Japan's National Chip Startup Races to 2nm Mass Production

Rapidus: Japan’s Leading Edge Semiconductor Manufacturing Hopium

Good Morning,

As some of you know I’ve been following the Semiconductor industry pretty seriously for the past few years. While TSMC has pulled ahead of the competition in recent years from Intel and even Samsung, there is one future contender I’m watching that I’m bullish on and that’s Japan’s Rapidus.

I’m of the belief that to understand AI you have to have a good understanding of the semiconductor supply chain, key players, and an appreciation of how important not just datanceters are, but the hardware that enables GPUs. Their niches and their stocks. Rapidus is easily among my favorite global semi startups. Many people who follow AI have never even heard of them. They plan to go IPO that is targeted for fiscal year 2031.

Rapidus Corporation is a Japanese company dedicated to the research, development, design, manufacture and sales of advanced logic semiconductors, in their own words. Essentially this is one of the most exciting Semiconductor chip startups (not a sponsor). Rapidus is racing towards 2nm mass production and it’s super important for the future of AI globally. I don’t find Rapidus is getting enough credit.

The Top TSMC Challenger in Asia

Rapidus Corporation is a Japanese semiconductor company founded in August 2022 to develop and manufacture advanced logic chips (2-nanometer node) by 2027. Backed by major Japanese firms (Toyota, Sony, NTT) and government support, it aims to establish a high-performance foundry for AI, autonomous driving, and edge computing to boost Japan’s competitiveness in the chip industry.

The Semiconductor industry is undergoing a generational boom with even Elon Musk confirming that Tesla plans to build a "TeraFab" in the U.S. to manufacture its own AI, logic, and memory chips, reducing reliance on suppliers like TSMC and Samsung. With Huawei racing to catch up to Nvidia, this is all shaping up to be a dynamic decade for the future of the Semiconductor industry that is also experiencing an HBM chip shortage.

There’s a Significant Semiconductor Boom

Prices for computer memory, or RAM, are expected to rise more than 50% this quarter compared to the last quarter of 2025. Three primary memory vendors that are Micron, SK Hynix and Samsung Electronics — make up nearly the entire RAM market, and their businesses are benefiting from the surge in demand. Micron’s stock is up 39% just this year and a stunning 387% over the past year.

While Elon Musk’s so-called future TerraFab will combine memory, chips and packaging in one facility claiming it’s the only way to reach the needed scale, I see the rise of Rapidus in the next five years as a distinct possibility. I do believe TSMC is a monopoly and for good reason, where Rapidus is one of the best newcomers to the space in years. How they utilize AI in their business model is also super relevant.

I asked Jason's Chips (Starr) a talented entrepreneur, student and writer out of Philly to dig into it for us in more detail. Jason is the founder of one of the fastest rising Semiconductor Newsletters on Substack and says he’s a chronically online college student obsessed with semiconductors posting deep single-name equity research because it’s fun.

Jason takes you on deep semiconductor tech journeys via 50+ page research reports in as entertaining and simplified a way as possible.

I highly recommend you follow his Newsletter.

Why Rapidus Fascinates me?

Rapidus could be the most intriguing cinderella story in the entire semiconductor industry. Learning about the semiconductor industry is also all about learning about business in places like Taiwan (where I live), South Korea and Japan. That’s why I started the Semiconductor Things Newsletter.

Rapidus is Japan's state-backed "all-or-nothing" bet to reclaim its crown in the semiconductor industry.

Rapidus encompasses an enormous amount of collaboration among Japan’s top companies and Government.

Founded in 2022 by eight Japanese giants (including Sony, Toyota, and SoftBank), it aims to jump from Japan’s current decade-old technology directly to the world’s most advanced 2-nanometer (2nm) chips.

So far so good: They broke ground on their IIM-1 fab in Hokkaido in 2023, completed the cleanroom in late 2024, and successfully prototyped 2nm Gate-All-Around (GAA) transistors in July 2025. Rapidus isn't inventing 2nm from scratch. They are using technology transferred from IBM (who built the world's first 2nm test chip).

Can Generative AI accelerate Semiconductor Fabs?

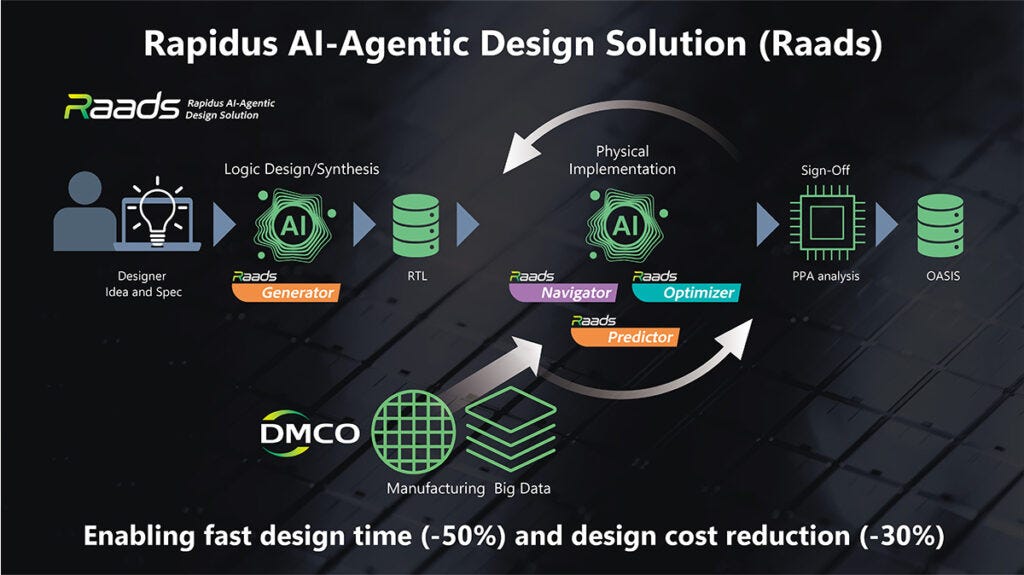

In late 2025, Rapidus unveiled Raads (Rapidus AI-Assisted Design Solution). It uses Large Language Models (LLMs) to help engineers design chips specifically for the 2nm process.

Following the launch of Raads Generator and Raads Predictor, Rapidus will also release additional tools throughout 2026 including:

Raads Navigator / Raads Indicator: Utilizes LLMs to provide quality assurance and assistance to designers to derive solutions to design issues and problems.

Raads Manager: A layout design tool that utilizes ML/AI to create a hierarchical configuration that minimizes design time.

Raads Optimizer: Applies ML/AI to search for and derive parameters to optimize PPA.

Jason’s Chips Publication

Jason’s work also is a must-read for investors covering a lot of the topics and companies I care about. Here’s why: his goal is to do technical engineering research to uncover alpha, build comprehensive operating models and DCFs, then distill his work into clear, cohesive, and hilarious stories readers intuitively understand. He models using a revenue build + 3 statements + DCF (Discounted Cash Flow) valuation approach with granularity beyond what you see on the sell side.

He’s doing a B.S. in Finance and Artificial Intelligence and I believe in emerging writers just like him. Unlike other tech/semiconductor investing Substacks he focuses a bit more on the financial side understandably. As a student he’s seeing all this with fresh eyes: He adds:

“Because after all, as much as we love the tech, we buy stocks for their free cash flows. So, you’ll hear a lot more about operating leverage, cyclicality, capital intensity, and accounting than you usually would from another semis writer.”

He writes classic deep dives, portfolio reviews and even Earning reviews. There simply aren’t many writers around who can do that (3.9 GPA). Semiconductor and Investing Newsletters are among the most profitable on Substack and since he’s early his prices are still really low, so grab a paid sub to him while they are this low.

His body of work for just five months since he started his Newsletter is impressive.

Rapidus are targeting high-end, specialized AI accelerators, like a genuine national moonshot for Japan. Japan has come into focus in 2026 for multiple reasons, I don’t have to tell you we live in interesting times.

Japan in Context: 2026

Japan's benchmark Nikkei 225 stock average soared over 2,000 points to all-time highs. Japanese Prime Minister Sanae Takaichi's party is likely to score a landslide victory (above left).

The deep dive today on Rapidus is locked for premium readers. In February, 2026 free articles go out guaranteed on Thursdays. Title:

Rapidus: Japan’s Leading Edge Semiconductor Manufacturing Hopium

My deepest appreciation to Michael Spencer for giving me the opportunity to write this guest post. Please see my other content at Jason’s Chips. Author’s trending works:

The Lumentum Series | Part 2: Co-Packaged Omnipotence

The Aixtron Series | Part 1: Power Electronics

The Aixtron Series | Part 2: The Optoelectronics Supercycle