lately James has been putting out some really fascinating articles:

What LLMs Will Do To Jobs: All You Need is an Oracle

AI is Overturning the Military World Order

AI's Endgame (How Foundational Model Companies Can “Win”)

I like how James frames the impact of AI and while techno-optimism predominates in VC circles, how much is just consensus, group-think and wishing thinking I wonder? It’s literally their job to be guardians of a non-critical view of AI’s potential. With the decline of journalism, Venture Capital’s influence on media is only getting stronger. Public relations and lobbying jobs are replacing dying investigate journalism jobs for a reason. “AI mode” is breaking the internet, and this is a weird shift for the internet. The zero click internet is upon us.

The AI Bull Market Could Last Years 🐮

We know this moment feels like an AI bubble, but what does the data say? The U.S. stock market has a Historical Average P/E: ~20.5 (modern era). Today we’re looking at valuations more like U.S. Stock Market P/E: ~24.34 (estimated). We appear to be in an AI bull market. The reality is demand for AI chips and datacenter expansionism and National Defense spending with geopolitical uncertainty could extend this bull market for years to come, giving Generative AI ample time to actually back up its swanky visions of AI Supremacy pitch decks and Venture Capitalist and Tech CEO proclamations. It’s all go if you are an AI podcast bro.

My baseline view of VC’s reality with AI, isn’t biased with financial incentives and insider knowledge of how great AI is going to be:

I asked James for his take on Mary Meeker’s incredibly detailed AI report. To my surprise he took the are we in an AI bubble analysis up in a fairly detailed way and to new levels.

I admire James also for asking some of the biggest questions in AI technology. He’s also working on a related book. I wish I knew more VCs who invest in the AI space, feel free to DM me on LinkedIn if you are one. So much of what we are doing today depends on the timing and historical curve of the Generative AI cycle. Recessions and Deep learning winters don’t come as often as they once did, but are there structural issues in the mania?