AI’s Bubble Talk Takes a Bite Out Of The Euphoria 🌊

There is a growing divergence between the general AI euphoria, enterprise spending led by Big Tech, VC funding, and consumer outlook on AI.

Hello Everyone,

Audio Summary 🎧: 1:34 | Read Online

I’ve been trying to evaluate the AI bubble for quite some time. There are multiple ways of evaluating it too. Even a Pragmatic Optimist can see the signs. Uttam Dey writes:

“A growing number of investors and industry watchers are looking to the 1990's dotcom bust and growing wary of the overcapitalized reach of today's AI investments.”

I am one of those analysts.

📬 Peer Newsletter

Want to connect the dots in macroeconomics, technology & culture to help you understand the "big picture", build perspectives with clarity, identify great businesses & improve your financial & mental wellbeing to thrive in a better world tomorrow?

I am a fan of the work of Amrita Roy and Uttam Dey:

I asked Uttam to expand on this topic along with graphs and visuals. If ChatGPT wot dunnit, Nvidia’s ascent has been nothing but spectacular.

Uttam is the quintessential data enthusiast with an eye for spotting trends at the intersection of technology, finance and geopolitics.

I have no doubt in my mind that the AI frenzy has shades of dot-com mania with dangerous monopoly Capitalism manipulation. Companies like Nvidia, Microsoft and OpenAI are huge and making super-charged money, but if they do crash there'll be sweeping fallout. For me, this is 1995 all over again with AI drama. But if the euphoria isn’t profitable for most parties, it’s a big red flag. Let’s explore this further in Uttam’s piece.

Subscribe to The Pragmatic Optimist ☔ By Uttam Dey April, 2024. Researcher & Thought Leader about Futurism, Vancouver, Canada. 🍁

AI’s Bubble Talk Takes a Bite Out Of The Euphoria

It’s been a couple of months now since one of the most celebrated public companies in technology, Nvidia $NVDA, crossed $2 trillion in market capitalization. This is a watershed moment for the company, which has almost become a beacon of hope for powering the endless possibilities of what AI can do.

For Nvidia, to say that business is booming is an understatement. Such was the demand last year that many companies & startups (and some countries) began hoarding Nvidia’s semiconductor products. For those living under a rock, Nvidia produces semiconductor chips that accelerate the computing output of computers and servers used to power applications like media, games, cryptocurrency mining, data centers, and now, AI.

At the same time, such a landmark moment is drawing intense battle lines with speculation that all things AI are in a bubble. Simultaneously, Nvidia’s market cap has pulled back from its all-time high of $2.4 trillion in March, as did many other semiconductor stocks, fanning the flames of the AI bubble bursting. Plus, another emerging darling of the chip sector, Super Micro Computer, Inc. $SMCI, reported subpar earnings.

🏆 TPO - Hall of Fame Articles 💎

Risk a banking crisis or reignite inflation? The Fed's worst dilemma is here.

Dating apps are causing swipe fatigue. So, people are finding love elsewhere.

Support and Dive Deeper

If you enjoy my deep dives, our guest contributors and broad range of topics and Newsletters:

Support my work for as little as $2 a week. 🎓📚💡

What is a bubble anyway, and why is AI said to be in one?

Right after Nvidia crossed the historic $2 trillion milestone, a corner of the market often identified as bulls cheered the company’s milestone. While Dan Ives, an analyst at Wedbush Securities, sported his Friday best 🥳 and predicted the party was just starting for artificial intelligence stocks, Wall Street’s loudest bull, Fundstrat’s Tom Lee, went further to say that over time the world will replace “salaried workers with silicon.”

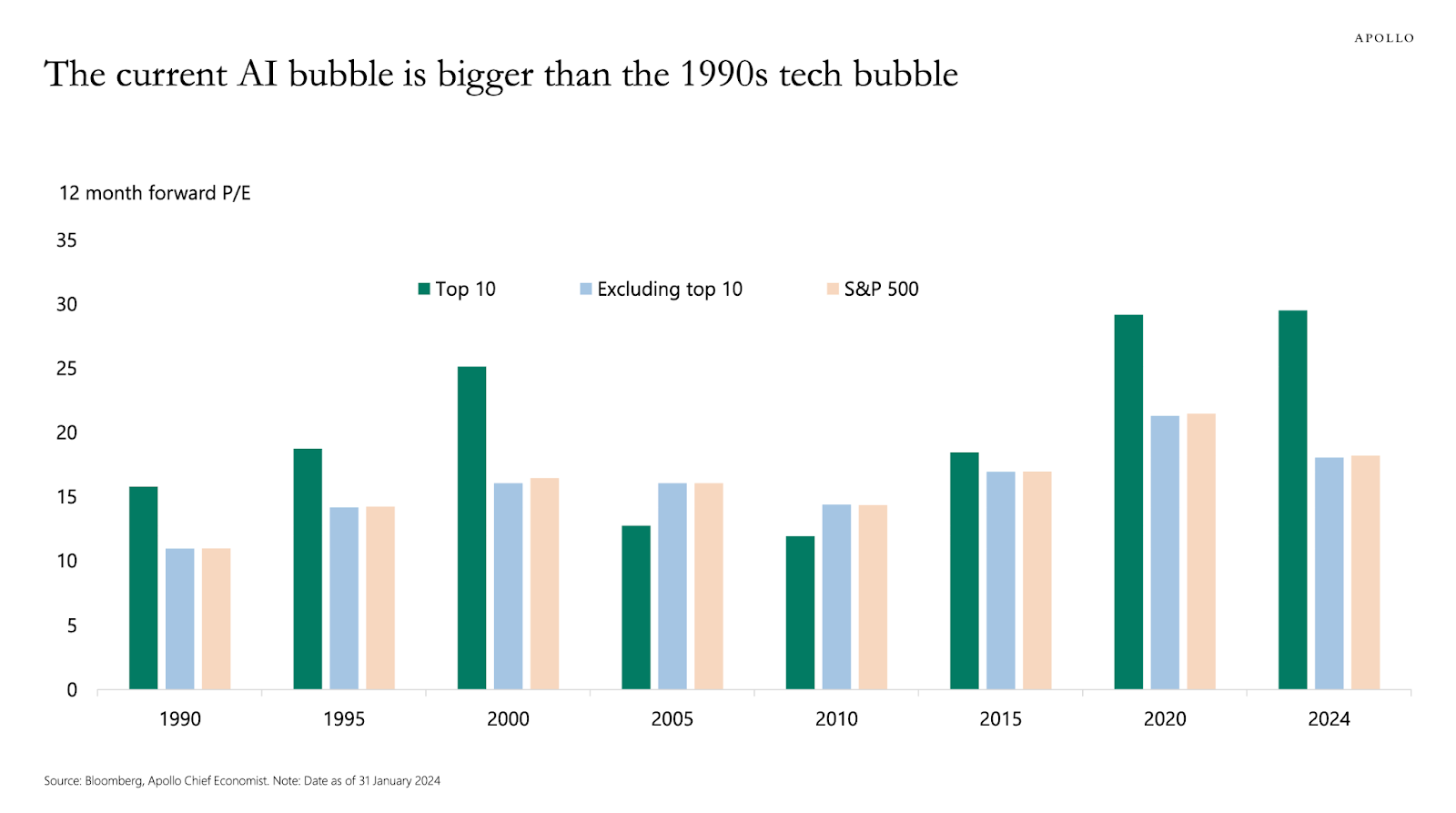

On the other hand, Torsten Sløk, chief economist at Apollo Global, published his research note, in which he argued that “the top 10 companies in the S&P 500 today are more overvalued than the top 10 companies were during the tech bubble in the mid-1990s.”

Chart: Bubble - Apollo Top10 PE

All of this debate brings up a fundamental question that is key to understanding whether AI is in a bubble - What is a bubble really?

In 2015, the U.S. Federal Reserve published a paper that defined an asset bubble as "an upward price movement over an extended range that then implodes." On the other hand, Investopedia defines economic bubbles as “economic cycles that are characterized by the rapid escalation of market value, particularly in the price of assets,” a notion that is similar to the Federal Reserve’s explanation of a bubble.

Taking this definition, if we were to simply chart the value of market capitalization of a few top stocks deemed as beneficiaries of the AI wave, we would arrive at a version of an answer to the question about the AI bubble.

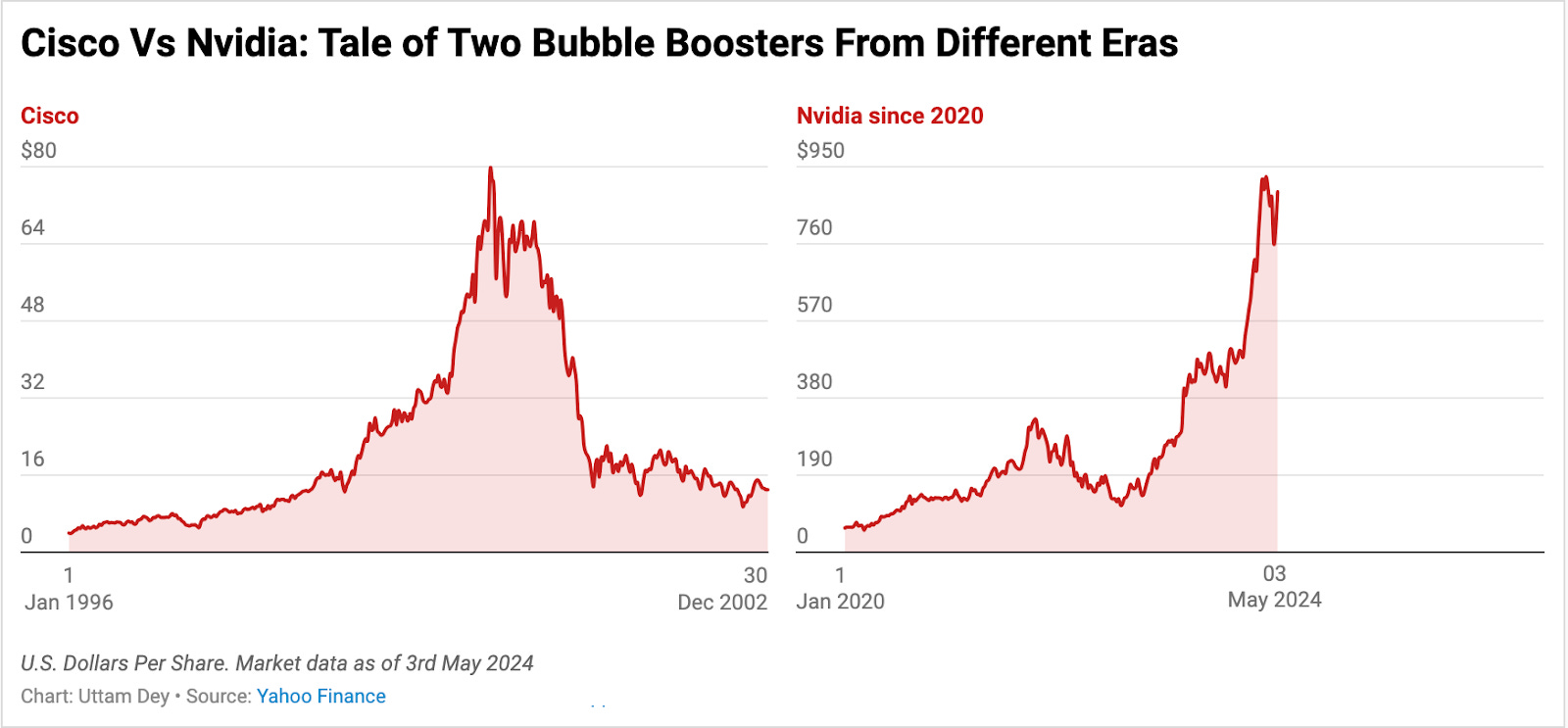

Chart: Bubble - Nvidia chart

Alternatively, some eager AI agonists also look to take the historical lens and apply it to Nvidia’s price ascent to arrive at the same conclusion by analyzing Nvidia’s record price ascent. In this case, Nvidia often gets compared to 90’s dot-com favorite stock, Cisco.

Does that mean we are in a bubble? Well, we wouldn’t know until it implodes. But it would echo Apollo Global economist Torsten Sløk’s concern about high valuation levels, especially when compared to the 1990’s tech bubble as a baseline.

The 90’s dot-com bubble offers some clues

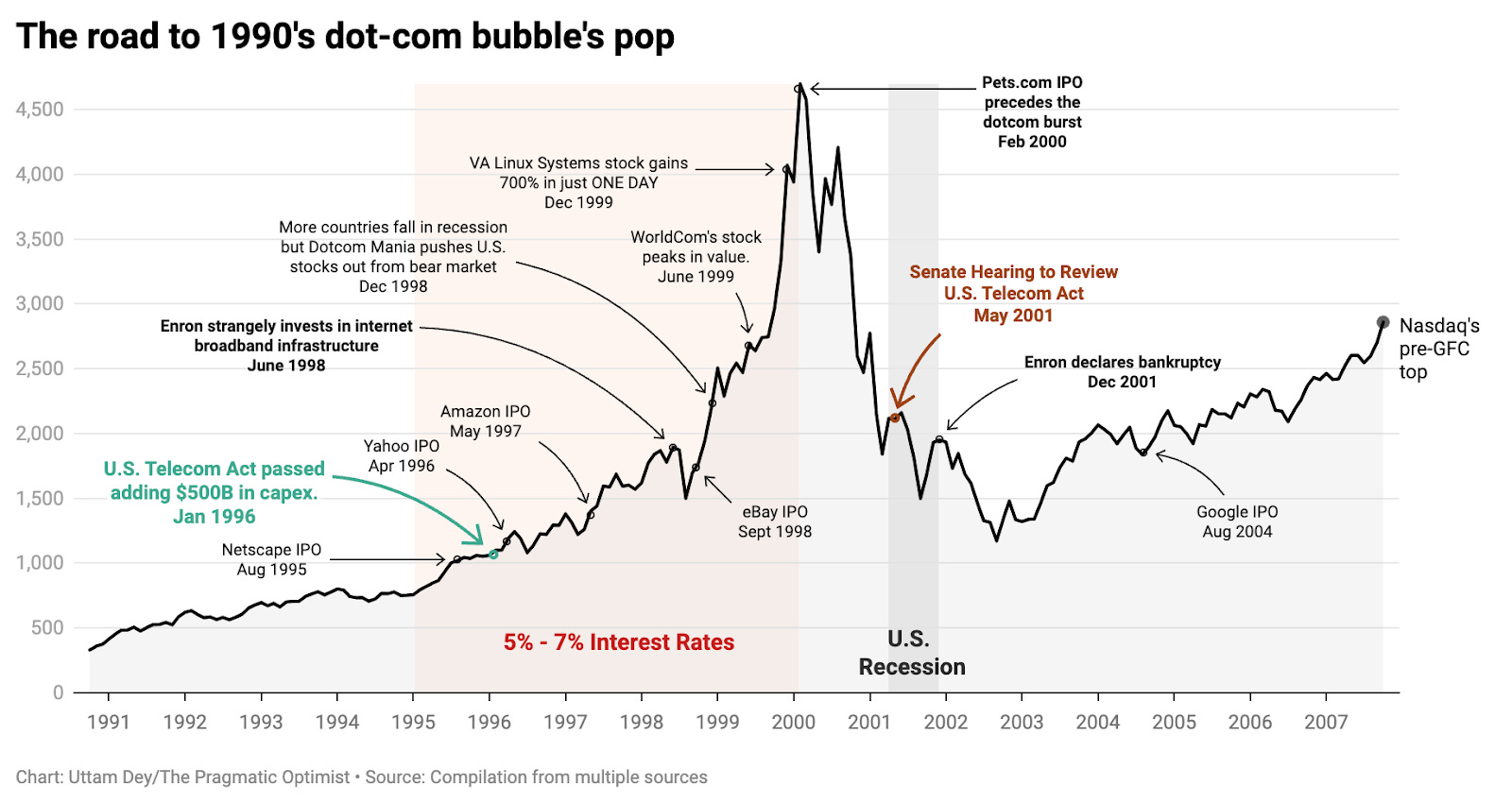

In order to understand what Sløk was referring to when he pointed to the tech bubble in the mid-90’s, it made sense to look at a few milestones achieved in the 1990’s leading up to the dot-com bubble that eventually burst at the end of that decade.

Chart: dot-com bubble pop

Netscape started the dot-com party as one of the first dot-com-era companies to go public in 1995. This was really the ‘Big Bang’ of the internet era, ushering in a boom of IPO’s that would eventually become overinflated in terms of market valuation. Along the way, there were some successful companies during those years that still exist in some shape or form today: Amazon, eBay, whatever is left of Yahoo, and others.

But looking at the chart above, a key driver of this could be traced to the Telecommunications Act that was passed by the U.S. Congress in 1995.

According to testimony by a senior McKinsey executive to the U.S. FCC during a 2001 Senate hearing, the passing of the Telecommunications Act led to a huge surge in investments by corporations. Companies were purchasing all kinds of “communications stuff” as a result of the Act—equipment, software, devices, services, etc. Based on the McKinsey executive’s testimony, the business investments that the U.S. saw between 1995 and 1999 doubled from $250 billion to $500 billion in just four years. All of this at a time when interest rates were rising and had reached almost 7% just before the dot-com bubble burst.

All these companies were buying equipment with one aim: to increase the capacity of the World Wide Web, a nascent internet technology at the time, so that more companies could take advantage of lower costs and create consumer-facing internet applications. The investments made by companies dating back to the Telecommunications Act in 1995 sowed the seeds for making the internet commercially available as it is today. It was these investments that built the base web technology upon which the Amazons, Ubers, Googles, and Facebooks of today thrive.

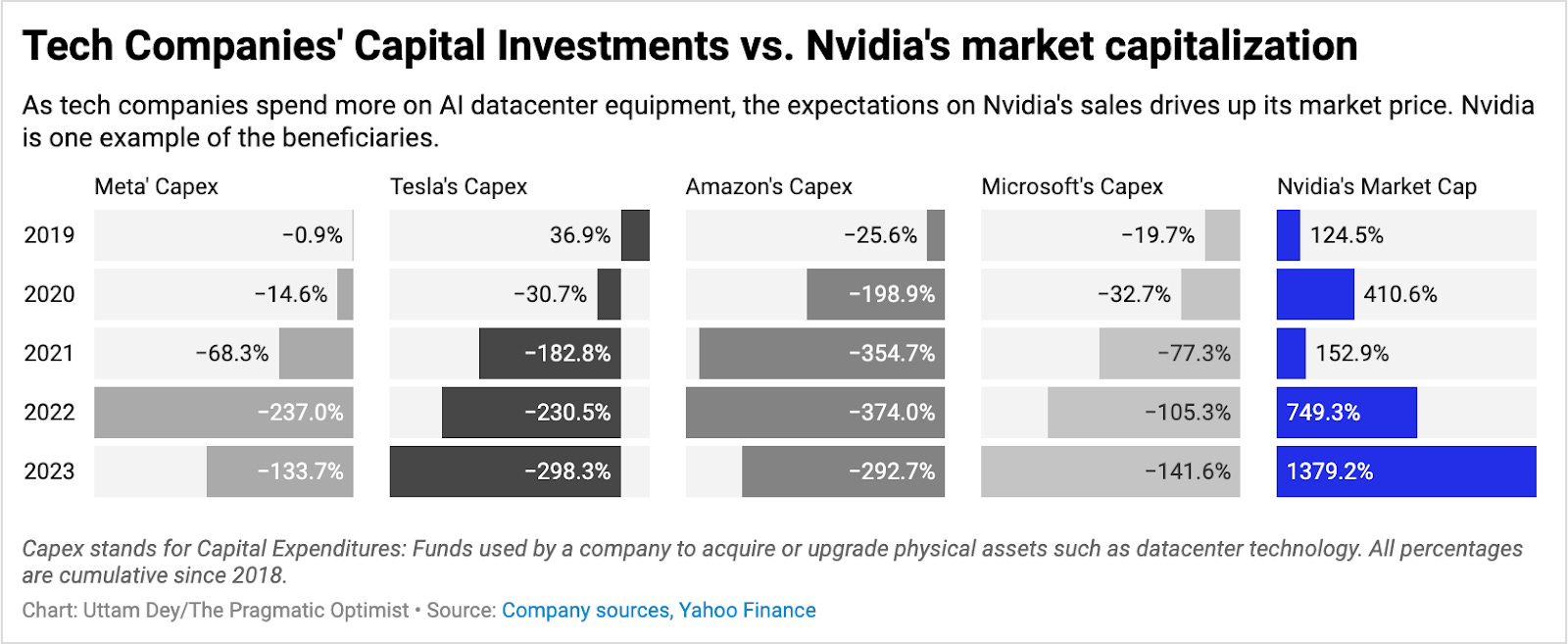

The story is quite similar to today’s AI, too. All the excitement in the stock markets around AI can primarily be traced to businesses spending large sums of money to invest in increasing the capacity needed to scale their AI ambitions. For example, McKinsey estimates that the CHIPS and Science Act passed in August 2022 is projected to infuse at least $280 billion in the semiconductor and related technologies space, the same industry of which Nvidia is a part. So far, this money is being spent on a wide range of capital investments, such as semiconductor chips, GPUs, data center infrastructure, and other services and software key to training and deploying machine learning models and AI applications.

Chart: Capex Trends of Tech companies

All the technology companies in the chart above are customers of Nvidia’s GPU products and have been significantly investing in GPUs and other hardware to increase capacity so that their machine learning models can run with vast amounts of data and faster. For example, Meta Platforms advised their investors that they now expect to be spending approximately 38% more this year on buying things like GPUs and data center infrastructure for their AI models, up from the ~23% they were expecting to spend just a quarter ago.

Until now, companies led by the top 7–10 are locked in a race to expand their computing capacity & foundational AI capabilities, similar to the business investments made in the early–mid 90's, creating almost inelastic demand dynamics and leading to skyrocketing valuation levels for some beneficiaries, such as Nvidia. But there are risks to such significant ramp-ups in investments. The biggest risk is not correctly projecting demand for end-user AI consumption, which would threaten the utilization of the capacity and capital investments made by tech firms today. This would leave them exposed at the height of the valuation bubble, if and when it bursts, just like Cisco’s growth story that began to unravel in 2000.

After all, history may not repeat, but it often rhymes.

VC’s show some signs of slowing down AI funding.

Despite all this talk of a bubble, funding from venture capital firms showed no signs of slowing down last year. 2023 was a record year for generative AI investment. According to CB Insights, funding towards GenAI startups grew 65% on a compound basis between 2019 and 2023, with VC funding in 2023 growing at least two times faster than any other year in the last five years, after a significant valuation reset noted in 2022.

Unsurprisingly, OpenAI took the prize for the largest hike in value for a private unicorn company in 2023, while France-based open-source foundation model developer, Microsoft-backed Mistral AI, saw its valuation rise 672% to $2 billion in December last year after it closed its Series A funding round. Anthropic was the other startup that saw its valuation rise +2x from the prior year.

But there was something quite different in these funding rounds than other rounds going back to even the dot-com era: Big Tech firms dominated most of the funding rounds last year as compared to any other prior year.

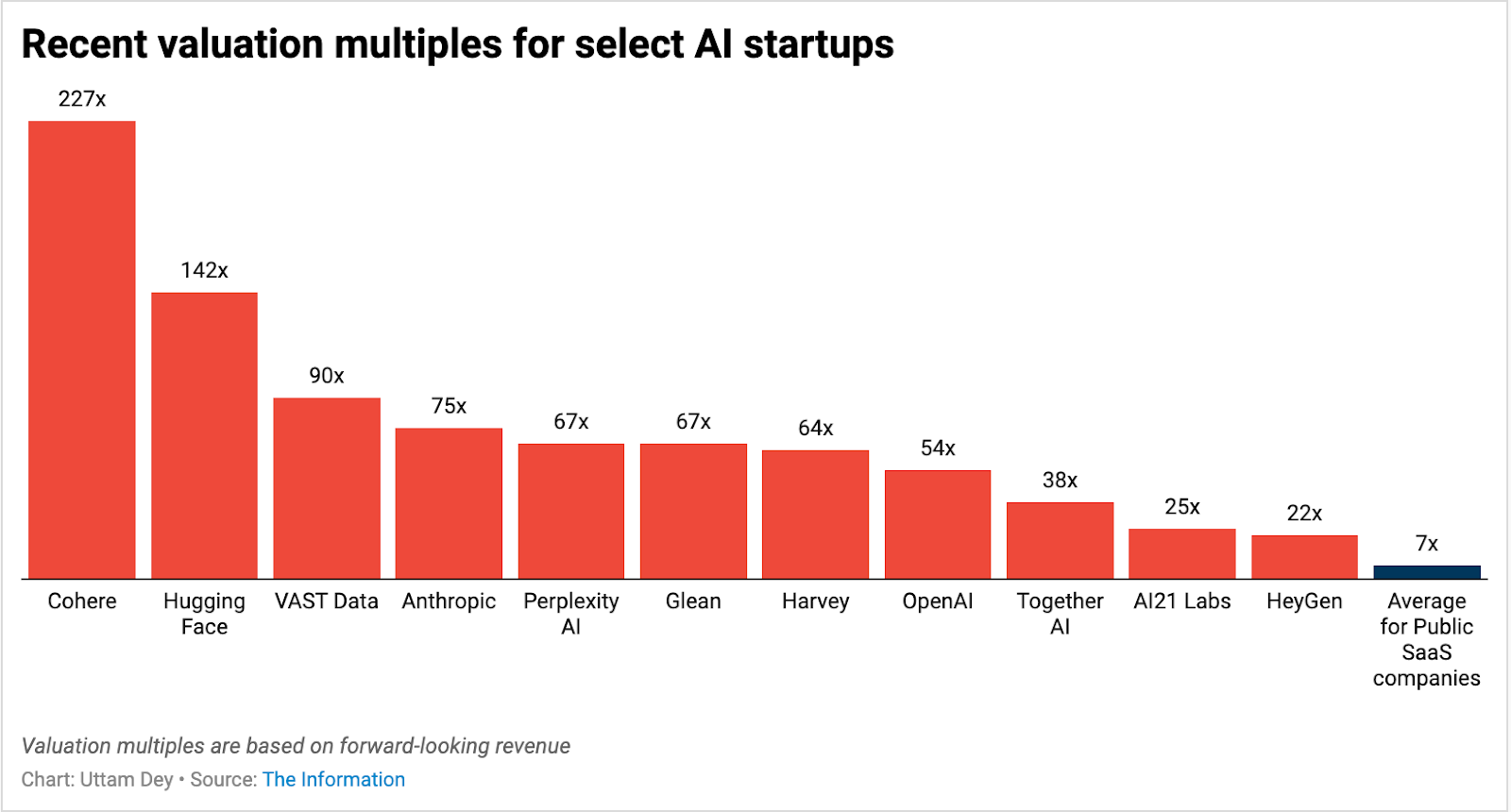

Microsoft led the biggest and co-led the second-biggest rounds. Nvidia, Amazon, and Google led some of the other large funding rounds of 2023, per Crunchbase data. This put many venture capital firms in a unique position of feeling priced out. Other VCs also started to look at valuations in a different light, and consensus started to build that valuations may be running away at current levels.

Last month, The Information reported that the valuations of some AI startups were dropping. Investors tend to value startups at a premium based on their growth rates, which fell three months ago. While the research did note that valuations were pulling in mostly because of a normalization in the growth rates of startups, it also noted that the same startups were not attracting the same investment capital as they were earlier, a strong indication that the promise of the technology is running up against reality.

Earlier this year, General Catalyst’s Niko Bonatsos said that he was already seeing some contrition among investors due to the elevated valuation levels of startups in this space. But he also expects costs to come down rapidly. Usually, when costs decrease at such rapid clicks, it leads to a breadth of innovation, which so far has been largely seen in just the foundational layers of a new innovation such as GenAI. This is not a new trend. It was also something that was seen during the dotcom era, where investments and capital expenditure that were mostly allocated to laying out the foundation layer of the internet then moved to the front end, where internet companies actually built dotcom properties for the online consumer. Something similar could be expected in the current AI bubble as well, giving the euphoria more legs to run on.

At Upfront Ventures' annual confab in Los Angeles last month, a number of top VCs took the stage to share their thoughts on navigating the climate of sky-high valuations and finding other opportunities. Many VC firms, led by General Catalyst, Menlo Ventures, and Lightspeed Ventures, talked about getting into niche GenAI areas and investing in verticalized AI.

AI has a bright future. But there are risks along the way.

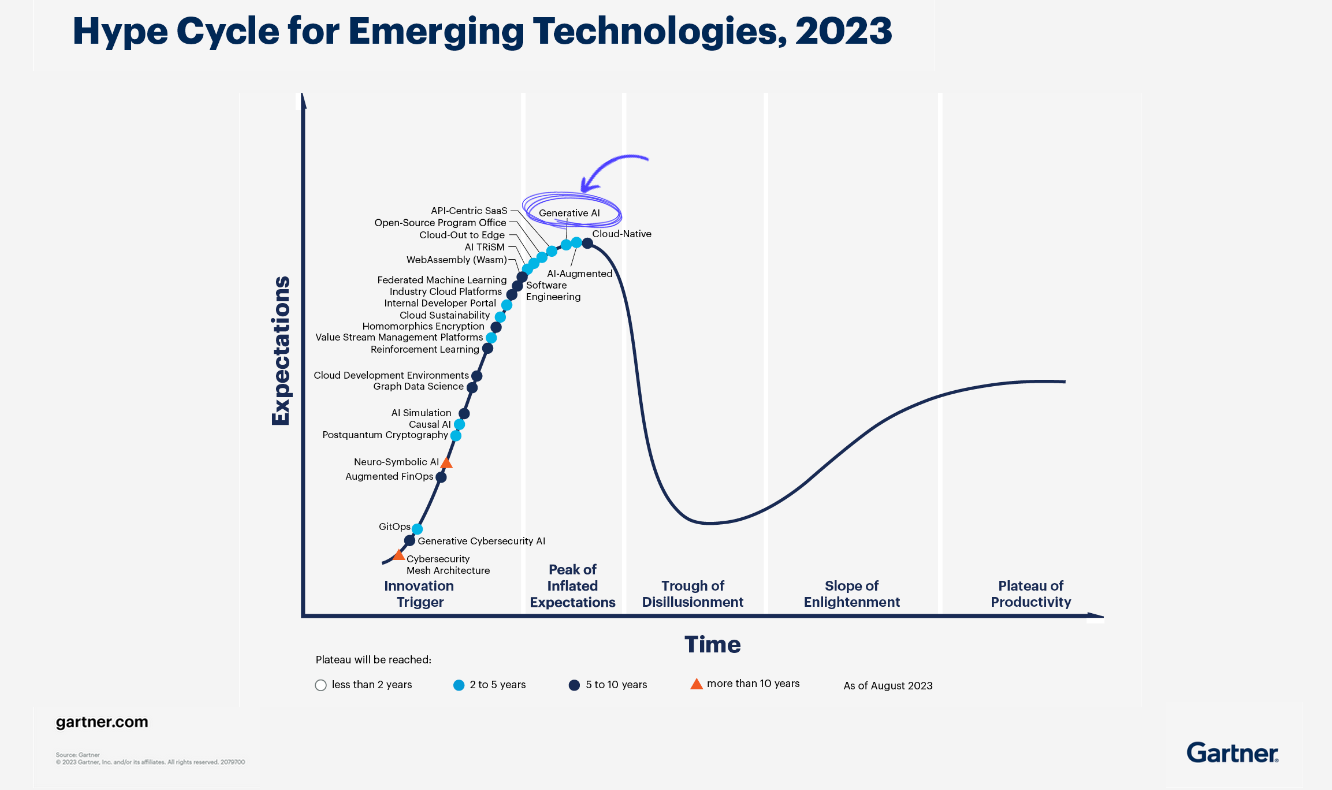

The folks at Gartner have created the Hype Cycle framework, which plots different technologies along the course of a 5-wave lifecycle. It’s not the best of predictions, but the essence of the hype cycle is to really illustrate the phases that every major emerging technology goes through.

All major technologies, including AI, have started with an innovation trigger, leading to heightened expectations that get overinflated into bubbles. But in the end, only those technologies that are able to suffer through periods of disillusionment (a.k.a valuations/expectations reset) are eventually able to deliver long term productivity goals. So far, Gartner’s hype cycle shows that the expectations of GenAI are in a heightened range.

Add Chart: Bubble - Hype cycle

There is no doubt that AI has the potential to change the course of human civilization. The excitement in AI’s potential is reflected in research that points to how the initial adoption of GenAI has overtaken the initial adoption curves for the smartphone.

But as usage of AI deepens and broadens among the masses, important issues such as plagiarism, deepfakes, cybercrime, racial bias, & privacy are gradually starting to encroach on the AI party.

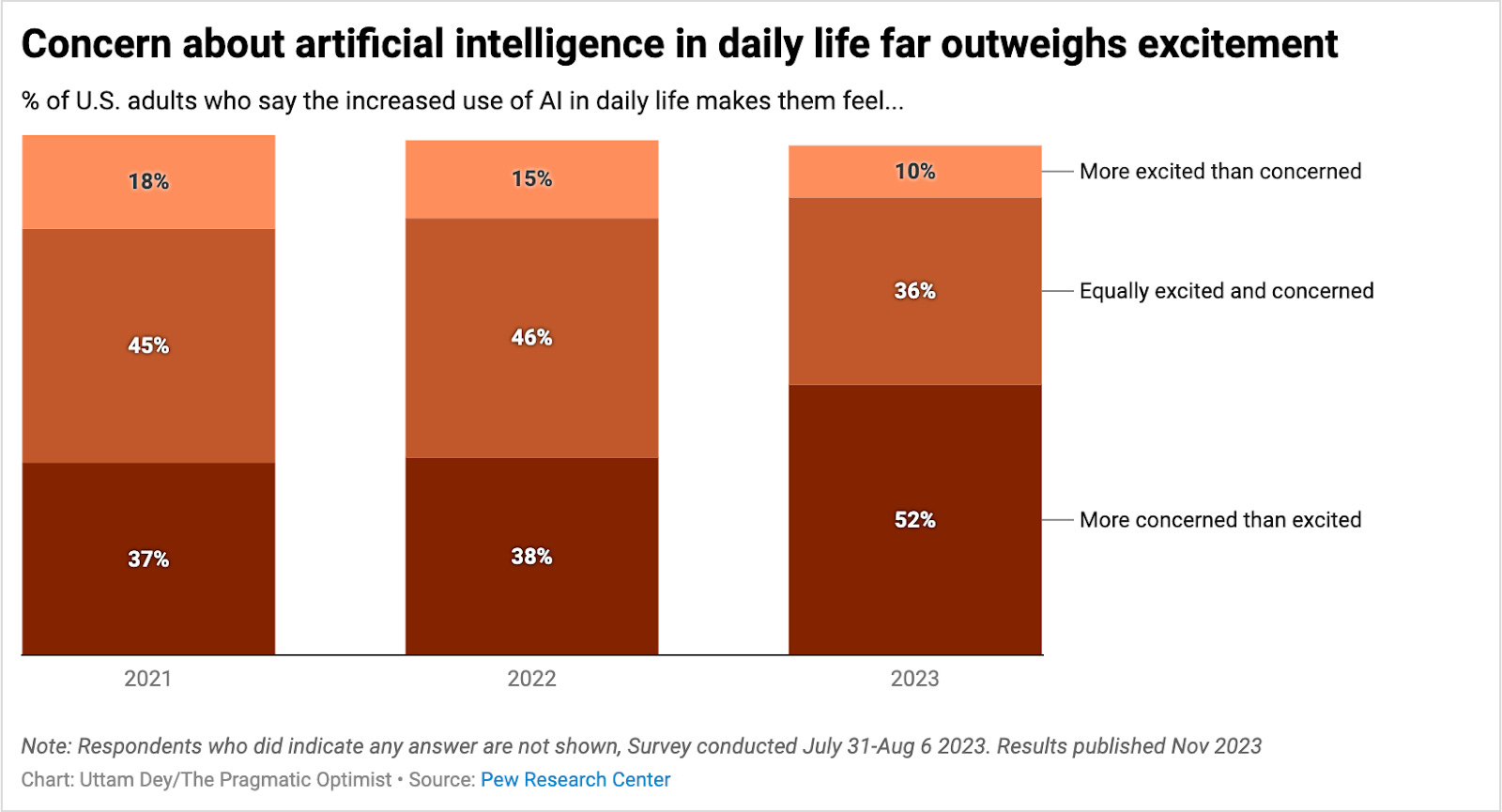

Amidst all the AI hype last year, a study published in November last year showed that Americans were increasingly cautious about the growing role of AI in their lives generally. Over half of the adults in the study mentioned they were more concerned than excited about AI in their daily lives, up from just under a fourth of survey participants a year ago.

Some may point to bias in the survey given that Americans might be perturbed due to the upcoming elections this year. But a separate global study echoed similar findings, where trust in AI fell to 53%. This type of evolution in user behavior as adoption deepens is not new.

An examination of an old survey from research archives published in 1998 showed how the number of people going on the internet jumped from 23% in 1996 to 41% in 1998. At the same time, over half of the users surveyed reported feeling anxious about their privacy. Simultaneously, 60% of the users surveyed also reported feeling frustrated with the speed of their internet connection as well as the accuracy of information being found online. Some of these sentiments are also starting to be echoed by users today.

These developments are increasingly pointing towards some kind of top in the bubble of users' expectations of AI as fundamental questions start getting asked. This could very well lead AI through Gartner’s disillusionment phase. But once key issues are solved, the long term productivity boost that AI promises could very well be seen.

How long can this euphoria last? Ask Peter Thiel’s Founders Fund.

At the Upfront Ventures confab mentioned earlier, Brian Singerman, a partner at Peter Thiel’s Founders Fund, was asked about contrarian areas worth investing in given the current landscape. His response: “Anything not AI”.

Singerman drew parallels between the current wave of self-proclaimed AI startups and the pre-IPO internet companies of the dot-com era, which were leading to very crowded trades for investors and VC firms. Thiel’s Founders Fund may be famously contrarian, but it strikes a tone quite similar to General Catalyst and a growing number of VC firms that are looking to allocate their seed capital elsewhere. Especially when the euphoria among tech firms is at its highest as more firms swap their.com domains for.ai domains.

Parading AI out into the world paints a compelling vision for most tech firms today because the world has never experienced what AI could really do. For the longest time, AI was generally confined to erudite halls of academia and whitepapers until 2022, when users actually got to play with image generators and AI chatbots. AI firms are dangling incentives like free usage credits and promotions to entice users to trial, or even better, pay for monthly subscriptions. In anticipation, enterprises are expected to ramp up their spending on building AI capabilities by almost 9x from today’s levels.

But the moment users’ experience with AI starts to wane and users become cognizant of its usability limitations or the fundamental risks that AI poses, general interest in this space will taper off. And suddenly, all those colossal investments that tech companies made to rapidly scale their AI capabilities will instantly be underutilized, leading to lower revenues, overcapitalized balance sheets, and a much-needed reset in expectations. What usually follows the reset in expectations is a rapid re-rating in valuation premiums, vindicating people like Apollo Global’s Sløk and Founders Fund’s Singerman who are staying far away from AI and Big Tech’s current nosebleed valuation premiums.

Eventually, some companies and firms out there will be left to foot the mega bill of the infrastructure and capital they invested in, which could be the start of the bubble popping. Until then, the bubble grows, and the party in AI continues.

The END.

Thanks for reading!

Last Words

40 seconds

The biggest sign for me that AI is a bubble is how Microsoft, OpenAI and Google are taking the majority of the actual Enterprise AI revenue, meaning other Generative AI startups will struggle generating actual revenue and being sustainable in the long-term. To say that Consumer AI app revenue hasn’t taken off, would be an understatement.

Generative AI as a movement seems to be more about monopoly BigTech doing cost management at a time of slower growth and lower earnings, artificially inflating their Cloud and advertising momentum with LLM hype. I hope I’m wrong, but the data doesn’t lie.

Bio

Uttam (Dey) is an ex-Silicon Valley technologist at heart, deeply fascinated by the numerous advantages sustainable adoption of technology brings. He is the quintessential data enthusiast with an eye for spotting trends at the intersection of technology, money and finance.

Through his research, Uttam aims to pragmatically unravel the rapidly moving world of innovation and money which often gets overcrowded with exaggerated acronyms and overbearing jargon.

He co-authors The Pragmatic Optimist newsletter along with his wife.

The AI "Scam" is how the re-distribution of wealth occurs here with Generative AI super-charging the Cloud and Ads growth of monoopoly firms. While the vendors get peanuts outside of the winners that aren't even determined in a meritocratic way, i.e. OpenAI eating most of the ALL of the profits made by Generative AI startups today.

So the Generative AI narrative is really a scam that accelerates winners takes all Capitalism in America. It also allows the elites to get a lot more wealthy on the stock market pumping their winners. It's an age-old playbook but with a stark lack of regulation, transparency and even factual information.

I got several Email replies about how well this piece was written. Credit to the authors and their Newsletter as well: take a look: ~ Want to connect the dots in macroeconomics, technology & culture to help you understand the "big picture": https://amritaroy.substack.com/