AI Report Nuggets and Commentary Early 2026

All that is currency is not Gold. 🧈 The "AI Summer" stretches into another year. But uncertainy lingers.

Good Morning,

I’ve been reading some AI reports and wanted to share some of the infographics that jumped out at me, at times with my own commentary. Here are some of the reports in case you enjoy reading them too:

Battery Ventures: State of AI Report (Dec, 2025) - PDF

International Energy Agency (IEA) – “Electricity 2025: Data Centers and AI’s Growing Energy Footprint (Dec, 2025)

Brookings: A new direction for students in an AI world (Education): Prosper, prepare, protect, Jan 14th, 2026. - PDF

Agents, Robots and Us - McKinsey, November, 2025.

Anthropic Economic Index Report, Jan, 2026. - PDF

Oxfam’s “Resisting the Rule of the Rich: Protecting Freedom from Billionaire Power”, January 19th, 2026.

Bessemer Venture Partners: State of AI, August, 2025.

BIS: Financing the AI boom: from cash flows to debt, Jan, 2026. - PDF

Accel’s Race to Compute Report, Nov, 2025. - PDF

Atomic State of European Tech 2025 Report, - PDF

Full disclosure: While obviously AI reports are typically a form of marketing for AI hype by Venture Funds, companies and consultancies and their customers to promote their own business interests, they do provide some data snapshots of macro and general interest. In particular, I’ve been trying to read those with insights on the AI infra rollout, and future capabilities of AI.

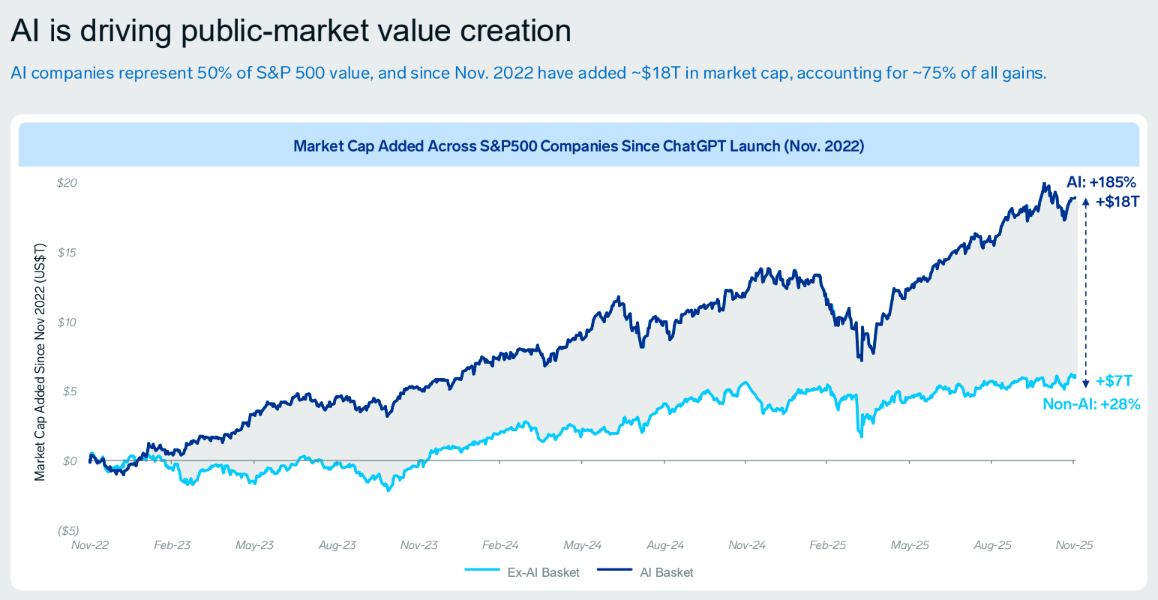

Since ChatGPT was launched, AI is Driving Public Market Valuation

U.S. Liquidity Needs Somewhere to Go Exaggerating the Value of AI

The hype is real in terms of the stock market, but don’t let the elevated index, passive funds and liquidity haul fool you.

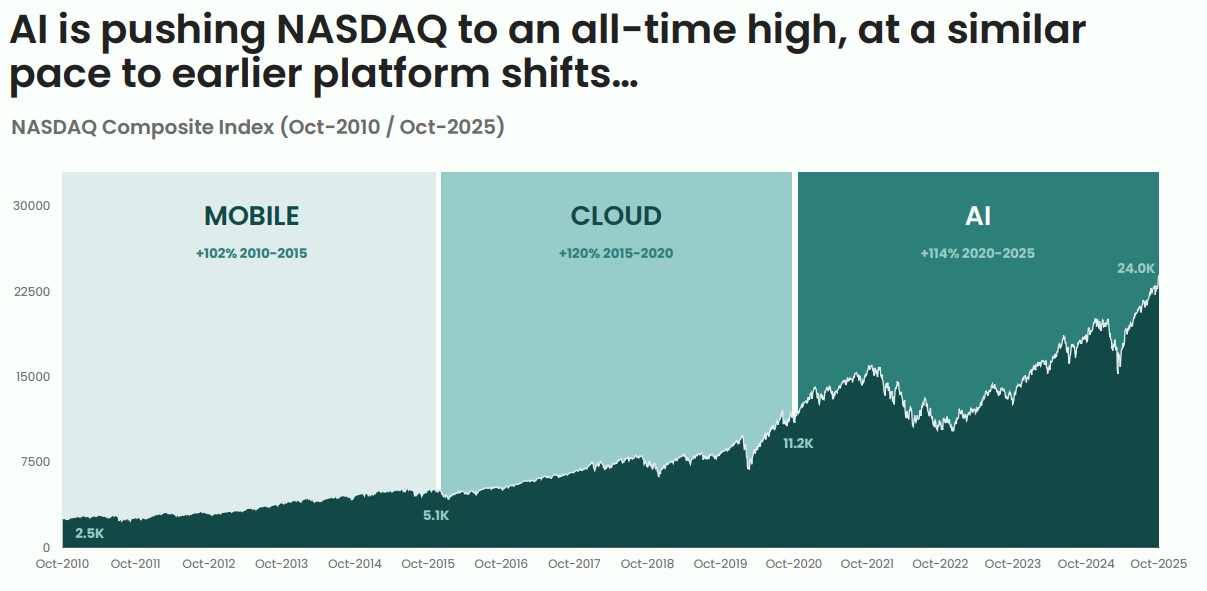

AI is not necessarily the value creator the Mobile, Cloud or much less the Internet has been.

Private AI Startups valuations are untethered to fundamentals, margins and risks.

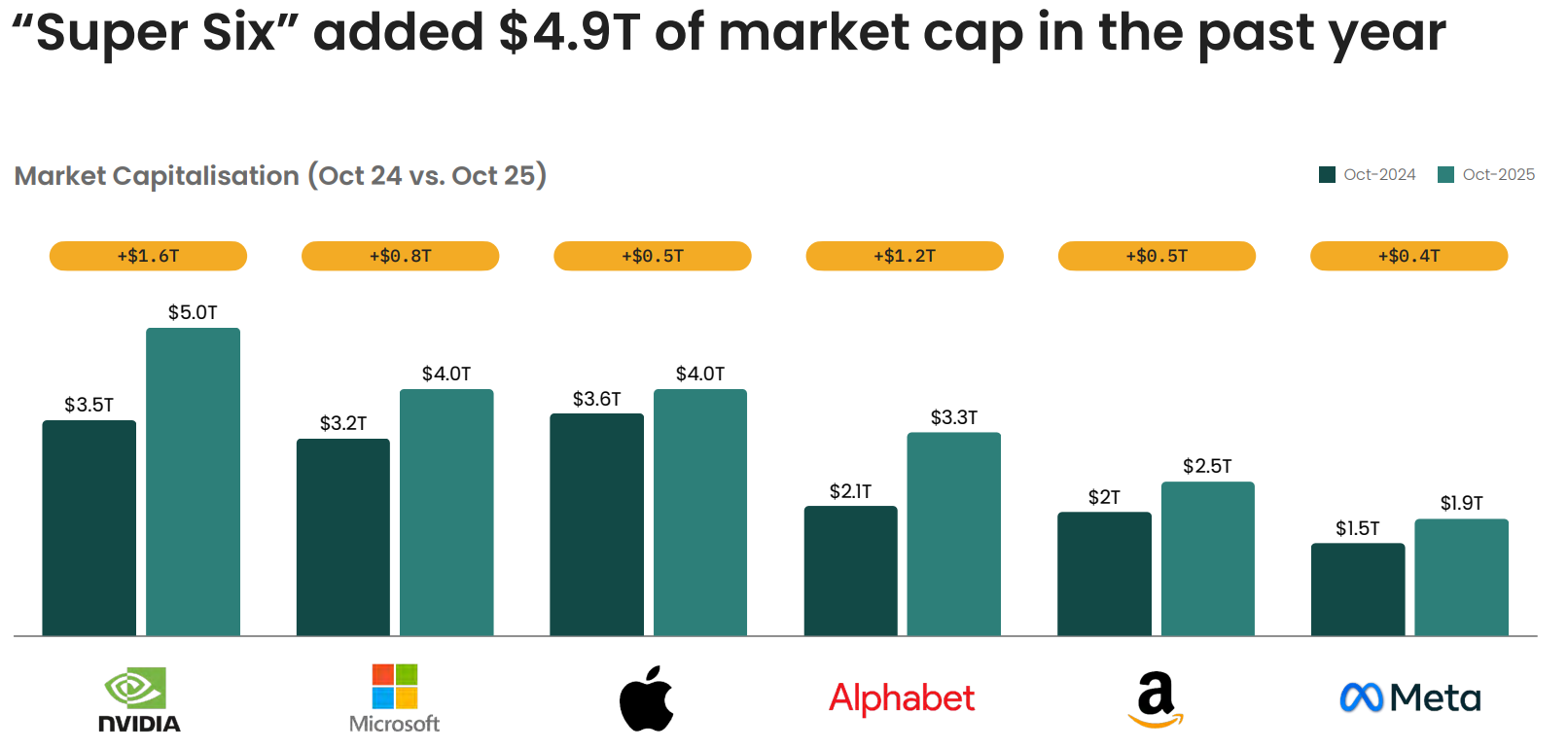

AI is Concentrating Market Dominance

The Magnificent 7 dominated U.S. stock market, now has Nvidia, Broadcom and TSMC on the rise.

However the dominance of BigTech in market cap compared to all other companies continues to increases in the AI boom, even while the tech has somewhat dubious ROI and adoption rates so far.

Higher capex by BigTech also means more layoffs.

Trillions of Market Cap added in AI Bull Market Each Year

Index funds and wealth inequality can shape the pyramid, Generative AI seems like its fortifying empires instead of uplifting actual people.

The Price of the AI Bull Market is Erosion of Values

be careful what you wish for

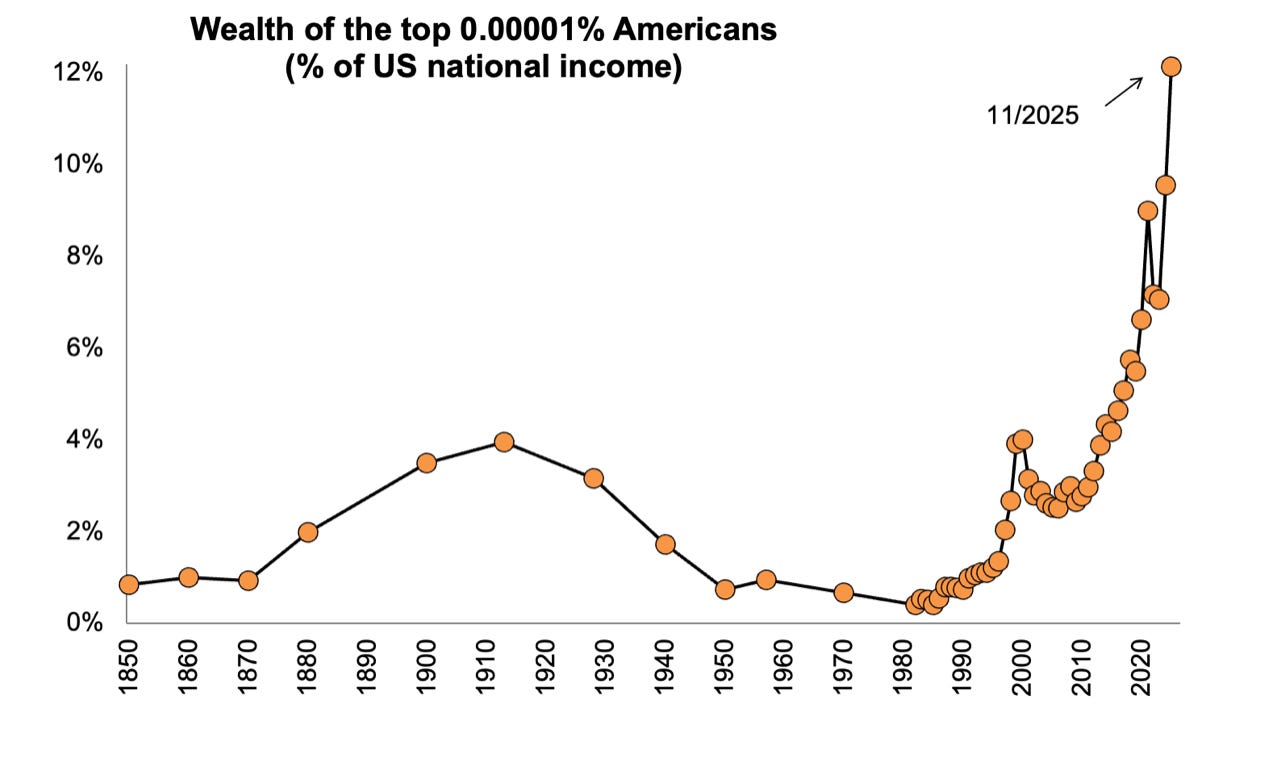

At the peak of the Gilded Age in 1910, the richest 0.00001% of the US population owned wealth equal to 4% of national income.

Now, the richest 0.00001% owns 12%.

This trend is likely going to continue to erode democratic and meritocratic values as a whole in the United States especially.

AI Boom vs. Bubble Debate Has a lot of runway to Keep Going

Likely we’re still in the early stages of the datacenter rollout and Semiconductor boom.

Themes I’m Watching:

The Power bottleneck of Datacenter projects really becomes a bigger issue this year and the next.

The IPO, M&A and consolidation of Generative AI is going to be impactful in the months ahead.

The demand for compute is creating an economic momentum all of its own in capacity constrained hyperscalers and Chip Fabs that cannot keep up with the demand.

The Trump Administration’s goal is to bring 40% of Taiwan’s semiconductor supply chain to the U.S (unrealistic by the way) could erode Taiwan’s independence and so-called Silicon Shield.

If you like AI report infographics and related commentary, you might enjoy this read. You can scan through AI related infographics and deduce your own conclusions and read some of my field notes.