As you know I am a bit of a chart nerd, when it comes to projections around the AI renaissance.

For the last decade that is since 2015, Coatue has hosted their East Meets West conference, an annual gathering of technology and business leaders for a dialogue on global innovation.

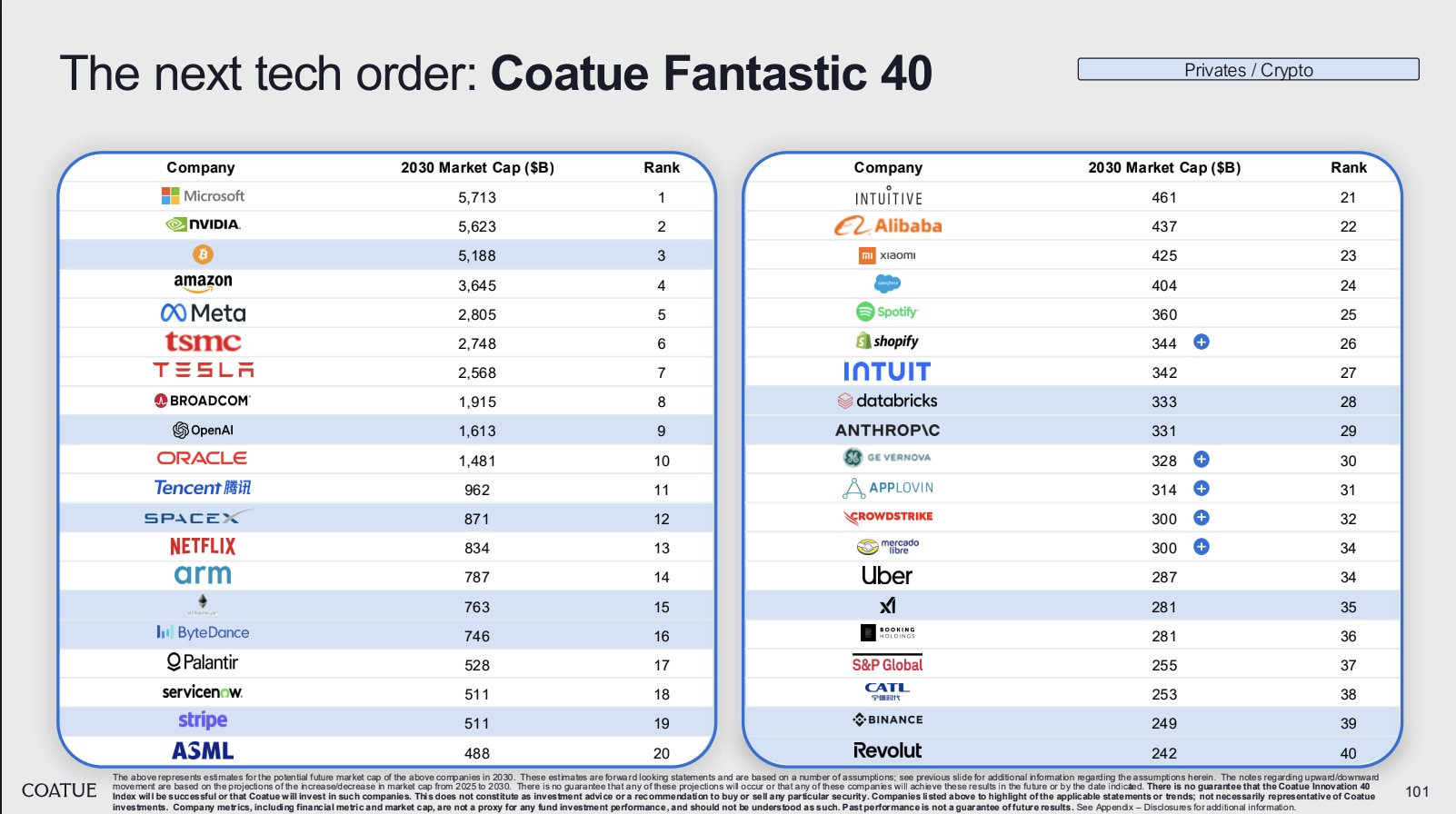

This year they released a projection of some of the biggest corporations in 2030 and there was some chatter about which BigTech players are no longer on the list by 2030, or just five years from now. See for yourself:

The Coatue Fantastic 40

OpenAI goes public and rises quickly into the top 10 companies in the world by market cap.

Google does not appear to be a major BigTech corporations by 2030.

Coatue does not seem to see Anthropic, xAI or other Generative AI firms as major winners by 2030 outside of OpenAI.

This slides in this analysis are from the event’s keynote address where co-Founders Philippe Laffont and Thomas Laffont opened the conference in their classic "Coatue View on the State of the Markets," and shared their outlook on the macroeconomic landscape and public and private markets.

Why does what Coatue says matter?

Coatue Management has been one of the most active investors in the Generative AI space, with over 50 AI-related companies in their portfolio as of 2023. They've raised a $1 billion fund specifically for AI investments in 2024, demonstrating their strong commitment to this sector.

Major Generative AI Investments

Foundation Models & Infrastructure

Anthropic - Claude AI assistant and safety-focused AI research

Together AI - Open-source AI platform ($106M Series A led by Salesforce with Coatue participation)

Adept AI - AI that can use software tools and take actions

Character.ai - AI chatbot platform for interactive conversations

Hugging Face - Open-source machine learning platform ($100M Series C with Coatue participation)

Creative & Content Generation Tools

Runway - AI video generation and editing platform

ElevenLabs - AI voice synthesis and cloning technology

Ideogram - AI image generation platform

Tome - AI-powered presentation creation tool

Developer Tools & Platforms

Replit - AI-powered coding platform

Aurora Solar - AI for solar energy system design

Norm AI - Regulatory compliance automation

Among VCs that I know who have invested prolifically in AI, only perhaps Nvidia’s lineup to me seems more impressive.

According to ChatGPT

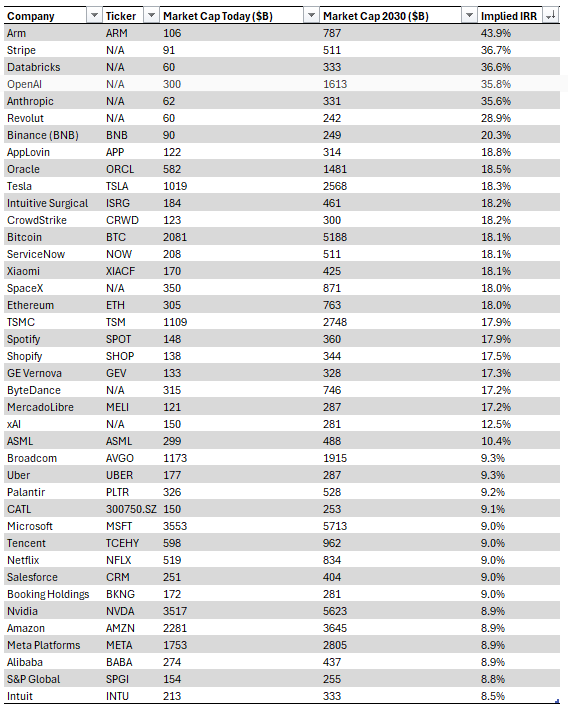

Internal Rate of Return (IRR) is a financial metric that calculates the discount rate at which the net present value (NPV) of all cash flows from a project or investment equals zero. That is, it represents the effective annual rate of return on an investment, considering the time value of money.

Projections 2025 at 2030. ✨ Coatue’s Fantastic 40 - Implied IRR

Arm

Stripe

Databricks

OpenAI

Anthropic

The Mechanisms of U.S. Capitalism

I think a great deal about how the stock market accelerates AI especially in an AI driven bull-market like we have seen between 2023 and 2025 accompanied by a surprising demand for compute and enormous capex investments by BigTech in AI Infrastructure that we have covered at some length on this Newsletter.

Let’s take a quick tour.

According to Nvidia’s founder AI Infrastructure and datacenters will be worth many Trillions of dollars as a market soon. If you like charts and graphs about the future and AI, you might also like:

AI reports in 2025 Say we are Underestimating Its Impact

Mary Meeker's AI Report

You will enjoy these charts mostly if you like the history of business and analysis on technological waves and AI’s trajectory.

The Gen AI Bull Market will Shape New Winners and Losers